1. ELTIF: DISTRIBUTING ALTERNATIVE STRATEGIES TO NON-PROFESSIONAL INVESTORS

Regulation (EU) 2015/760 on European long-term investment funds (ELTIF) will be amended by the revised ELTIF Regulation which shall apply from 10 January 2024.

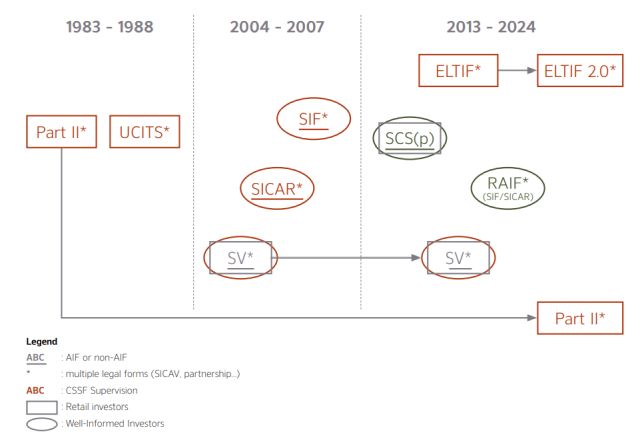

The Luxembourg industry (and Elvinger Hoss Prussen in particular) have played an instrumental role historically in structuring investment products accessible to retail investors. More recently, we have been structuring investment funds, whether open-ended or closed-ended, that provide alternative strategies to non-professional investors.

These 'democratized' vehicles have been structured mainly as ELTIFs or Luxembourg undertakings for collective investment setup under part II of the Law of 2010 or the combination of ELTIFs and Part II structures. The Part II fund is a Luxembourg domestic AIF that may accept all types of investors, including retail.

The ELTIF regime enables alternative investment fund managers to market their AIFs in the EEA with a passport to retail investors. Part II funds have been well-known to investors beyond the EEA for several decades.

An ELTIF may be set-up as a Part II fund (or a compartment thereof) to release the full potential of its retail marketing passport.

2. OVERVIEW OF LUXEMBOURG INVESTMENT VEHICLES

3. ELTIF KEY FEATURES

- Alternative investment fund (AIF) – subject to AIFMD

- Managed by an authorised AIFM – no sub-threshold AIFM

- Authorised and supervised by the financial regulator (CSSF) – for compliance with ELTIF Regulation aspects

- Authorisation at the level of the sub-fund - possible to add ELTIF sub-funds to an existing structure

- EU marketing passport for professional and retail investors – unique advantage for AIFs

- Objective to facilitate the raising and channeling of capital towards long-term investments in the real economy

4. EU MARKETING PASSPORT

- The ELTIF Regulation is directly applicable in all EU countries.

- Member states are not allowed to add requirements in the field covered by the ELTIF Regulation (art. 1 paragraph 3)

- Notification procedure as per AIFMD for both professional and retail investors

5. ELIGIBLE INVESTORS

| ELTIF | ELTIF - UCI Part II | ELTIF - RAIF, SIF or SICAR |

|

|

|

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.