INTRODUCTION

Being a trying time for the world economy and the world corporate finance market, the need for tax efficient structures as well as restructuring options for existing structures is growing rapidly. As such, in order to derive the optimum results in such transactions, including mitigation of risk and taxes, the jurisdiction to be used for the implementation of such structures would need to be carefully selected.

The use of the Cypriot jurisdiction may indeed turn such vision into practice. Cyprus' reputation in the international business world as a leading international business center, rests, among others, to its geographical position, its most favourable tax infrastructure and modernized legal system, its stable economy and well established banking sector and equally its Membership to the European Union.

The EU Membership of Cyprus back in 2004 required the harmonisation of its legislation with the acquis communautaire and hence led to a revision of the legislation, among others via the adoption and implementation of a number of EU Directives, providing for a harmonized and tax efficient regime within the Union.

In line with the above, Cyprus has long developed into a key venue for the worldwide operations of multinational companies, primarily via the use of Cyprus holding companies being a major vehicle for international tax planning.

Conventionally and subsequently as a result of its EU membership, Cyprus has been established as the main connection of investors to Russia, Central and Eastern Europe as well as the European Union.

Fig. I The Benefits of a Cyprus Holding Company

Holding companies, classified as tax residents of Cyprus, are, just like all Cyprus resident companies, subject to 10% Corporate Income Tax on their worldwide income.

In line with the above, residency is determined by whether its management and control is exercised in Cyprus, and as such, the mere incorporation of a company in Cyprus is not adequate to that extent. Without "management and control" being formally defined under the Cypriot legislation, and based on the application of the English Common Law principles, management and control is said to be established where:

- The majority of the Directors of the Company are residents in Cyprus, and

- Important Company decisions are taken in Cyprus by the local directors,

- The Company maintains real offices in Cyprus, with distinct telephone/fax lines, domain names, etc. and the employment of professional staff;

- The Company has an economic substance, i.e. commercial and economic activities in Cyprus.

Cyprus Holding Companies are widely used due to the favourable dividend income streams they have to offer. Most importantly, incoming dividends are exempt from Corporate Income Tax. Even though a 15% defence tax may be imposed on incoming dividends, in most cases, an exemption is allowed. Such exemption is allowed where a holding of at least 1% can be established between the holding and subsidiary company, however it may be refused where BOTH:

- more than 50% of the activities of the subsidiary company result in investment / passive income; AND

- the foreign tax imposed on the income of the subsidiary company is substantially lower that the Cyprus taxes, i.e. under 5%.

Dividend payments between Cyprus resident Companies are exempt from defence tax.

As evident from the above, specific anti-abuse provisions are arguably provided for in the form of "controlled foreign company" (CFC) provisions which are intended to prevent the inflow of passive income from low taxed jurisdictions into Cypriot Holding Companies, which would in turn be converted into exempt dividend income.

In addition, the substance-over-form test is applied, which is intended to trigger abusive and artificial transactions, while at the same time the right of a taxpayer to arrange his affairs in a tax efficient way is recognized.

Another important advantage of Cyprus is the fact that capital gains tax is only triggered by gains deriving from the disposal of immovable property situated within Cyprus or gains from the disposal of shares in Companies in possession of immovable property situated in Cyprus. As such, capital gains deriving from the sale of immoveable property situated outside Cyprus fall outside the scope of capital gains tax.

In line with the above, the disposal of securities is exempt both under the Cyprus Income Tax Law, as well as under the Cyprus Capital Gains Tax Law.

The extended list of instruments falling within the definition of securities increases the competitiveness of the Cypriot jurisdiction from a tax planning perspective even further given that the ability of investors to reduce or even eliminate their tax liability by the use of a Cyprus holding company in their structure is further enhanced.

The profit after tax of a Cyprus Holding Company, is available for distribution to its shareholders. The distribution of dividends to Cyprus resident shareholders is subject to a 15% defence tax, which is withheld at the time of distribution. Deemed dividend distribution provisions apply in cases of profits not distributed within a 2-year period following the end of the tax year in which they arose. Accordingly, 70% of the nondistributed profits are taxed at the rate of 15%.

Equally, an exemption from defence tax is granted to non resident shareholders, which is also extended to the deemed dividend distribution provisions.

Apart from the most favourable domestic law provisions, Cyprus Holding Companies may also benefit from the wide network of Double Tax Treaties Cyprus has concluded, and derive dividend payments from its subsidiaries with low or no withholding taxes. Equally, the provisions of the EU Parent - Subsidiary Directive have application where the Cyprus Company receives dividend income from an associated company established in another EU-Member State, thus providing for an elimination of withholding taxes over the dividend distributed.

