1. ELVINGER HOSS PRUSSEN LUXEMBOURG LAW FIRM

THE FIRM IN BRIEF:

Elvinger Hoss Prussen was founded in 1964 by lawyers committed to excellence and creativity in the provision of legal services. The founders of the firm were among the first to foresee the role that Luxembourg was about to play as a leading European financial centre.

For decades, the partners of the firm have played an instrumental role in the construction of the legal and regulatory environment which is crucial to the success of the Luxembourg financial sector. In this context, the firm pioneered instruments and legal structures before they were recognised by law and regulations and used on a daily basis in financial transactions. Today the firm advises on high-profile local and international transactions and has an impressive client base.

Over the years the firm has grown with the financial centre and earned the reputation of being one of the most prestigious and highly respected law firms in Luxembourg.

Elvinger Hoss Prussen has a broad experience in working on all kinds of capital market transactions and assists its clients in securing listings on the regulated or alternative markets. We regularly advise on equity, convertibles and debt listings including Euro MTN programmes. Among others we pioneered "tier one" hybrid instruments for Luxembourg banking institutions and their foreign parents as well as fiduciary note structures listed on the Luxembourg and on foreign stock exchanges.

2. THE LUXEMBOURG STOCK EXCHANGE

The Luxembourg Stock Exchange (the "LSE") was set up in 1927 and operates two markets, the regulated market "Bourse de Luxembourg" (hereafter the "Regulated Market") and the alternative market, the "Euro MTF". The Euro MTF market is a multilateral trading facility as defined in the law of 13th July 2007 implementing European directive 2004/39/EU of 21 April 2004 on markets and financial instruments.

An issuer targeting professional investors only (i.e. professional clients or qualified investors / wellinformed investors) has the possibility to seek an admission to the professional segments. Because the admitted securities will not be accessible for retail investors, the requirements pursuant to Prospectus Regulation1 , Prospectus Law2 , MiFID II3 and PRIIPS4 are alleviated.

An issuer will further have the possibility to seek an admission to the official list only, the LSE Securities Official List (the "SOL") without any admission to trading on neither the Regulated Market nor the EuroMTF.

Over 37,000 tradable securities in more than 60 currencies are currently listed on the LSE.

WHICH ISSUERS CAN LIST THEIR SECURITIES ON THE LSE?

The term "issuer" is defined very broadly by the rules and regulations of the LSE (the "LSE Rules") as "any legal entity that has issued Securities or an Admitted Financial Instrument or wishing to proceed to such an admission".

Issuers of securities listed on the LSE include Luxembourg and foreign corporate issuers as well as sovereigns and international institutions.

WHICH TYPES OF SECURITIES MAY BE ADMITTED ON THE LSE?

The LSE Rules provide for the possibility to admit:

- shares of companies and other securities equivalent to shares of companies and partnerships, and share depositary receipts;

- bonds and other debt securities including depositary receipts representing such securities;

- any other security giving the right to buy or sell such securities or with a cash settlement, determined by reference to transferable securities, a currency, a rate of interest or yield, commodities or indices;

- shares and units in undertakings for collective investment;

- money market instruments and all other securities which, the LSE may determine can be traded on a securities market of the LSE.

Since 2022, the LSE also admits security tokens to be registered onto the SOL, without admission to trading. The following criteria shall be met in order for the security tokens to be considered for admission onto the SOL:

- the security tokens shall qualify as debt instruments offered exclusively to Qualified Investors (as such term is defined in the Prospectus Regulation) or issued in a denomination per unit of at least EUR 100,000;

- the issuers of the security tokens shall have previously issued securities in capital markets or have a proven track record in capital market transactions; and

- the pricing of the security tokens shall be in fiat currency.

3. WHICH REGULATIONS APPLY TO WHICH MARKET?

For an admission on the SOL the following regulation applies:

- The Grand-Ducal Regulation of 13 July 2007, which implements Directive 2001/34/EC of the European Parliament and of the Council of 28 May 2001 on the admission of securities to official stock exchange listing and on information to be published on those securities;7 and

- The Rulebook on the SOL (the "SOL Rulebook").8

For an admission of security tokens on the SOL, in addition to the two regulations mentioned above, the Guidelines for the registration of DLT Financial Instruments9 onto the SOL dated January 2022 apply, including with respect to the additional information regarding the issuance of DLT Financial Instruments that must be contained in the information notice.

