1. Introduction

On December 20, 2019, the Financial Services Agency of Japan (the "FSA") released a report by the "Working Group on Regulations for Payment Services Providers and One-Stop Financial Services Brokers" under the Financial System Council (the "FSC Report"),1 which recommended various regulatory reforms for payment services (such as e-money) as well as the introduction of a regulatory framework for one-stop financial service brokerage that covers the banking, non-bank money-lending, securities, and insurance industries. Based on the recommendations in the FSC Report, on March 6, 2020, the Japanese government submitted to the Diet (Japan's parliament) a bill to amend the Act on Sales, etc., of Financial Instruments, the Payment Services Act, and other relevant statutes (the "ASFI/PSA Amendment Bill").2

On the same day as the FSC Report, the Ministry of Economy, Trade and Industry of Japan (the "METI") also released the final report of the Installment Sales Subcommittee of the Commerce, Distribution and Information Committee under the Industrial Structure Council (the "ISC Report"), which recommends certain regulatory reforms concerning postpaid services (such as credit cards).3 Based on the recommendations in the ISC Report, on March 3, 2020, the Japanese government submitted to the Diet a bill to amend the Installment Sales Act (the "ISA Amendment Bill").4

This newsletter provides an overview of the expected legal and regulatory amendments recommended or proposed by these reports and bills.

2. Reform of payment services regulations under the Payment Services Act

Based on the FSC Report and the ASFI/PSA Amendment Bill, the Payment Services Act is expected to lead to the following reforms in the regulations governing Funds Transfer Services and Prepaid Payment Instruments.

(1) Fund Transfer Services

Under the current law, in principle, only licensed depository financial institutions, such as banks, may engage in "fund transfer transactions" (kawase torihiki).5 As an exception to this principle, an entity not licensed as a depositary financial institution is, if registered as a "Funds Transfer Service Provider" under the Payment Services Act, permitted to engage in fund transfer transactions, subject to a ceiling of one million yen (or an amount equivalent thereto) per transaction ("Funds Transfer Service").6

(a) New regulatory framework based on the amount of remittance

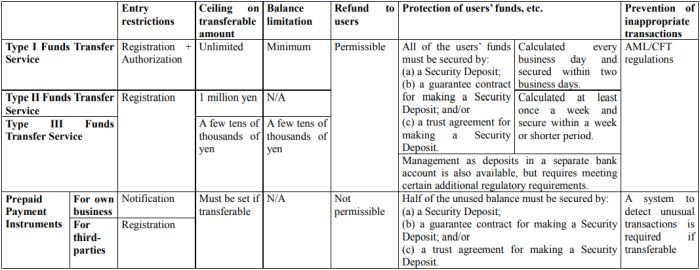

As mentioned above, under the current law, Funds Transfer Services are subject to a ceiling of one million yen (or its equivalent) per transaction. Under the new regulatory framework, there will be the following three regulatory categories of Funds Transfer Services in accordance with the amount of remittance per transaction (summarized in Table 1), any number of which can be conducted concurrently.

Type I Funds Transfer Service: Category for remittance of large amount of funds without a ceiling.

In addition to the requirement to be registered as a Funds Transfer Service Provider with the regulator, authorization of the provider's business implementation plan by the regulator is also required. The provider is prohibited from receiving deposits from users without specific remittance instructions or keeping such deposits for more than the period of time needed for the transfer of funds.

Type II Funds Transfer Service: Category based on the current regulations, subject to a ceiling of one million yen per transaction.

Type III Funds Transfer Service: Category for remittance of a small amount of funds, subject to ceiling of a few tens of thousands of yen per transaction as well as the deposit balance subject to a ceiling of a few tens of thousands of yen.

The ASFI/PSA Amendment Bill proposes that Funds Transfer Service Providers be required to take measures not to keep deposits received from users that are unlikely to be used for fund transfer transactions. In this regard, according to the FSC Report, in the case of a Type II Funds Transfer Service, if the amount deposited by a user exceeds one million yen, the Funds Transfer Service Provider will be required to check whether such deposit is related to fund transfer transactions and, if found to be unrelated, such deposit should be returned to the user.

