Cyprus Companies, Cyprus financing companies, Cyprus Notional Interest Deduction (NID) on new equity, new Cyprus taxation advantages and illustrative examples

The introduction of notional interest deduction will further strengthen the setting up of Cyprus companies and especially the setting up of financing activities in Cyprus.

Cyprus Companies are often used to finance other associated foreign companies. This is achieved by setting up a Company in Cyprus in order to finance other associated companies.

According to Cyprus new taxation laws, Cyprus companies that originally financed by own funds shall be given notional Interest deduction (NID). This will mean a reduction of the overall effective tax rate of a Cyprus Company depending on the level of Cyprus Company capitalization. The notional Interest deduction (NID) will be granted annually.

The new Cyprus taxation law on Cyprus Notional Interest Deduction (NID)

Equity. New equity can be introduced either in the form of cash or in kind. Where new equity will be introduced in the form of assets (in kind), the sum of these may not exceed the market value. Assets must be fully documented. Notional interest deduction (NID) will be given on new capital (share capital and share premium to the extent that they have been paid) issued from 1st January 2015.

Interest. Notional interest deduction (NID) will be calculated on the amount of new share capital / share premium the same way as with interest on loans. The rate of notional interest deduction (NID) is defined as the 10 year government bond yield (at December 31 of the year preceding the tax year) of the country in which the new equity is invested, increased by 3% and having as a lower limit the 10 year Cyprus government bond increased by 3%.

Notional interest deduction (NID) is deducted from taxable income but it cannot exceed 80% of taxable income (as defined for tax purposes) before deducting Notional interest deduction (NID).

The Cyprus notional interest deduction (NID) applies to companies that are tax residents of Cyprus and to companies which are not resident in Cyprus but have a permanent establishment in Cyprus.

The above will be applicable retrospectively as from 1 January 2015.

Cyprus Company illustrative example (In this case a Cyprus Company used as a Cyprus financing company)

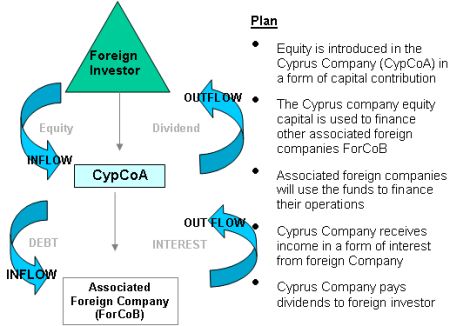

- New equity is introduced in the Cyprus Company (CypCoA) in a form of capital

- The Cyprus equity is used to finance other associated foreign companies ForCoB i.e. by granting an interest bearing loan to foreign Company

- Associated foreign company will use the funds to finance its operations

- Cyprus Company receives income in a form of interest from foreign Company

- Cyprus Company pays dividends to foreign investor

Cyprus financing company - Cyprus taxation structure

Illustrative example 1 of a Cyprus Company (In this scenario Cyprus financing company)

New equity is introduced in the Cyprus Company in a form of capital €10m. The equity consist a mixture of share capital and share premium fully paid up

Cyprus Company grants an interest bearing loan to foreign Company. The other foreign company jurisdiction 10 year government bond is 0.5% and the the Cypriot 10 year government bond is for example 5.5%.

Cyprus Company receives income in a form of interest from foreign Company at the rate of 10%

| CYPRUS COMPANY A (IN THIS CASE CYPRUS FINANCING COMPANY) | € | |

| STATEMENT OF FINANCIAL POSITION | ||

| Assets | ||

| Loan receivable | 10.000.000 | |

| Equity | ||

| Share Capital | 10.000.000 | |

| INCOME STATEMENT | ||

| Interest received (10m x 10%) | 1.000,000 | |

| Taxable income before Notional Interest Deduction | 1.000.000 | |

| Cyprus Notional Interest Deduction is: | ||

| The higher of: | ||

| 3.5% Foreign government bond rate + 3% X 10m | 350.000 | |

| 8.5% Cyprus government bond rate +3% X10m | 850.000 | |

| And the lower of: | ||

| 8.5% Cyprus government bond rate + 3% X10m | 850.000 | |

| 80% of taxable income i.e. X 1.000.000 | 800.000 | 800.000 |

| Net interest income after Notional Interest Deduction | 200.000 | |

| Cyprus tax at 12.5% | 25.000 | |

| Effective tax on interest received | 2.5% |

Illustrative example 2

New equity is introduced in the Cyprus Company in a form of capita€10m. The equity consist a mixture of share capital and share premium fully paid up.

