Introduction

In May 2012, Cyprus introduced a package of incentives and tax exemptions relating to investment in intellectual property rights, commonly known as an "IP box." Intellectual property projects are particularly susceptible to cross-border planning by reason of the mobility of intellectual property rights, which do not consist of physical assets and so can be easily moved between different jurisdictions and tax systems according to prevailing circumstances.

There has been considerable opposition from some countries to IP box regimes, and now that consensus has been reached on the modified nexus approach under Action 5 of the G20/OECD base erosion and profit shifting project, new entries to such schemes will not be permitted after mid-2016. However, companies that join the Cyprus scheme before that date can look forward to benefiting from substantial savings until mid-2021.

Comparison With Other European IP Box Regimes

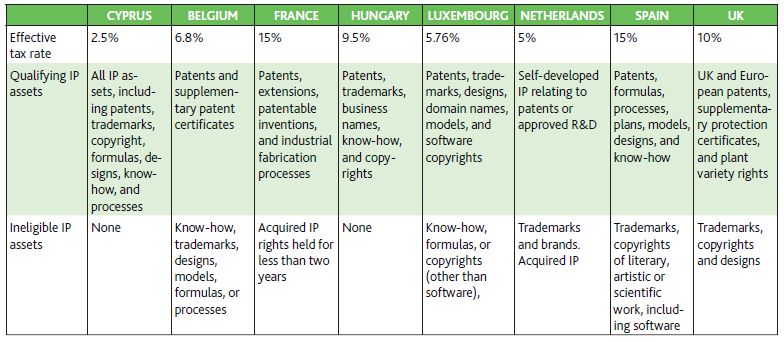

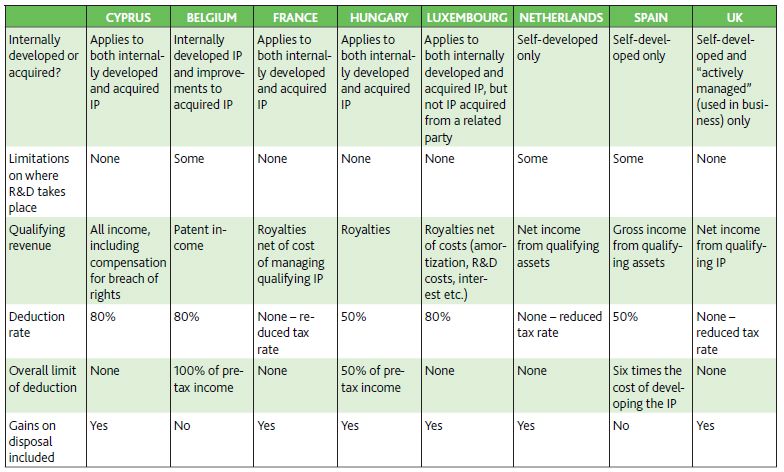

The table below summarizes the key aspects:

Cyprus's IP box regime provides a maximum tax rate of 2.5 percent on income earned from IP assets. The comparable rate in its nearest competitor, the Netherlands, is twice that amount, at 5 percent. Luxembourg (5.76 percent) and Belgium (6.8 percent) are close behind the Netherlands but far behind Cyprus.

The Cyprus IP box regime applies to a wider range of income than any other European scheme, most of which restrict benefits to income from patents and supplementary patent certificates. There is no cap on benefits, such as applies in Belgium, Hungary and Spain; there is no requirement regarding self-development of the IP; and there are no restrictions on where the expenditure on acquisition or development of IP is incurred.

While the French, Hungarian, Luxembourg, Netherlands and United Kingdom schemes offer partial exemption of gains on disposal, the exemptions are less attractive than those provided by the Cyprus scheme, due to limitations on qualifying assets and less generous deduction rates. Furthermore, full exemption can be relatively easily obtained in Cyprus by holding the IP assets in a separate company and disposing of the shares in the company rather than the IP itself, taking advantage of Cyprus's extensive capital gains tax exemptions.

In most comparisons of the benefits offered by different jurisdictions there is a trade-off to be made. One jurisdiction will be better on certain aspects, but another will be better on others, and the differences will have to be assessed and weighed against one another to arrive at the best overall solution. In the case of the IP box regime there is no need for this, as Cyprus is the clear leader on every single aspect.

In most cases, immediate economic and tax savings can be accomplished by transferring intellectual rights currently held by entities located in low- or no-tax jurisdictions to Cyprus resident companies in order to take advantage of the new exemptions. The transfer of IP rights into a Cyprus company will not attract any form of taxation in Cyprus, and the new benefits and substantial exemptions will become available as soon as the asset is transferred.

The Cyprus IP box provides attractive opportunities for structuring the exploitation of IP assets through Cyprus and in particular through the use of Cyprus-resident IP owners, especially in conjunction with Cyprus's extensive network of double tax treaties, under which withholding tax on royalty income is either eliminated altogether or substantially reduced.

"All Good Things Come To An End"

There has been considerable opposition from some countries to the introduction of IP box regimes and, as part of the G20/OECD base erosion and profit shifting project, a number of countries, including Germany, put forward what has become known as the "modified nexus" approach. This approach seeks to ensure that preferential regimes for intellectual property require substantial economic activities to be undertaken in the jurisdiction concerned, by requiring tax benefits to be connected directly to R&D expenditures within the jurisdiction.

The United Kingdom, which had its own patent box regime, was initially opposed to the modified nexus approach, but once agreement was reached between Germany and the United Kingdom on the matter towards the end of 2014 any other opposition quickly fell away and the G20 meeting in November 2014 endorsed the joint proposal put forward by the two countries.

Countries are required to close existing schemes that do not comply with the modified nexus approach to new entrants no later than June 30, 2016. In order to provide transitional relief to taxpayers, countries are allowed to introduce grandfathering rules, under which all taxpayers benefiting from an existing regime may continue to enjoy the benefits of the scheme until an "abolition date" of no later than five years after the closure of the scheme to new entrants, implying a backstop date of June 30, 2021.

Now that consensus has been reached on the modified nexus approach and the timetable for its introduction, there is only limited time to enter into the Cyprus scheme, since it and all similar schemes will be closed to new entrants from June 2016. However, companies that join the scheme before then can look forward to benefiting from substantial savings until mid-2021. All that is required is to establish a suitable Cyprus structure for holding IP and transferring the business's intangible assets into it.

It would therefore behoove any business with significant IP assets or income to examine the option of benefiting from the favorable Cyprus IP taxation regime while the opportunity lasts.

Originally published in Global Tax Weekly on 9 July 2015The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.