(b) Protection of users' funds

Under the current law, a Funds Transfer Service Provider is required to secure users' funds through (i) a security deposit with an official depository that functions as collateral for users (a "Security Deposit") and/or (ii) a guarantee contract for making a Security Deposit, or (iii) a trust agreement for making a Security Deposit.7

Under the new regulations recommended by the FSC Report and proposed by the ASFI/PSA Amendment Bill, it will be acceptable to use method (iii) (a trust agreement) in combination with (i) and/or (ii). In addition, the frequency of the secured amount calculation will be standardized to a minimum of at least once a week (or, in the case of Type I Funds Transfer Service, every business day). The period between the calculation date and the date on which the secured amount is actually secured (under the current law, one week for (i) and (ii) above while one business day for (iii) above) will be a week or a shorter period specified in the regulation under the Payment Services Act (according to the FSC Report, two business days for Type I Funds Transfer Service).

According to the FSC Report, in cases where method (ii) (a guarantee contract) is used for a Type II Funds Transfer Service, the Funds Transfer Service Provider will be required to take measures to prevent the utilization of users'funds for lending purposes.8

Furthermore, with regard to Type III Funds Transfer Services, Funds Transfer Service Providers will be allowed to manage users'funds as deposits in bank accounts (separate from proprietary accounts), instead of securing them through (i) through (iii) above. As they are unlikely to be considered bankruptcy remote, Funds Transfer Service Providers will be required to provide users with information on the risk of bankruptcy, to conduct external audits on the management of users' funds and financial documents, and to periodically report the status of such management to the relevant regulator.

(c) Unauthorized transactions

The FSC Report recommends requiring Funds Transfer Service Providers to inform users of their respective policies on treatment of unauthorized transactions (such as their indemnification policy), rather than regulation of the substance of such policies.

(2) Prepaid Payment Instruments

The Payment Services Act categorizes gift vouchers, prepaid cards, and non-refundable e-money as "Prepaid Payment Instruments" and regulates certain issuers thereof as "Issuers of Prepaid Payment Instruments." As Prepaid Payment Instruments are prohibited from being refunded in principle,9 it is understood that the issuance of Prepaid Payment Instruments does not fall under the definition of "fund transfer transactions." Compared with the regulations on Funds Transfer Services, less restrictive regulations are imposed on Issuers of Prepaid Payment Instruments. For instance, the amount to be secured through a Security Deposit or guarantee contract / trust agreement by Issuers of Prepaid Payment Instruments is only half, rather than the full amount, of the unused balance of the outstanding Prepaid Payment Instruments, and it is not subject to the regulations for anti-money laundering and combating the financing of terrorism under the Act on Prevention of Criminal Proceeds Transfers (the "AML/CFT Act").

In view of these regulatory circumstances, practically, issuers of e-money that can be transferred among users (so-called "open-loop") often issue (i) non-refundable e-money as an Issuer of Prepaid Payment Instruments for users who have not yet completed the KYC process under the AML/CFT Act, and (ii) refundable e-money as a Funds Transfer Service Provider for users who have completed the KYC process.

(a) Prevention of inappropriate transactions

In order to prevent the use of "open-loop" e-money that falls under the category of "Prepaid Payment Instruments" for inappropriate transactions that harm public order and good morals, the FSC Report recommends requiring Issuers of Prepaid Payment Instruments to establish an upper limit for transferable balances and to establish a system to detect unusual transactions.

(b) Protection of the unused balance

An Issuer of Prepaid Payment Instruments is required to secure only half the total amount of the unused balance of the outstanding Prepaid Payment Instruments through a Security Deposit or guarantee contract / trust agreement for making a Security Deposit, unlike a Funds Transfer Service Provider, which is required to secure all of the users'funds. While the FSC Report suggests that immediate reforms dealing with such regulatory gap are not required at this time, it recommends requiring Issuers of Prepaid Payment Instruments to provide users with information concerning how the balance is secured and the fact that only half of the unused balance is secured.

(c) Unauthorized transactions

For unauthorized transactions, the same recommendation as described in (1)(c) above is made for Issuers of Prepaid Payment Instruments (i.e., requiring Issuers of Prepaid Payment Instruments to inform users of their respective policies on the treatment of unauthorized transactions).

(d) Ensuring consistency with the regulations on Funds Transfer Services

The regulations on Issuers of Prepaid Payment Instruments will align more closely with those on Funds Transfer Service Providers due to introduction of the duty to chaperon outsourced contractors and the increased flexibility of the regulator's authority to issue business improvement orders.

(3) Agency payment (shuno daiko) services

In practice, a large number of enterprises provide services that involve accepting receivables payments (under entrustments) on behalf of creditors, such as business operators and the national and local governments (i.e., so-called "agency payment" (shuno daiko) and "cash-on-delivery" services), based on the proposition that such services do not fall under the definition of "fund transfer transactions" and therefore the service provider is not required to be a depositary financial institution or a Funds Transfer Service Provider. However, the emergence of "agency payment" services for payments between consumers, such as bill-splitting apps and escrow services, have raised arguments concerning such interpretation of the current law.

