Finding the right professional employer organization (PEO) payroll company in Panama will allow you to hire qualified local staff without having to formally establish a business in the Central American country. For foreign companies with a limited-scale or short-term operation, it is often the most suitable option available, while for others planning a larger-scale involvement, using a PEO payroll company in Panama offers the opportunity to get familiar with the market before investing further.

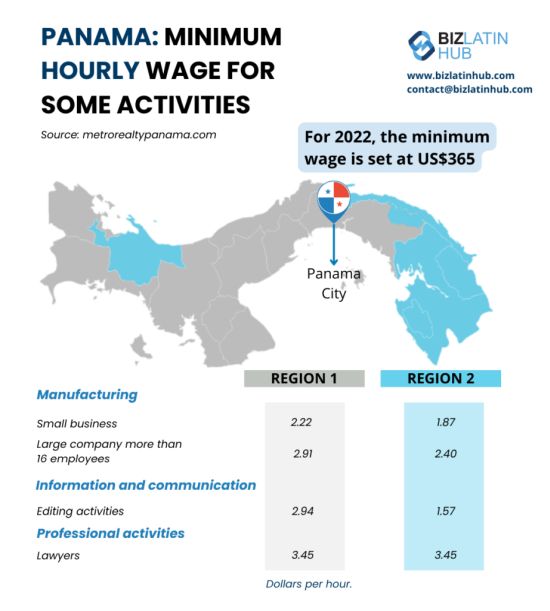

Panama minimum hourly wage for some activities. PEO Payroll Company in Panama.

A PEO company can also be known as an employer of record (EOR), while PEO payroll services can also be referred to as payroll outsourcing.

With a gross domestic product (GDP) of 7605 billion (all figures in USD) in 2022 and a population of approximately 4.5 million, Panama is considered a high-income country that saw it score a high 92.0 in the World Bank's Doing Business 2020 report. The nation recorded more than $2 billion of foreign direct investment (FDI) inflows in 2022, stimulated by a territorial tax system in which only income earned within the country is taxed.

The Central American country's business-friendly approach sees it employ the lowest value-added tax (VAT) and income tax rates in Central America, while its politically stable government and secure banking sector have made it a highly popular destination for foreign investors and expats. Some of the country's main export commodities include refined petroleum, coal tar oil, passenger and cargo ships, and gold.

Panama has an advantageous geographic location, linking Central America to South America, while also connecting the Caribbean Sea and the Atlantic Ocean via the iconic Panama Canal, through which roughly 14,000 ships transit each year, generating an estimated 8% of the nation's GDP.

If you are considering company formation in Panama or are otherwise looking to enter the market, read on to understand the advantages of hiring local staff through a PEO payroll company in Panama.

What is a PEO / EOR payroll company in Panama?

A PEO payroll company will support your business expansion by providing high-quality HR services that will give you time to focus on other vital aspects of your business. A PEO payroll company in Panama will be responsible for recruiting, hiring, firing, managing employee payroll, and paying all holiday and social benefits.

Operating as the official employer in the eyes of the local government, a PEO payroll company in Panama will be in charge of remunerating local personnel in the event of resignation, dismissal, maternity leave, retirement, and any other payments established by local labor regulations.

In addition, with extensive knowledge of local labor, tax, and corporate legislation, a PEO payroll company in Panama will also guarantee your business remains in good standing with authorities and will assist you with time-consuming administrative processes, such as drafting contracts and other documents and paperwork.

Legal Framework Governing Employers of Records (EORs) in Panama

Panama has a well-developed legal framework governing EORs. Under Panamanian law, an EOR is known as a "contratista de personal," which translates to "personnel contractor." Personnel contractors are regulated by the Panamanian Labor Code and must be registered with the Ministry of Labor and Social Security.

One of the key advantages of using an EOR in Panama is that it allows companies to quickly and easily establish a presence in the country without the need to set up a separate legal entity. However, it is important to note that while EORs can help streamline the process of expanding into Panama, they are not a substitute for compliance with all applicable laws and regulations.

Employers must ensure that they are working with a reputable EOR that is in compliance with all relevant laws and regulations in Panama. This can help mitigate the risks associated with using an EOR, such as the risk of reputational damage or legal liability.

How to use a payroll calculator

If you are keen to get an idea of the possible costs involved in payroll outsourcing in Panama, using a payroll calculator is one way to get a very good estimate.

PEO Payroll Company in Panama – Use the Biz Latin Hub payroll calculator

Because while a payroll calculator won't be completely accurate, it will give you the opportunity to search according to the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our Hiring & PEO Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Caribbean based on country, currency, and salary, with the calculator factoring in local statutory deductions.