Cyprus Company grants an interest bearing loan to foreign Company. The other foreign company jurisdiction 10 year government bond is 0.5% and the Cypriot 10 year government bond is for example 4%.

Cyprus Company receives income in a form of interest from foreign Company at the rate of 10%

| CYPRUS COMPANY A (IN THIS CASE CYPRUS FINANCING COMPANY) | € | |

| STATEMENT OF FINANCIAL POSITION | ||

| Assets | ||

| Loan receivable | 10.000.000 | |

| Equity | ||

| Share Capital | 10.000.000 | |

| INCOME STATEMENT | ||

| Interest received (10m x 10%) | 1.000,000 | |

| Taxable income before Notional Interest Deduction | 1.000.000 | |

| Cyprus Notional Interest Deduction is: | ||

| The higher of: | ||

| 3.5% Foreign government bond rate + 3% X 10m | 350.000 | |

| 7.0% Cyprus government bond rate +3% X10m | 700.000 | |

| And the lower of: | ||

| 7.0% Cyprus government bond rate + 3% X10m | 700.000 | 700.000 |

| 80% of taxable income i.e. X 1.000.000 | 800.000 | |

| Net interest income after Notional Interest Deduction | 300.000 | |

| Cyprus tax at 12.5% | 37.500 | |

| Effective tax on interest received | 3.75% |

Illustrative example 3

New equity is introduced in the Cyprus Company in a form of capital €10m. The equity consist a mixture of share capital and share premium fully paid up.

Cyprus Company grants an interest bearing loan to foreign Company. The other foreign company jurisdiction 10 year government bond is 3.75% and the Cypriot 10 year government bond is for example 3.50%.

Cyprus Company receives income in a form of interest from foreign Company at the rate of 10%

| CYPRUS COMPANY A (IN THIS CASE CYPRUS FINANCING COMPANY) | € | |

| STATEMENT OF FINANCIAL POSITION | ||

| Assets | ||

| Loan receivable | 10.000.000 | |

| Equity | ||

| Share Capital | 10.000.000 | |

| STATEMENT OF FINANCIAL POSITION | ||

| INCOME STATEMENT | ||

| Interest received (10m x 10%) | 1.000,000 | |

| Taxable income before Notional Interest Deduction | 1.000.000 | |

| Cyprus Notional Interest Deduction is: | ||

| The higher of: | ||

| 6,75% Foreign government bond rate + 3% X 10m | 675.000 | |

| 6.50% Cyprus government bond rate +3% X10m | 650.000 | |

| And the lower of: | ||

| 6,75% Foreign government bond rate + 3% X 10m | 675.000 | 675.000 |

| 80% of taxable income i.e. X 1.000.000 | 800.000 | |

| Net interest income after Notional Interest Deduction | 325.000 | |

| Cyprus tax at 12.5% | 40.625 | |

| Effective tax on interest received | 4.06% |

Cyprus Taxation Consequences

- Low or no withholding tax on interest payments due to the "favorable" Cyprus double tax treaty network or EU directives

- Deductability of interest expenses in the borrowing company

- Provided that one of the major business activities of the Cyprus Company is that of financing activities, the Cyprus Company will be taxed at a Corporation tax rate of 12,5%

- Cyprus Notional Interest Deduction (NID) is deducted from interest income and therefore Interest income is taxable in Cyprus at an effective tax rate of 2.5% i.e. (20% X 12.5% - 80% is given as a notional interest deduction)

- No withholding tax on dividend payments from Cyprus at all times

Conclusion and our views

- The new law aims to harmonize the tax treatment of equity finance with the tax treatment of finance by borrowing (equal treatment). It aims also to further strengthen Cyprus companies' competitiveness. Investors will now be financing their companies through equity instead through borrowings.

- It is expected that there will be no law contradictions between EU and Cyprus as Notional Interest Deduction is already applied with success in other Member States. Furthermore legal advice was taken as to the compatibility with EU regulations and BEPS.

- Since now Cyprus companies will have the right to use and enjoy the interest received unconstrained, other countries could not argue that the Cyprus Company is not the beneficial owner. Therefore the treaties between Cyprus and foreign countries will apply.

http://www.pkf-cyprus-nicosia.com.cy/

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.