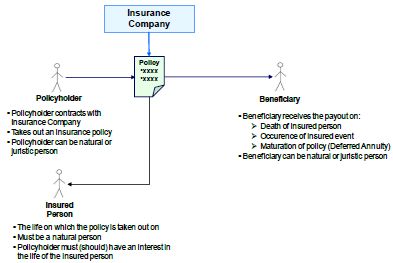

The parties to a PPLI contract is well understood and the same as traditional life insurance. The figure below illustrates the parties involved to the policy.

Figure 1: Relationships of the policyholder, insured person and beneficiary to the insurance company

The insurance company issues the policy, the policyholder takes out the policy on the life of the insured person and the beneficiary (often multiple) receive a payout in the event of death (or other insured event). Nothing new here - Insurance 101.

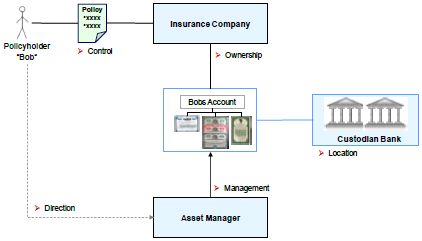

PPLI differs with the segregation of assets underlying the policy, the involvement of an independent asset manager and a custodian bank. Assets are transferred to a custodian bank, a depot account for the securities is set up, an asset manager is nominated who manages the assets in the account according to a predefined strategy chosen by the policyholder.

In Switzerland, a life insurance policy generally directly involves four parties:

- The Insurance Company: which issues the policy and provides coverage to the policyholder in return for payment of the insurance premium, which may be a lump sum or a series of regular payments.

- The Policyholder: who takes out the policy enters into a contract with the insurer and receives coverage for him/herself and/or other persons (beneficiaries). A legal entity such as a company or foundation, but also a trust, can be the policyholder. As the contracting partner, the policyholder owes the insurance premiums that need to be paid to the insurer in return for providing insurance coverage.

- The Custodian Bank where the assets are deposited for safekeeping and management

- The Asset Manager who manages the assets – receives a Power of Attorney from the Insurance Company.

Also indirectly:

- The Insured Person: - whose life the insurance policy covers. This can, but need not be, the same person as the policyholder, but it must be a natural person.

- The Beneficiary(s): – who receive payments from the policy on the death of insured person or occurrence of the insured event. The beneficiary(s) are those persons designated by the policyholder to receive the specified capital from the insurer at either a specified date in the future (DVA) or in the case of the insured persons death - the insured event (VUL). Also, the beneficiary can be a legal entity or a trust and must not necessarily be a natural person.

The figure below shows the basic structure.

Figure 2: Participants to a policy - How does unit linked life insurance work?

A further advantage is the separation of duties. Assets are:

- Controlled by the Policyholder

- Owned by the Insurance Company

- Located at the Custodian Bank

- Managed by the Asset Manager

There is full separation of control, ownership, management and location of the assets. This can confer certain additional benefits, eg., sucession planning. Depending on jurisdiction, the policyholder can retain anything from zero to full control of the underlying assets. In most cases, the policyholder can continue to maintain some level of direction.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.