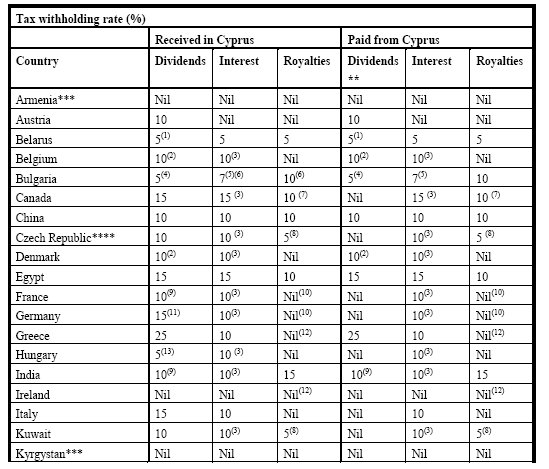

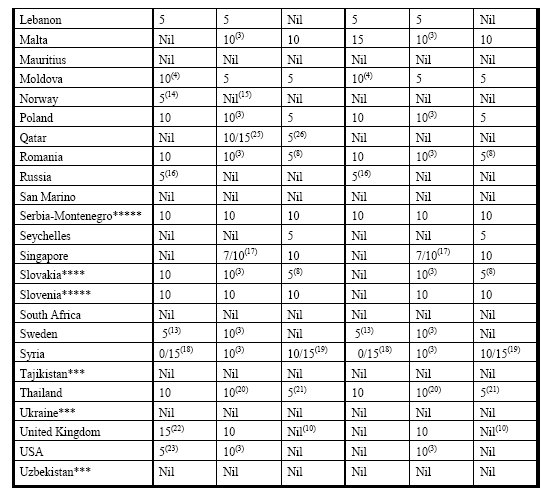

Double Tax Treaties

*(All the treaties refer to those, which have been ratified. There are 32 treaties covering 40 countries. The numbers in the brackets refer to the explanatory notes here below.

**Under Cyprus tax law, dividends paid to non-resident companies are not subject to withholding tax.

*** Application of the Treaty between the Republic of Cyprus and the USSR.

**** Application of the Treaty between the Republic of Cyprus and Czechoslovakia.

***** Application of the Treaty between the Republic of Cyprus and Yugoslavia.

Explanatory Notes

- 5% of the gross amount if the beneficial owner has a holding in the share capital of the paying company of at least Euros 200.000; 10% if the beneficial owner holds directly at least 25% of the share capital of the paying company; 15% in all other cases.

- 10% of the gross amount if recipient is a company with at least 25% direct (also indirect in the case of Belgium) share interest; 15% in all other cases.

- Subject to certain exemptions.

- 5% if beneficial owner is a company which holds directly at least 25% of the capital of the company paying the dividends; 10% in all other cases.

- Nil if interest is paid or guaranteed by the government of the other state or a statutory body thereof or to the central bank of the other state.

- These rates shall not apply if at least 25% of the capital of the Cypriot resident is owned directly or indirectly by the Bulgarian resident (either alone or with other related persons) that is paying the interest of royalties, except when the resident of Cyprus is not liable to tax which is lower than the usual tax rate.

- Nil if royalties are copyright and other literary, dramatic, musical or artistic work not including film or videotape royalties.

- Nil if royalties are on literary, artistic or scientific work including cinematography films and films or tapes for television or radio broadcasting.

- 10% if recipient is a company with at least 10% if recipient is a company with at least 10% direct share interest; 15% in all other cases.

- 5% on cinematography films including television films.

- 10% if recipient is a company with at least 25% direct share interest; 27% if recipient is a company with more than 25% direct or indirect share interest as long as the German corporate tax on distributed profits is lower than that on undistributed profits and the difference between the two rates is 15% or more; 15% in all other cases.

- 5% on cinematography films not including television films.

- 5% if recipient is a company with at least 25% direct share interest; 15% in all other cases.

- Nil if received by a company which controls, directly or indirectly, at least 50% of the voting power.

- At the rate applicable in accordance with domestic law.

- 5% if the beneficial owner has directly invested in the capital of the company more than the equivalent of US$100.000:10% in all other cases.

- 7% if it is received by a bank or a similar financial institution; 10% in all other cases. Interest paid to the government of the other state, as defined, is exempt from tax.

- Nil if shareholder is a company that holds directly at least 25% of the capital of the company paying the dividends; 15% in all other cases.

- 15% for any patent trade mark, design or model, plan, secret formula or process or any industrial, commercial, or scientific equipment or for information concerning industrial, commercial or scientific experience.