4. MAIN DIFFERENCES BETWEEN THE REGULATED MARKET AND THE EURO MTF

- The applicable accounting standards required for the financial statements of issuers to be included in the listing prospectus and to be provided on an ongoing basis: the regulations applicable to the Regulated Market require that the financial statements are prepared in accordance with Regulation (EC) 1606/2002 on international accounting standards as adopted by the EU (IFRS) in case of EEA issuers or in case of third-country issuers, in accordance with accounting standards considered as equivalent. Issuers listed on the Euro MTF may prepare their financial statements under their national GAAP and IFRS.

- The Euro MTF market is out of scope of the Transparency Law.

- A listing prospectus approved by the LSE in accordance with the LSE Rules for an admission on the Euro MTF does not benefit from the European passport as provided by the Prospectus Law.

5. MAIN FEATURES OF THE SOL

- The SOL is an admission to the official list only and not an admission to trading. Therefore, the SOL market is out of scope of the Market Abuse Provisions and the Transparency Law.

- SOL is only regulated by the Grand-Ducal Regulation of 13 July 2007 and the SOL Rulebook.

- The SOL Rulebook provides the obligation of providing an Information Notice containing the relevant information concerning the issuer and the securities to be admitted onto the LSE SOL. There is an exemption if a prospectus has been already approved by a competent authority.

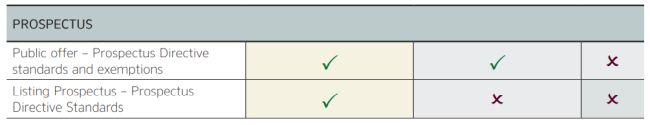

6. THE LISTING PROSPECTUS

1. THE REGULATED MARKET

- the competent authority for the approval of the listing prospectus is the Commission de Surveillance du Secteur Financier ("CSSF");

- the content requirements for the prospectus are set out in the Prospectus Regulation and relevant delegated acts10;

- the consolidated financial statements of issuers must be drawn up in accordance with IFRS (or equivalent);

- the Prospectus Regulation sets out specific rules regarding the structure of the prospectus and the basic order of the various sections; the Prospectus may be drawn up in English, French or German;

- the Prospectus may be used as a public offer prospectus and for further listings, in the EEA.

2. EURO MTF

- the competent authority for the approval of the listing prospectus is the LSE;

- the content requirements for the prospectus are set out in the relevant schedules of the LSE Rules;

- financial statements can be in IFRS or the national GAAP of the issuer;

- the LSE Rules do not include guidelines regarding the LSE Rules do not include guidelines regarding

- the Prospectus may not be used as a public offer document or for further listings in Luxembourg or other jurisdictions.

3. SOL

- the competent authority for all decisions and operations relating to the admission of Securities on to SOL is the LSE;

- the content requirements for the information notice are set out in the SOL Rulebook and its relevant schedules;

- no specific requirements concerning the financial statements;

- the LSE Rules do not include guidelines regarding a specific structure of the listing prospectus; the Prospectus may be drawn up in English, French or German;

- the LSE Rules do not include guidelines regarding a specific structure of the listing prospectus; the Prospectus may be drawn up in English, French or German;

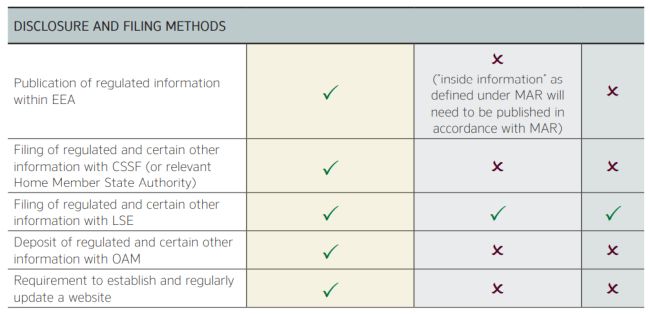

7. SUMMARY OF THE ONGOING OBLIGATIONS FOR ISSUERS HAVING BONDS LISTED ON THE LSE

1. TRANSPARENCY LAW

The Transparency Law only applies to the Regulated Market and provides, in summary, for the following obligations for an issuer of bonds:

- Periodic financial information:

Issuers are required to publish:- annual financial reports

- semi-annual financial reports

Certain exemptions may apply depending the type of issuer or the type of security. Certain exemptions may also apply in case the securities have a denomination of at least EUR 100.000.

