The Monetary Authority of Singapore (MAS) has recently introduced new guidelines for Single Family Offices (SFOs) applying for tax incentives under the Section 13O and Section 13U schemes. The changes aim to expand tax incentives for family offices to promote investment in environmental and social causes.

Key updates include:

Minimum Assets Under Management (AUM)

- The minimum AUM for the 13O Scheme is now S$20 million at the point of application and throughout the incentive period(i.e., no longer any grace period).

- The minimum AUM for the 13U Scheme remains unchanged at S$50 million at the point of application and throughout the incentive period.

- Funds must maintain the minimum AUM throughout their lives, which means that SFOs must now plan for a buffer in the event of a market downturn.

Investment Professionals (IPs)

- The 13O Scheme requires an SFO to employ at least two IPs, with at least one non-family member IP.

- The 13U Scheme continues to require at least three IPs, with one non-family member IP.

- IPs must have relevant fund management qualifications and be tax resident in Singapore.

Minimum Spending Requirement

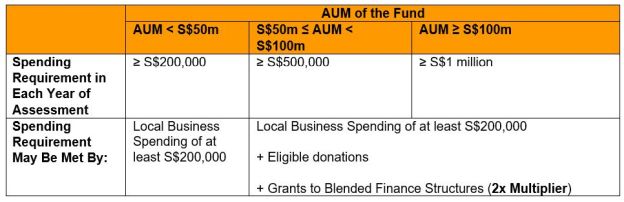

- The 13O Scheme requires a minimum local business spending of at least S$200,000 per financial year, subject to a Tiered Spending Requirement Framework (below).

- The 13U Scheme requires at least S$500,000 in local business spending per financial year, subject to the same framework.

Tiered Spending Requirement Framework

Capital Deployment Requirement (CDR)

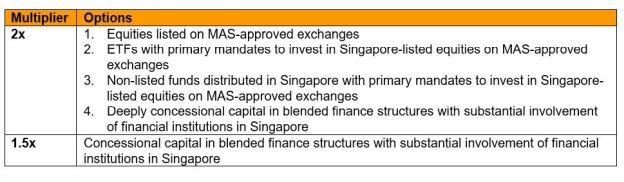

- Funds must invest at least 10% of their AUM or S$10 million (whichever is lower) into specified local investments, the list of which has been broadened to include climate-related investments and blended finance structures with substantial involvement of Singapore-licensed/registered financial institutions.

- Multipliers apply to certain investments to help meet the CDR (see below).

The new guidelines are designed to make the 13O and 13U Schemes more flexible for SFOs and encourage investments in Singapore. It is also aimed at increasing the professionalism of SFOs and creating job opportunities for locals in the wealth management industry.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.