- 10% of the gross amount if it is received by any finical institution (including an insurance company) or in connection with the sale on credit of any industrial, commercial or scientific equipment, merchandise; 15% in all other cases. Interest paid to the government of the other state is exempt from tax.

- 5% of the gross amount of the royalties for the use of or the right to use any copyright of literary, dramatic, musical, artistic or scientific work, including software, cinematography films, or films or tapes used for television or radio broadcasting; 10% of the gross amount of the royalties received as consideration for the use of, or the right to use industrial, commercial or scientific equipment or for information concerning industrial, commercial or scientific experience; 15% of the gross amount of the royalties received as consideration for the use of, or the right to use, any patent, trade mark, design or model, plan, secret formula or process.

- A resident of Cyprus, other than a company which either alone or together with one or more associated companies controls directly or indirectly at least 10% of the voting power, is entitle to a tax credit in respect of the dividend. Where a resident of Cyprus is entitled to a tax credit, tax may also be charged on the aggregate of the cash dividend and the tax credit, tax may also be charged on the aggregate of the cash dividend and tax credit at a rate not exceeding 15%. In this case any excess tax credit is repayable. Where the recipient is not entitled to a tax credit, the cash dividend is exempt from any tax.

- 5% if recipient is a company with at least 10% direct share interest; 15% in all other cases.

- 5% on cinematography films

- Interest withheld depending on whether income is deriving in the ordinary course of business or not. 10% or 15% are charged respectively.

- Royalties charged should not exceed 5%.

Additional benefits under the Cyprus Tax System:

Interest Income Received:

Under the Cypriot tax legislation a distinction is made between interest income received in or being closely related to the ordinary course of business of the Company and interest income earned outside the ordinary course of business of the Company.

In accordance with the above, interest income earned in or being closely related to the ordinary course of business is not treated as interest for tax purposes but rather as income from trading activities and as such it is subject to Cyprus Corporate Income Tax at the rate of 10%. Interest income deriving from group financing activities is treated as interest income closely connected to the ordinary course of business of a Company.

On the other hand, interest income earned outside the ordinary course of business of a company is subject to 10% corporate income tax on 50% of the said interest income and also to a special contribution for the defence of the Republic, rated at 10%, effectively leading to a 15% tax.

Thin capitalization rules:

Cyprus did not incorporate any thin capitalisation rules under its legislation, essentially in the form of debt-to-equity restrictions. It should be noted though, that the Cyprus Income Tax legislation, incorporates deemed interest payment provisions with respect to loans advanced by a Cyprus Company to its shareholders or directors, with no or low interest rates.

Transfer pricing:

There is no specific transfer pricing legislation currently in place, however, from a transfer pricing perspective, the arm's length principle has application, as defined by the OECD, in transactions between related / associated parties. The arm's length principle provisions are incorporated in the revised Income Tax Legislation. From a back-to-back financing perspective, a minimum margin should be allowed, depending on the value of the loans to be put in place.

Interest Paid by the Cyprus Financing Company to Creditors is not subject to any withholding taxes.

Royalties received in Cyprus:

Net royalties income, after the deduction of any royalty payments or expenses and the allowance of any tax credit available, is subject to 10% Corporate Income tax.

Gains on the sale of Intellectual Property:

Gains deriving from the sale of intellectual property may arguably be exempt from Corporate Income Tax, unless the said gain is deemed to be a result of the trading activities of the Company.

Royalties paid are not subject to any withholding taxes given that the rights are exercised outside Cyprus.

Equally, the provisions of the EU Interest and Royalties Directive have application where the Cyprus Company receives interest or royalty payments from an associated company established in another EU-Member State, thus providing for an elimination of withholding taxes over the interest and royalty payments.

A unilateral tax credit is allowed with respect to foreign taxes paid.

Expenses are deductible given that they have incurred wholly and exclusively for the production of income.

The implementation of the EU Mergers Directive enables tax neutral corporate reorganizations.

It is possible to carry forward losses indefinitely, and equally, group relief is allowed for the utilization of tax losses.

CONCLUSION

Especially in today's market, tax exposure has a vast influence on the structuring of investment decisions. While the ultimate aim of investors is to maximise their return on an investment after tax, tax leakage should be kept to the very minimum.

In line with the above, Cyprus may prove to be the ideal jurisdiction for the establishment of an investment vehicle in the form of an intermediary holding company. With its EU Membership and harmonization of its legislation with the EU acquis communautaire, the lowest corporation tax rate within the EU and its full compliance with the OECD regulations against harmful tax practice, Cyprus has a competitive advantage against various international financial centres.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.