Background

In May 2012 Cyprus introduced a package of measures to promote economic growth which included a number of tax incentives aimed at boosting the island's predominantly service-oriented economy. The most notable of these is a series of incentives and exemptions relating to investment in intellectual property rights, commonly known as an intellectual property rights box ("IP box").

The IP box concept dates back to 2001, when France introduced a reduced rate of tax on revenue or gains deriving from the license, sublicense, sale, or transfer of qualifi ed IP. Belgium, Hungary, Ireland, Luxembourg, Netherlands, Spain and the United Kingdom have also introduced similar schemes. The underlying rationale is to stimulate a flow of investments into the research and development sector by providing tax incentives, which can be justified on the grounds that successful innovation creates benefits for the public at large.

IP box regimes can be broadly divided into two categories. The first category (adopted by France, the Netherlands and the United Kingdom) provides for reduced rates of tax on qualifying income. The second category (adopted by Belgium, Hungary, Luxembourg, Spain and Cyprus) provides for an exemption of a specified proportion of revenues. This second category further subdivides into schemes that exempt a proportion of gross revenues and those that exempt a proportion of net revenues.

Intellectual property projects lend themselves to cross-border planning by reason of the mobility of intellectual property rights, which do not consist of physical assets and so can be easily moved between different jurisdictions and tax systems according to prevailing circumstances and developments in different tax jurisdictions. By amending its tax legislation Cyprus hopes to consolidate its position as a hub for the cross-border holding and exploitation of intellectual property rights.

The amendments to the Income Tax Laws are effective from January 1, 2012 and apply to all expenditure for the acquisition or development of intangible assets incurred by a person carrying on a business. They apply to all categories of intellectual property, including the rights set out in the Patent Law of 1998 as amended, the Intellectual Property Rights Law of 1976 as amended and the Trademarks Law, Cap. 268 as amended.

Principal Features Of The Cyprus IP Box

The principal features of the Cyprus IP box are set out in the following paragraphs.

Five year amortisation period

The cost of acquisition or development of an IP right acquired by a Cyprus company may be capitalised and written off on a straight line basis over five years, giving an annual writing down allowance of 20 percent.

For years prior to 2012 amortisation rates were determined by reference to the estimated useful life of the underlying asset. For example, if a patent had a validity of 20 years its useful life would be deemed to be 20 years and the writing down allowance would be 5 percent per annum.

The acceleration of writing down allowances will significantly defer tax liabilities and result in substantial cash flow benefits, particularly if the value of the IP asset is substantial.

Four-fifths deduction of revenue from exploitation of IP rights

Four-fifths of the profit earned from the use of intangible assets (including any compensation for improper use) is deducted for tax purposes. Therefore, only 20 percent of IP income after deduction of the costs of earning the income (including amortisation), is taken into account.

Applying Cyprus's corporate tax rate of 12.5 percent, among the lowest in the EU, the maximum rate of tax on income earned from IP assets is therefore 2.5 percent. This is half the rate offered by the next most attractive scheme (the Netherlands). However, given the deductibility of expenses including amortisation, most Cyprus companies will suffer an actual rate of less than 2.5 percent.

In the event that IP-related costs and deductions exceed revenue earned from IP assets, the loss may be off set against other income for the year or carried forward.

Tax exemption of dividends resulting from IP activities

Any dividend income generated out of royalty income earned by a Cyprus company and paid to its non-resident shareholders is fully exempt from Cyprus tax of any description.

Four-fifths deduction of profits on disposal of IP rights

Four-fifths of any profit resulting from the disposal of relevant intangible assets is disregarded for tax purposes.

While this is a more generous exemption than is available under any competing regime, in most cases a more beneficial result from the taxpayer's viewpoint can be achieved by holding the assets concerned in a separate company and disposing of the shares in that company, rather than the assets themselves. Th is option would result in full exemption of the gain, as well as stamp duty savings, since gains on disposals of qualifying securities (which includes shares) are exempt from all forms of taxation in Cyprus except to the extent that they derive from the disposal of immovable property located in Cyprus

Comparison With Other European IP Box Regimes

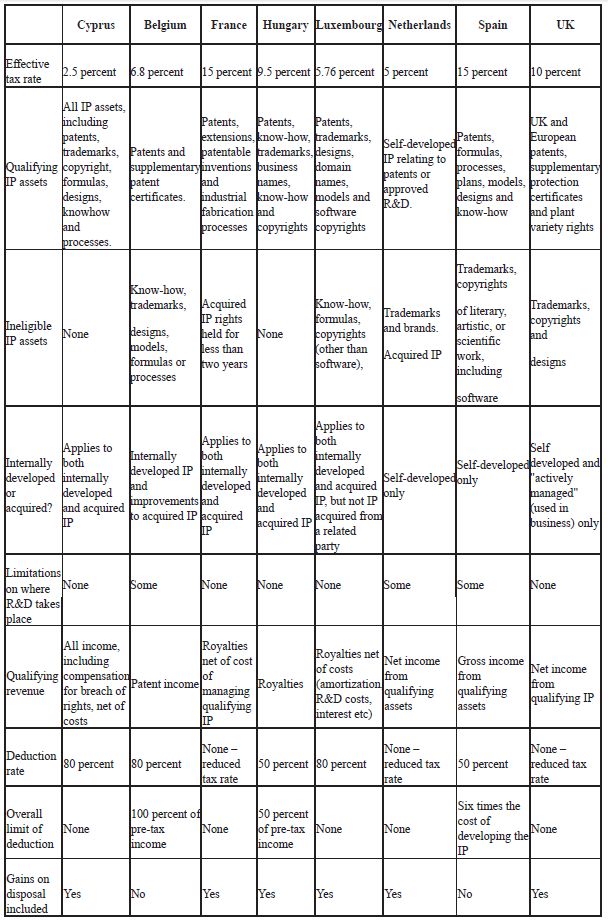

The table below summarises the key differences:

