The Dubai Virtual Assets Regulatory Authority (VARA) issued the much-anticipated executive regulations under the Law No. (4) of 2022 Regulating Virtual Assets in the Emirate of Dubai' ("DVAL") on February 07, 2023. DVAL governs virtual assets activities undertaken in and from the Emirate of Dubai ("Emirate"), including the special development zones and free zones but excluding the Dubai International Financial Centre.

VARA has issued the over-arching Virtual Assets and Related Activities Regulations 2023 ("VARA Regulations") and a suite of rulebooksthereunder, including (i) four Compulsory Rulebooks (namely, Company Rulebook; Compliance & Risk Management Rulebook; Technology & Information Rulebook and Market Conduct Rulebook) that set out, amongst others, mandatory conduct of business obligations and compliance requirements for Virtual Asset Service Providers ("VASPs") who meet VARA's licensing requirements; (ii) seven Activity-Specific Rulebooks that will apply to VASPs based on the activities they are licensed to provide; and (iii) a Virtual Assets Issuance Rulebook that regulates issuance of virtual assets in the Emirate (collectively referred to as "Rulebooks"). Previously, VARA had issued the 'Administrative Order No. [01] of 2022: Relating to Regulation of Marketing, Advertising and Promotions Related to Virtual Assets' which regulates marketing, advertising and promotional activities relating to virtual assets in the Emirate ("Marketing Order").

The VARA Regulations, together with the Rulebooks, introduce a comprehensive regulatory framework for virtual assets activities and VASPS. Issuance of this regulatory framework demonstrates the Emirate's commitment towards promoting innovation and growth in this rapidly evolving sector. In this article, we provide an overview of the VARA Regulations, the Rulebooks and certain key aspects that VASPs must take into consideration.

A. GENERAL PROHIBITION

VARA Regulations contain a general prohibition wherein no entity may carry out by way of business, promote, offer a regulated virtual asset activity or purport to do so, unless (i) it holds a license from VARA; or (ii) qualifies as an exempt entity (defined as a UAE government entity or a public, not-for-profit and charitable entities of an UAE government entity.)

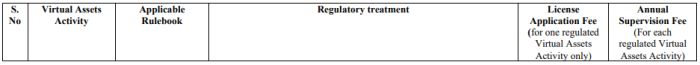

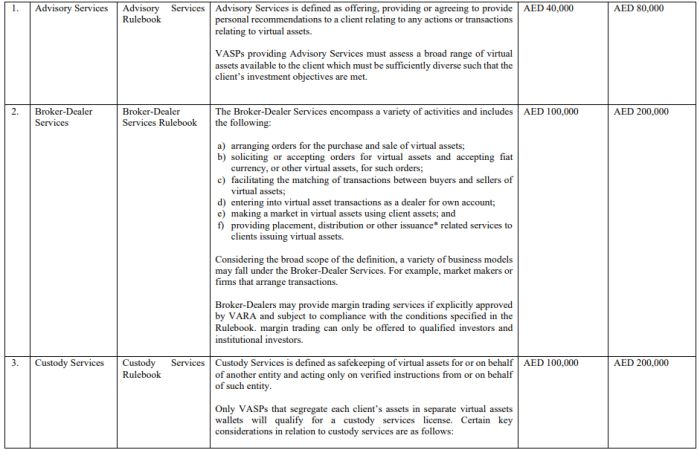

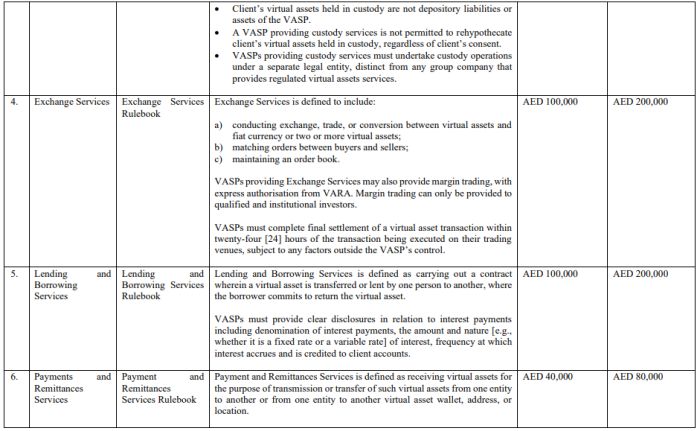

B. PERMITTED VIRTUAL ASSETS ACTIVITIES

We have assessed below VARA's regulatory framework in relation to certain key virtual assets activities. It is noteworthy that VARA has not assigned any prudential category to the activities. Depending on the business model, VASPs may need to obtain approvals for more than one virtual asset activity and may have to ensure compliance with multiple Activity Specific Rulebooks.