- publishing without delay any changes in the rights of holders of securities (such as changes in terms and conditions, loan terms or interest rates);

- ensuring equal treatment of all holders of debt securities ranking pari passu in respect of all the rights attaching to those debt securities.

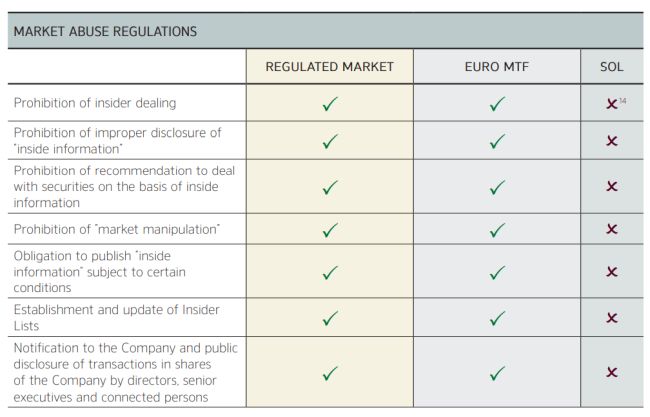

2. MARKET ABUSE PROVISIONS

Issuers whose bonds are listed on the Regulated Market or the Euro MTF (or who have requested admittance to any such market) must:

- publish price sensitive inside information as soon as possible (subject to the right with a valid reason and subject to certain conditions to postpone such publication); and

- keep insider lists.

3. THE LSE RULES

The LSE Rules provide for obligations which apply to the SOL, the Euro MTF and the Regulated Market. As the Transparency Law does not apply to issuers having bonds listed on the Euro MTF and the SOL the LSE Rules include some specific obligations in this respect.

These various obligations under the LSE Rules relate to various notification obligations to the LSE in case of certain securities events and certain publication requirements which are however lighter than the regime applicable pursuant to the Transparency Law. The LSE has issued a specific set of rules applicable to SOL.11

8. SUMMARY OF ONGOING REPORTING OBLIGATIONS

(This Summary does not include all ongoing reporting obligations which may be applicable and does not take into consideration specific exemptions which may apply in certain cases)

Footnotes

1. Regulation 2017/1129 of the European Parliament and the Council of 14 June 2017 on the prospectus to be published when securities are offered to the public or admitted to trading.

2. Law of 16 July 2019 on prospectuses for securities.

3. Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments.

4. Regulation (EU) No 1286/2014 of the European Parliament and of the Council of 26 November 2014 on key information documents for packaged retail and insurance-based investment products.

5. Law of 11th January 2008 on transparency requirements in relation to information about issuers whose securities are admitted to trading on a regulated market and transposing Directive 2004/109/EC of the European Parliament and of the Council of 15th December 2004 on the harmonisation of transparency requirements in relation to information about issuers whose securities are admitted to trading on a regulated market and amending Directive 2001/34/EC.

6. Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse ("MAR") and Directive 2014/57/EU of the European Parliament and of the Council of 16 April 2014 on criminal sanctions for market abuse as implemented by a law of 23rd December 2016 (the "Market Abuse Law"and together with MAR, the "Market Abuse Provisions").

7. Grand-Ducal Regulation of 13 July 2007 (coordinated version), https://www.cssf.lu/wp-content/uploads/GDR_130707_official_listing_eng. pdfhttps://www.cssf.lu/wp-content/uploads/files/Lois_reglements/Legislation/RG_NAT/GDR_13077_official_listing_upd300518eng.pdf

8. Rulebook – LuxSE Securities Official List (SOL) (the "SOL Rulebook"), https://www.luxse.com/regulationhttps://www.bourse.lu/documents/ legislation-LISTING-SOL-rulebook.pdf

9. Financial instruments within the meaning of MiFID II, which are issued, recorded, transferred and stored using distributed ledger technology

10. Commission Delegated Regulation (EU) 2019/980 of 14 March 2019 supplementing Regulation (EU) 2017/1129 of the European Parliament and of the Council as regards the format, content, scrutiny and approval of the prospectus to be published when securities are offered to the public or admitted to trading on a regulated market, and repealing Commission Regulation (EC) No 809/2004.

11. Please see the SOL Rulebook

12. There is no reporting obligation under the SOL Rulebook.

13. Directive (EU) 2022/2464 of the European Parliament and of the Council of 14 December 2022 (Corporate Sustainability Reporting Directive)

14. The obligations required under EU Market abuse and Transparency Law, MiFID II/MIFIR and Prospectus Regulation are not applicable to securities listed on SOL.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.