As noted above, Cyprus's IP box regime provides a maximum tax rate of 2.5 percent on income earned from IP assets. The comparable rate in its nearest competitor, the Netherlands, is twice that amount, at 5 percent. Luxembourg (5.76 percent) and Belgium (6.8 percent) are close behind the Netherlands but far behind Cyprus . The Cyprus IP box regime applies to a wider range of income than any other European scheme, most of which restrict benefits to income from patents and supplementary patent certificates. Th ere is no cap on benefits, such as applies in Belgium, Hungary and Spain, there is no requirement regarding self-development of the IP and there are no restrictions on where the expenditure on acquisition or development of IP is incurred . While the French, Hungarian, Luxembourg, Netherlands and United Kingdom schemes off er partial exemption of gains on disposal, the exemptions are less attractive than those provided by the Cyprus scheme, due to limitations on qualifying assets and less generous deduction rates. Furthermore, full exemption can be relatively easily obtained in Cyprus by holding the IP assets in a separate company and disposing of the shares in the company, as described above.

In most comparisons of the benefits offered by different jurisdictions there is a trade-off to be made. One jurisdiction will be better on certain aspects, but another will be better on others, and the differences will have to be assessed and weighed against one another to arrive at the best overall solution. In the case of the IP box regime there is no need for this, as Cyprus is the clear leader on every aspect.

Cyprus IP Structures

Before the IP box regime was introduced a Cyprus licensing arrangement would typically involve a company in a low- or no-tax jurisdiction (the IP owner) which licensed the use of its IP rights to a Cyprus company established for the purpose of acting as an intermediary licensing vehicle. This latter company would sub-license the right to exploit the IP rights to another entity, usually registered and tax resident in a country with a double tax treaty with Cyprus. The royalty fees charged by the IP owner would usually be around 90 percent of the royalty income generated by the Cyprus company, leaving a 10 percent margin subject to Cyprus tax.

However, following the introduction of the IP box, there is no longer a need for a separate IP owner since the Cyprus company can fulfil this role. This will provide substantial tax savings and planning opportunities, and reduce administrative and compliance costs also by eliminating unnecessary bureaucracy.

For example, a Cyprus company can hold the IP asset and enter into licensing agreements with entities located in jurisdictions accessible to low withholding tax rates, whether via a double tax agreement or the EU Interest and Royalties directive, which provides a uniform tax regime for royalties paid throughout Europe. Cyprus has an extensive network of double tax treaties and is also a member of the EU, giving Cyprus resident companies the benefi ts of the Interest and Royalties directive. Cyprus is therefore an ideal location for the establishment and maintenance of the IP owner which will generate royalty income that will be substantially exempt from taxation in Cyprus. There will no longer be any need to maintain a structure involving entities in several jurisdictions, with the costs that that entails . The new rules will also enhance the degree of legal and jurisdictional protection, given that the legal and corporate governance affairs of the IP structure will be governed by the laws of Cyprus, so ensuring an increased level of legal certainty, asset protection and predictability.

Using A Cyprus International Trust As Shareholder Of And Provider Of Finance To The Cyprus IP Owner

Further benefits can be achieved by using a Cyprus International Trust to hold the shares in and provide finance to the Cyprus IP owner. A Cyprus international trust receiving dividends from a Cyprus IP owner (the source of which is royalty income) will not be subject to any form of taxation in Cyprus. At the same time, the trust can accumulate income which can be converted into capital at the end of the year without any Cyprus tax consequences for the trust or its beneficiaries, provided that no beneficiary is a Cyprus tax resident . The Cyprus International Trust can also provide interest- bearing finance to the IP owner for the purpose of acquiring the IP assets or for working capital. While the interest paid by the company will be deductible for tax purposes, it will be exempt in the hands of the trust, which optimizes the structure even further from a tax perspective.

VAT

The acquisition of intellectual property rights from anywhere in the world by a Cyprus company is treated as a service rendered to the company which will create an obligation for it to register for VAT and to account for VAT on services received in accordance with the reverse charge mechanism.

If the company charges royalty fees to taxable persons within the European Union area it will also have to register for the EU VAT Information Exchange System.

Conclusion

As the table above demonstrates, Cyprus is the clear European leader on every aspect of its IP taxation regime, from the eff ective rate of tax, through the scope of assets covered, to the freedom from restrictions and limitations.

In most cases immediate economic and tax savings can be accomplished by transferring intellectual rights currently held by entities located in low- or no-tax jurisdictions to Cyprus resident companies in order to take advantage of the new exemptions. The transfer of IP rights into a Cyprus company will not attract any form of taxation in Cyprus and the new benefits and substantial exemptions will become available as soon as the asset is transferred.

The Cyprus IP box provides attractive opportunities for structuring the exploitation of IP assets through Cyprus and in particular through the use of Cyprus-resident IP owners, especially in conjunction with Cyprus's extensive network of double tax treaties, under which withholding tax on royalty income is either eliminated altogether or substantially reduced.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.