C. LICENSING PROCESS

As of February 24, 2023, VARA is continuing to operate its Minimum Viable Product (MVP) program wherein it has issued MVP permits to a select number of VASPs. Under the MVP program, each VASP must pass four stages of licensing process, as shown below. Until a Full Market Product license is obtained, VASPs are not permitted to provide services to mass retail investors; they may only provide services to qualified and/or institutional investors upon securing a MVP Operating Permit. VARA has stated that it will issue Full Market Product licenses only after the current regulatory regime is tested.

![]()

Under Stage 1 and Stage 2 above, VASPs are required to undertake readiness steps such as establishing offices, onboarding employees with work visas and securing domestic bank accounts. VASPS are not permitted to undertake any market operations during these stages.

The VARA Regulations state that VARA may prescribe a licensing process from time to time, which implies that VARA may in due course notify a new licensing process for VASPs. As of February 24, 2023, VARA has not released any application forms or opened an online portal where new applications for a license can be submitted.

D. KEY FACTORS TO CONSIDER:

a) Capital requirements: The capital requirements range from AED 100,000 to AED 1,500,000 or may depend on the fixed annual overheads. The capital requirements vary with each regulated activity and the number of regulated activities undertaken.

b) Net Liquid Assets and Reserve Assets: VASPs must at all times hold and maintain sufficient current liquid assets such that the surplus over current liabilities is at least 1.2 times their monthly operating expenses. In addition, VASPs must maintain reserve assets equivalent to 100% of their liabilities towards clients for all virtual assets activities. VASPs must hold reserve assets on a one-to-one basis in the same virtual asset that liabilities are owed to its

c) Insurance: VASPs must maintain multiple types of insurances including (i) professional indemnity insurance; (ii) directors' and officers' insurance; (iii) commercial crime insurance or similar types of insurance for all virtual assets stored in hot wallets; and (iv) any other type of insurance as directed by VARA

d) Proprietary trading: VASPs that actively invest in their own portfolio in virtual assets where the investment volume is equal to or more than USD 250 Million (equivalent value of Virtual Assets) during any rolling thirty [30] calendar days period, must register with VARA, prior to investing or within 3 working days from the date such volume is invested. Proprietary traders must not accept or trade virtual assets of a third party. VASPs that do not meet this Provisional Permit Preparatory Permit MVP Operating Permit Full Market Product ("FMP") license registration criteria may choose to voluntarily register with VARA. It must be noted that registration with VARA is not equivalent to a license and it does not authorize the proprietary trading entity to provide any regulated services.

e) Trading on own account: VASPs are prohibited from actively investing their own or their group's portfolio of virtual assets or any other assets, unless such active investing is undertaken in connection with the management of net liquid assets required to be held by the VASP.

f) Scope of virtual assets:

i. VARA Regulations prohibit issue of privacy tokens and associated virtual assets activities in the Emirate. On the other hand, virtual assets activities in relation to Central Bank Digital Currency will remain under the regulatory purview of the CBUAE.

ii. VASPs may not be required to seek specific approval for each virtual asset that they intend to provide services in relation to; VASPs must however establish their own standards for such virtual assets. The virtual assets standards must be disclosed on the website and must meet certain minimum criteria specified by VARA.

g) Voluntary registration: VASPs involved distributed ledger technology (DLT) services may voluntarily register with VARA. Such registration does not however authorize the DLT entity to engage in any regulated virtual assets activities.

h) Conduct of business obligations (COBS) and compliance requirements: VASPs must comply with various COBS and compliance requirements including: (i) undertaking assessment of client suitability; (ii) making mandatory staff appointments; (iii) implementing a compliance management system; (iv) making required public disclosures; and (v) implementing policies, systems and procedures for AML/CFT compliance, risk management, handling of client assets and client money, data protection, handling of client complaints, whistleblowing, business continuity and cybersecurity. Few VASPs (such as VASPs providing Custody Services or Exchange Services) are required to appoint an independent director on the board and constitute committees of the

E. CONCLUSION

VARA's regulatory framework is tailored to address specific needs of the virtual assets sector. For instance, activities such as staking, lending and borrowing of virtual assets and issuance of virtual assets are addressed in the regulatory framework. At the same time, the regulations do not compromise on requirements in relation to corporate governance, regulatory reporting, public disclosures, market integrity, risk management, consumer protection and compliance. Overall, VARA's regulatory framework is a step in the right direction, as it introduces a nuanced regulatory regime for virtual assets activities and VASPs.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.