Introduction

In May 2012 Cyprus introduced a package of incentives and tax exemptions relating to investment in IP rights, commonly known as the 'IP box'. IP projects lend themselves to cross-border tax planning by reason of the mobility of IP rights, which do not consist of physical assets and so can easily be moved between different jurisdictions and tax systems according to prevailing circumstances. There has been considerable opposition from some countries to IP box regimes and, under the G20/Organisation for Economic Co-operation and Development (OECD) base erosion and profit-shifting project, new entries to such schemes will not be permitted after mid-2016. However, companies that join the Cyprus scheme before that date can benefit from substantial savings until mid-2021.

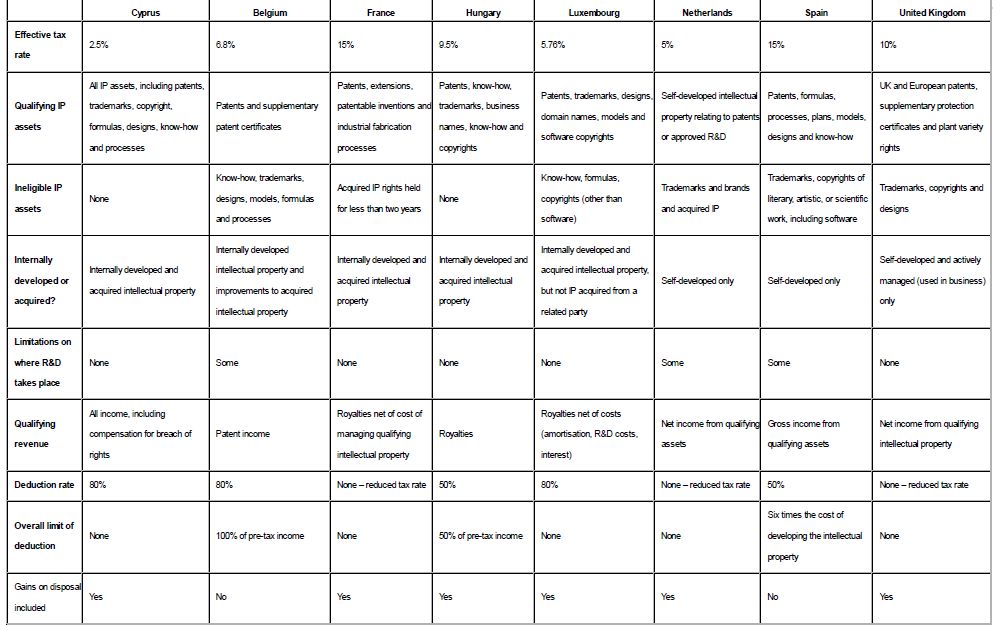

Comparison with European regimes

Cyprus's IP box regime provides for a maximum tax rate of 2.5% on income earned from IP assets. The comparable rate in its nearest competitor, the Netherlands, is twice that amount, at 5%. Luxembourg (5.76%) and Belgium (6.8%) follow close behind the Netherlands, but far behind Cyprus.(1)

The Cyprus IP box regime applies to a wider range of income than any other European scheme, most of which restrict benefits to income from patents and supplementary patent certificates:

- There is no cap on benefits, such as applies in Belgium, Hungary and Spain;

- There is no requirement regarding self-development of the intellectual property; and

- There are no restrictions on where expenditure on the acquisition or development of intellectual property is incurred.

While the French, Hungarian, Luxembourg, Netherlands and UK schemes offer a partial exemption for gains on disposal, the exemptions are less attractive than those provided by the Cyprus scheme, due to limitations on qualifying assets and less generous deduction rates. Further, full exemption can be relatively easily obtained in Cyprus by holding the IP assets in a separate company and disposing of the shares in the company rather than the intellectual property itself, thus taking advantage of Cyprus's extensive capital gains tax exemptions.

In most comparisons of the benefits offered by different jurisdictions, there is a trade-off to be made. Certain regimes will be more favourable on specific aspects than others and the differences must be assessed and weighed against each other to identify the best overall solution. In the case of the IP box regime, there is no need for this, as Cyprus is the clear leader in every single aspect.

In most cases, immediate economic and tax savings can be made by transferring IP rights held by entities located in low or no-tax jurisdictions to Cyprus-resident companies in order to take advantage of the new exemptions. The transfer of IP rights to a Cypriot company will not attract any form of taxation in Cyprus and new benefits and substantial exemptions will become available as soon as the assets are transferred.

The Cyprus IP box provides attractive opportunities for structuring the exploitation of IP assets through Cyprus, and in particular through the use of Cyprus-resident IP owners – especially in conjunction with Cyprus's extensive network of double tax treaties, under which withholding tax on royalty income is eliminated or substantially reduced.

There has been considerable opposition from some countries to the introduction of IP box regimes and, as part of the G20/OECD base erosion and profit-shifting project, a number of countries put forward what has become known as a 'modified nexus' approach. This seeks to ensure that preferential regimes for intellectual property require substantial economic activities to be undertaken in the jurisdiction concerned, by requiring tax benefits to be connected directly with research and development expenditure within the jurisdiction.

Comment

Now that broad agreement has been reached on the modified nexus approach, there is only limited time to enter into the Cyprus scheme, since it and all similar schemes will be closed to new entrants from June 2016. However, companies that join the scheme before then can benefit from substantial savings until mid-2021. All that is required is the establishment of a suitable Cypriot structure for holding intellectual property and the transfer of the business's intangible assets into it.

It would therefore benefit any business with significant IP assets or income to examine the option of benefiting from Cyprus's favourable IP taxation regime while the opportunity lasts.

Footnote

1 The table below summarises the key aspects of European box regimes.

Originally published by International Law Office

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.