Guidelines 2023

Cost of Living Adjustment (COLA)

Full-timers: €9.90 per week

Part-timers: €0.25 per hr*

Minimum Wage

18 yrs and over: €192.73 per week (€4.82 per hr* for

part-timers)

17 yrs: €185.95 per week (€4.65 per hr* for

part-timers)

Under 17 yrs: €183.11 per week (€4.58 per hr* for

part-timers)

In addition to COLA, the weekly wage must be revised to reach €3 per week above minimum wage after the first year of employment and €6 per week above minimum wage after the second year.

Public Holidays falling on a weekend

2023: 2 days 2025: 4 days

2024: 6 days 2026: 3 days

For every Public Holiday falling on a weekend, 8 hrs of additional

Vacation Leave are due to full-timers.

Vacation Leave

2023: 192 hrs + 16 hrs = 208 hrs (26 days) 2025: 192 hrs + 32 hrs =

224 hrs (28 days)

2024: 192 hrs + 48 hrs = 240 hrs (30 days) 2026: 192 hrs + 24 hrs =

216 hrs (27 days)

A maximum of 12 days (96 hrs*) from annual leave entitlement may be

utilised for Shutdowns and Bridge Holidays.

Part-timers are entitled to vacation leave pro-rata the average hours worked in the previous quarter (13 weeks: January-March; April-June; July-September; October-December).

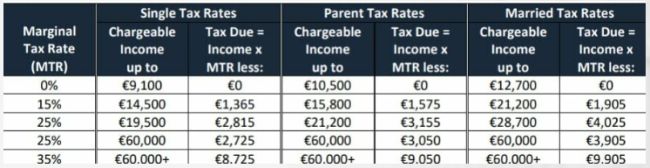

Tax Rates

Part-time employment where it is not the main employment: 10% on

the first €10,000

Part-time self-employment where it is not the main employment: 10%

on the first €12,000

Overtime: 15% on the first €10,000 provided annual basic wage

is under €20,000

Full-time employment and all other employment income is taxed according to applicable tax rates:

- Single Tax Rates apply to single persons and married persons whose spouse is in employment and who do not have dependent children (under 18 or under 23 years and full-time students);

- Parent Tax Rates apply to married persons whose spouse is in employment and who have dependent children;

- Married Tax Rates apply to married persons whose spouse is unemployed or single parents who have dependent children

National Insurance Contributions apply, made available on request

Retirement Age

Born 1962 or later: 65 years

Born 1959-1961: 64 years

Persons who attain the age of 61 years may choose to retire

earlier on a lower pension if they have the required number of

fully paid NI Contributions:

- Born before 1961: 35 years (1820 contributions)

- Born between 1962 and 1968: 40 years (2080 contributions)

- Born 1969 onwards: 41 years (2132 contributions)

Source: The Malta Chamber of Commerce, Enterprise and Industry, January 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.