Based on the FSC Report's recommendations, the ASFI/PSA Amendment Bill proposes including within the scope of "fund transfer transactions" the conduct of receiving (or having another person receive) funds from a debtor of a monetary claim (or any other person making a payment under a direct or indirect entrustment from the debtor or any other similar arrangement) as the payment thereof, utilizing an entrustment by the creditor, an assignment from the original creditor, or any other similar arrangement, and then transferring the received funds to the (original) creditor (without physical delivery) if certain conditions (such as the creditor being a consumer) are satisfied. In this regard, according to the recommendations in the FCR Report, "fund transfer transactions" will include, among "agency payment" services for payments between consumers, bill-splitting apps, but exclude escrow services.10

Table 1: Outline of the Regulations Based on the Recommendations or Proposals in the FSC Report and ASFI/PSA Amendment Bill

3. Postpaid service regulations under the Installment Sales Act

The ISC Report recommends, and the ISA Amendment Bill proposes, the following regulatory reforms with respect to regulations on credit cards and other postpaid services under the Installment Sales Act.

(1) Deregulation for small-amount postpaid services

The Installment Sales Act provides certain regulations on "Comprehensive Credit Purchase Intermediaries" (e.g., credit card issuers), including a registration requirement. Based on the recommendations of the ISC Report for new small amount postpaid services (opposed to traditional credit card services), the ISA Amendment Bill proposes introduction of a new regulatory category of "Registered Small-Amount Comprehensive Credit Purchase Intermediaries" for Comprehensive Credit Purchase Intermediaries with a small maximum credit amount (100,000 yen or less, according to the ISC Report). For this new regulatory category, according to the ISC Report, (i) registration acceptance will no longer be based on net asset (90% or more of the stated capital)11 or stated capital (20,000,000 yen, its equivalent, or more)12 requirements, (ii) the notice period to cancel a contract with a user due to the user's failure to pay (20 days)13 will be shortened to 7 or 8 days, (iii) the requirements to indicate the terms and conditions will be relaxed (by, for example, allowing the use of URLs), and (iv) the requirement to establish internal systems (such as those for internal audits and employee training) will be eased.

(2) Credit evaluation using technology and data

The Installment Sales Act requires a specific manner of credit evaluation be utilized by Comprehensive Credit Purchase Intermediaries, noting the subject matters to be investigated, methods of investigation (such as the duty to use credit information obtained from a Designated Credit Bureau) and methods of calculation.14 The ISC Report introduces the concept of "performance specifications", where only the required performance outcomes are specified in the laws and regulations, and specific measures and methods for achieving such performance are up to each company (and their use of the latest technology). The ISC Report also recommends, and the ISA Amendment Bill proposes, the introduction of a flexible framework permitting the use of technology and data in credit evaluation, subject to certification by the Ministry of Economy, Trade and Industry.

(3) Others

In addition to the above, based on the recommendations in the ISC Report, the ISA Amendment Bill proposes that, as an enhanced security measure, the scope of service providers that should take measures to appropriately manage credit card numbers15 should be expanded (covering certain payment service providers and QR code payment providers, as well as EC mall operators providing postpaid services), and that the requirements for electronic document delivery be eased.

4. Introduction of one-stop financial services brokerage regulations

Currently, financial services brokers are regulated separately for each industry, such as Bank Agents under the Banking Act, Financial Instruments Intermediaries under the Financial Instruments and Exchange Act, and Insurance Agents and Insurance Brokers under the Insurance Business Act. With the exception of Insurance Brokers, these financial services brokers are supposed to be subcontracted by specific financial institutions and subject to guidance therefrom, with such financial institutions remaining, in principle, liable for damages to customers caused by the financial services brokers.

Based on the recommendations in the FSC Report, the ASFI/PSA Amendment Bill proposes to amend the Act on Sales, etc., of Financial Instruments, renaming it as the Act on the Provision of Financial Services, to introduce a new regulatory framework for one-stop financial services brokers that cover multiple industries and are independent from financial institutions, called "Financial Services Brokers," under such Act.