To use the BLH payroll calculator, you will need to undertake the following steps:

Step 1: Select the country

Choose the country where you are doing business, or planning to launch. This feature will be useful when it comes to comparing potential alternative markets.

Step 2: Select the currency you wish to deal in

You can choose between US dollars (USD), British Sterling (GBP) and Euros, as well as the local currency for the country you are looking at, based on that which is most convenient to you. Note that for Ecuador, El Salvador, and Panama, the local currency is also USD, as they have dollarized economies.

Step 3: Indicate an employees monthly income

Here you can indicate the expected salary you will be paying an employee, in the currency of your choice.

Step 4: Calculate your estimated costs

Based on all of the information you have provided, you will receive results indicating your estimated costs, including a breakdown for estimated statutory benefits you will be liable for.

Step 5: Compare your costs to other options

With a good estimate at hand of how much your staff in Panama would be, if you are flexible about your expansion into Latin America and the Caribbean, you can use the BLH payroll calculator to compare those costs to other jurisdictions.

The main advantages of hiring local staff through a PEO payroll company

Working with a PEO payroll company allows you to enter the Panamanian market in a short time frame, allowing you to get your commercial operations underway in a timely manner. Some of the main benefits of hiring local staff through a PEO payroll company in Panama include:

- Legal Representation:Claims related to your company's employees will be addressed to the PEO payroll company, which is equipped to represent your business and resolve many employee-related legal and administrative issues that might affect your business venture.

- Legal Advice:with abundant knowledge of local civil, corporate, tax, and labor regulations, a PEO payroll company in Panama is able to provide expert advice to avoid delays and overcome challenges often faced by foreign enterprises.

- Profitability:Hiring local staff through a PEO payroll company in Panama will allow you to save money and avoid additional fees that may increase the cost of developing your business operations in the country.

- Employee recruitment:with years of experience helping companies find qualified personnel, a PEO payroll company will identify and recruit the most suitable staff for your company.

Disadvantages of Hiring through an EOR in Panama

- Permanent Establishment Risk:While the EOR structure can help businesses quickly and easily hire employees in a new location, it may also create a risk of inadvertently establishing a permanent establishment. This can occur if the business is found to have a significant level of control over the activities of the employees in the new location or a significant presence in foreign countries. In these situations, the business may be subject to local taxes and regulations and may be required to register as a local entity. To mitigate this risk, it is important for businesses to carefully evaluate their EOR arrangement and ensure that it is structured in a way that is compliant with local laws and regulations.

- Unattractive to employees: The EOR structure is often viewed as less attractive to employees because it can create a sense of instability. This is because the EOR arrangement typically involves a third-party company becoming the legal employer of the worker, while the worker continues to perform their job duties for another company. While this can provide benefits such as access to benefits and compliance with local labor laws, it can also lead to uncertainty for employees about their job security and future career opportunities. Additionally, the EOR structure may involve changes to employment status or benefits, which can further contribute to a sense of instability. As such, employees may be hesitant to pursue opportunities within an EOR arrangement, preferring instead the stability and security of traditional employment models by a local entity.

- Increased Cost: When hiring a large number of employees, the costs associated with the EOR structure can quickly add up. For example, the third-party company providing EOR services may charge a premium for their services, and there may be additional costs associated with managing and administering benefits for a large workforce. In these situations, establishing a local entity may be a better option. By setting up a local entity, businesses can gain greater control over their workforce and potentially reduce costs associated with the EOR structure. This can also provide greater flexibility and scalability for the business as they grow and expand in the new location. While the decision to use the EOR structure or establish a local entity ultimately depends on a range of factors, including the size and scope of the business and the regulatory environment in the new location, it is important for businesses to carefully consider their options and make an informed decision that aligns with their strategic goals and priorities.

- Difficulty Building a Company Culture:Companies that use EORs may find it more difficult to build a cohesive company culture. Because employees are working remotely and are managed by a third-party entity, it can be challenging to create a sense of connection and shared purpose among the workforce.

- Lack of Ownership and Control of Employees: Companies that use EORs may have less ownership and control over their employees. Because the EOR is the legal employer, the company may not have as much say in hiring decisions or other employment-related matters.

- Language and Cultural Barriers:Companies that are not familiar with the language and culture of Panama may find it challenging to communicate with employees and navigate local labor laws and regulations. This can increase the risk of miscommunications, misunderstandings, and compliance issues.

- Reputation Risk: If the EOR in Panama is not reputable or does not have a strong track record of compliance and reliability, this can reflect poorly on the company that uses its services. This can damage the company's reputation in the eyes of its customers, partners, and investors.

