Luxembourg has more than 190,000 cross-border commuters, most of whom live in Belgium, France, or Germany. Amazingly, since Brexit there have been more and more commuters from the UK too.

Given the traffic and travel issues arising alongside this trend, there have recently been more calls for flexible work arrangements. Working from home could be one such arrangement, though it comes with implications on income tax and social security—affecting both employee and employer.1

Income tax

Luxembourg has signed tax treaties with (among other countries) all of its neighbours and the UK, which enable it to tax income gotten from an employer in Luxembourg. However, the country of residence may also tax an employees' worldwide income, which would lead to double taxation2—were it not for the tax treaties.

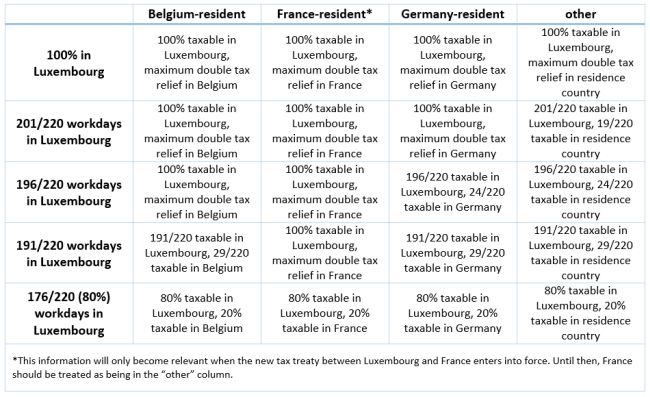

Luxembourg's treaties with Belgium and Germany have a special provision whereby the full employment income is taxed in Luxembourg only if the number of days worked outside of Luxembourg doesn't exceed a certain limit. For Belgium this limit is 24 days per year; for Germany it's 19. In the recently signed tax treaty with France (not yet in force), this threshold is 29 days per year.

If the number of workdays outside Luxembourg exceeds the threshold, then only the employment income related to the workdays in Luxembourg may be taxed in Luxembourg. A day worked at home, i.e. in the country of residence, counts as a workday outside of Luxembourg. Business trips outside Luxembourg count as non-Luxembourg workdays too. Thus, for employees, the physical location where the work is performed counts. (Different rules apply for non-executive directors and the self-employed).

The country of residence will only grant relief from double taxation for income taxable in Luxembourg. If only part of the employment income may be taxed in Luxembourg, you should make sure that you do not pay Luxembourg tax on the part that is not taxable in Luxembourg. If your employer withholds tax on the full income, you can claim a refund through your tax return, though this can take up to five years to process.

It is also possible to adjust the withholdings through payroll for workdays not taxable in Luxembourg. Ideally, such an adjustment would be done each month based on the actual days worked. However, for residents of Belgium and Germany it might only become clear in December whether they exceed the threshold. Thus, depending on the number of non-Luxembourg days worked, employers may decide to reconcile every quarter or at year-end. Most important is that the correct allocation to Luxembourg workdays is included in the annual salary certificate.3 Ultimately, adjustment through payroll ensures a direct refund of Luxembourg tax.

The combined Luxembourg and residence country taxes depend on individual circumstances. With only part of the employment income taxable in Luxembourg, the overall tax bill could be higher or lower than a 100% Luxembourg taxation. Working outside of Luxembourg can also affect your eligibility for Tax Class 2.4 Later in this article I include a few (simplified) examples, showing the financial impact of split taxation.

Social security

For social security, the rules are different. Within the EU, social security is coordinated by a European regulation5 that ensures that every employee is covered exclusively by one social security system.6 There is a special article for employees who work in multiple countries, i.e. multistate workers. You are a multistate worker if you regularly work more than 5% of your workdays in another country.

Multistate workers are covered by the social security system of their residence country if they work 25% or more (of their EU workdays) in that residence country. If that number is under 25%, then the social security system of the employer's residence country applies.

Example 1

Ashley resides in Belgium, works for a Luxembourg employer, works from home one day per week (20% of her working time), and works the other 80% physically in Luxembourg. Because less than 25% of her EU workdays are in Belgium, Ashley is covered by the Luxembourg social security system. Both employee and employer pay Luxembourg social security contributions on her full income.

Example 2

Tony resides in France, works for a Luxembourg employer, works from home one day per week (20% of his working time), and spends approximately 20% of his workdays outside the EU. His remaining workdays are spent in Luxembourg. Because Tony works 25% (20% out of 80%) of his EU workdays in France, where he resides, the French social security system applies. Both employee and employer pay French social security contributions on Tony's full income. No Luxembourg social security contributions are due in this scenario.

In this example, the Luxembourg employer would have to register with the French social security authorities and administer a French payroll for these social security contributions.

Employer costs

The applicable social security system affects the benefits, employee contributions, and employer contributions.

Costs for social security vary greatly within the EU: in Luxembourg almost all social security contributions are capped, but in Belgium and France they are not. Especially for higher incomes, the increased cost can be significant—see the implications in the examples below. (Check out this report for a high-level comparison of tax and social security costs in 17 European countries).

The calculations below are based on an employee of a Luxembourg company who lives outside of Luxembourg and is married with two dependent children.

Conclusion

From tax and social security perspectives, working from home could significantly affect an employee's net income. It may also have cost implications, and/or create a payroll obligation, for the employer.

Companies who employ remote workers or cross-border commuters: implementing a policy is probably a good idea. Such a policy should explain the potential implications of working from home and include the conditions that apply.

In addition to all that, there may be HR considerations when working from home—watch this blog for more on that topic soon!

Footnotes

1 Corporate tax and VAT implications with respect to a potential permanent establishment are not covered.

2 Double tax relief is typically provided by an exemption with progression or a tax credit, but varies per country and tax treaty.

3 Certificat de salaire, de retenue d'impôt et de crédits d'impôt bonifiés.

4 Read our newsletter about the new rules per 1 January 2018 for non-residents.

5 I.e., EC Regulation 883/2004 on the coordination of social security systems.

6 It has a broad scope and many provisions. For the purpose of this article I only focus on employees who work in more than one country, i.e. multistate workers.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.