(1) Scope of business

The scope of business of Financial Services Brokers will be:

- intermediary services for (a) acceptance of deposits, (b) lending of funds and discounting of bills and notes, and (c) fund transfer transactions by banks and other depositary financial institutions;

- intermediary services for conclusion of insurance contracts (covering life and non-life insurances);

- intermediary services for (a) sale and purchase of securities, (b) brokerage for sale and purchase of securities and derivatives on domestic or foreign exchanges, (c) distribution of securities, (d) conclusion of discretionary or non-discretionary investment advisory agreements (covering Type I Financial Instruments Business, other than Type I Small Amount Electronic Public Offering Service, and Investment Management Business, other than Investment Management Business for Qualified Investors); and

- intermediary services for lending of funds and discounting of bills and notes by Money Lenders.

A Financial Services Broker will not be allowed to act as an agent authorized to execute agreements on behalf of financial institutions.

Furthermore, financial instruments or services that require highly technical explanations will be excluded from the scope of business.16

In addition, if certain requirements are met, a Financial Services Broker will be allowed to engage in Electronic Payment Services (i.e., account information and/or payment initiation service)17 without registration as an Electronic Payment Service Provider.

(2) Entry restrictions

In addition to the registration requirements for Financial Services Brokers, they will be required to make certain Security Deposits, which will function as collateral for customers. According to the FSC Report, Financial Services Brokers will be prohibited from concurrently engaging in existing financial service brokerage services in the same sector in order to avoid confusion.

(3) Regulations on conduct

According to the FSC Report and the ASFI/PSA Amendment Bill, Financial Services Brokers will be subject to the following regulations.

- Acceptance of cash or other assets from customers is prohibited.

- Appropriate management of customers' non-public information is required.

- Disclosure of commissions received from financial institutions and whether or not there exist entrustment and/or capital relationships with them.

- Duties to provide certain explanations and information are imposed (unless such explanation is provided by the relevant financial institution).

- Regulations on conduct according to the nature and characteristics of the financial instruments and services will apply.

(4) Others

In addition to the above, the ASFI/PSA Amendment Bill proposes introducing regulations applicable to self-regulatory organizations and dispute resolution mechanisms for Financial Services Brokers.

5. Future developments

After the ASFI/PSA Amendment Bill and ISA Amendment Bill are passed into law, they will be effective within one and a half years and one year, respectively, from their respective dates of promulgation. Prior to the effective dates, the FSA and the METI will respectively publish draft rules under the amended statutes in the form of relevant Cabinet Orders, Cabinet Office or Ministerial Orders, and supervisory guidelines, seeking public comments, and then publish the final rules along with the responses to the public comments.

Therefore, it is important to continue to pay close attention to upcoming developments in the regulatory reforms.

Footnotes

1. Available at the FSA's website with the outline of the report (in Japanese).

2. Available at the FSA's website with the relevant materials (in Japanese).

3. Available at the METI's website (in Japanese).

4. Available at the METI's website with the relevant materials (in Japanese)

5. Supreme Court of Japan precedent indicates that the "conducting fund transfer transactions" in Article 2(2)(ii) of the Banking Act is interpreted to mean "upon a request from a customer for the transfer of funds utilizing a mechanism whereby funds are transferred without transporting funds directly between parties at a distance, undertaking such request or undertaking and then executing such request" (Supreme Court Order, March 12, 2001, SAIKO SAIBANSHO KEIJI HANREISHU Vol. 55, No. 2, p. 97).

6. Articles 37 and 2(2) of the Payment Services Act, and Article 2 of the Order for Enforcement of the Payment Services Act.

7. Articles 43(1), 44, and 45(1) of the Payment Services Act.

8. There are concerns that, if deposited user funds are not subject to a ceiling and available to be utilized for loans, it could be substantially equivalent to allowing a Funds Transfer Service Provider to engage in "banking business" (i.e., engaging in the acceptance of deposits and the lending of funds in combination), causing credit creation and liquidity risk.

9. Article 20(5) of the Payment Service Act.

10. It has been pointed out that a service provider for a bill-splitting app is not involved with transactions out of which monetary claims arise, while an escrow service provider is related to such transactions by, for example, ensuring cash-on-delivery payments.

11. Article 33-2(1)(iv) of the Installment Sales Act.

12. Article 33-2(1)(iii) of the Installment Sales Act and Article 5(2) of the Order for Enforcement of the Installment Sales Act.

13. Article 30-2-4(1) of the Installment Sales Act.

14. Article 30-2(1) of the Installment Sales Act.

15. Articles 35-16(1)(3) and 35-17-9 of the Installment Sales Act, and Article 133-11 of the Order for Enforcement of the Installment Sales Act.

16. For example, according to the FSC Report, financial instruments having features of derivatives are expected to be excluded.

17. Article 2(17) of the Banking Act.

Originally published 23 March 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.