Important Consideration: An alternative to hiring through an EOR in Panama is to establish a local subsidiary company and hire employees through that company, this will mitigate and/or remove the risks outlined above.

Visa processing: a payroll company will also monitor the work visa application process for foreign employees and reduce any chances of rejection.

Time-saving: By outsourcing time-consuming and complex HR tasks, you will have time to manage other essential aspects of your newly established business.

Editor's note: Changes have been made to the Panama Friendly Nations Visa, applicable as of August 2021.

Understanding the hiring process in Panama

Understanding local legislation can be challenging for foreign executives. Without the support of a PEO payroll company in Panama, you would need to complete the following process to legally hire staff in the country:

- Incorporate a new company

- Open a corporate bank account

- Register your company with the Ministry of Commerce

- Register your organization with the municipality where it is located

- Prepare formal employment contracts for all employees and obtain contract approval from the Ministry of Labor

- Register your company as a formal employer with the Social Security Fund of Panama (CSS)

- Comply with monthly payroll statements

Note that in Panama, only 10% of a company's total payroll can be foreign.

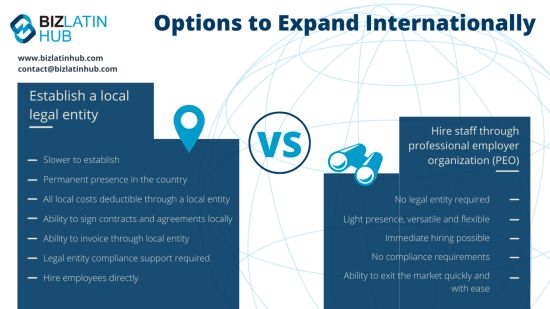

The graphic above highlights when it is best to use a Professional Employer Organization in Panama, or any country. PEO Payroll Company in Panama

The Future of EORs in Panama

As the business landscape in Panama continues to evolve, EORs are likely to play an increasingly important role in helping companies expand their presence in the region. With its strategic location, strong economy, and business-friendly environment, Panama has become an attractive destination for companies looking to establish a foothold in Latin America.

As the demand for EOR services in Panama grows, we can expect to see a number of trends emerging in this space. One key trend is the increasing use of technology to streamline EOR services and improve efficiency. This includes the use of cloud-based platforms for payroll and HR management, as well as AI-powered tools for compliance monitoring and risk management.

Another trend we can expect to see is the continued expansion of EOR services beyond traditional staffing and payroll functions. As companies seek more comprehensive solutions for managing their workforce, EORs in Panama are likely to offer a wider range of services, such as talent acquisition, training and development, and performance management.

Finally, we can expect to see more competition in the EOR market in Panama, as new players enter the market and existing providers expand their offerings. This will create more choices for companies looking to work with an EOR, but will also require careful consideration of factors such as reputation, experience, and cost.

Common FAQs when hiring through an Employer of Record (EOR) in Panama

Based on our experience these are the common questions and doubts of our clients.

- How to hire employees in Panama?

You can hire an employee by incorporating your own legal entity in Panama, and then using that entity to hire employees or you can hire through an Employer of Record (EOR), which is a third party organization that allows you to hire employees in Panama by acting as the legal employer. Meaning you do not need a Panamanian legal entity to hire local employees.

- What is in a standard employment contract in Panama?

A standard Panamanian employment contract should be written in

Spanish (and can also be in English) and contain the following

information:

-ID and address of the employer and employee

-A specification if the employee has dependants or not

-City and date

-Work position

-Work functions

-Type of contract (indefinite, definite, for a specific

task).

-The location where the service will be provided.

-Salary

-Payment frequency (Monthly, Bimonthly)

-Probation period (optional but recommendable)

-Working hours and clarification on the period (diurnal,

nocturnal, or mixed).

- What are the mandatory employment benefits in Panama?

The mandatory employment benefits in Panama are the

following:

-Social Security Contributions (health, pension, educational

insurance, and occupational risk)

-Vacations (30 calendar days per 11 months worked).

-Thirteen salary payments (payable on April 15th, August 15, and

December 15th of every calendar year.

-Sick leave (18 days per year).

For more information on mandatory employment benefits read our

recent article on Employment laws in Panama

- What is the total cost for an employer to hire an employee in Panama?

The total cost for an employer to hire an employee in Panama can

vary based on the salary; however, indicatively the employer cost

for mandatory employment benefits is 14.75% over the employee's

salary approximately, which is additional to the employee's

gross salary.

Please use our

Payroll Calculator to calculate employment costs.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.