Originally published on January 12, 2012

Keywords: Parent Subsidiary Directive, portfolio dividends, EEA, withholding tax

European Court of Justice Decision on Portfolio Dividends

In its decision dated October 20, 2011, (Case C- 284/09), the court of justice of the European Union, (ECJ), has held that Germany violates the principle of free movement of capital as set out in the rules of the European Union (EU) and the European Economic Area (EEA). It does so to the extent that it imposes withholding tax on dividend distributions made to EU/EEA shareholders who do not benefit from the withholding tax exemption provided under the Parent Subsidiary Directive. Pursuant to this, shareholders residing in the EU/EEA are entitled to receive dividends from subsidiaries located in other Member States free of withholding tax, provided that their shareholding represents at least 15 percent (from 2007) or 10 percent (from 2009) of the share capital.

Distributions within the EU/EEA on shareholdings below these thresholds are subject to the statutory withholding tax rate of 26.375 percent (which can be reduced to 15 percent upon application) or to the respective lower rate provided under the applicable double taxation treaty.

The reason why the ECJ has qualified the German withholding tax regime as being discriminative in relation to EU/EEA shareholders was that a German corporate shareholder is granted a full tax credit or refund, respectively, in case of a comparable shareholding below the thresholds of the Parent/Subsidiary Directive. Moreover, 95 percent of the dividend distributions are also free of corporate income tax if distributed from one corporate entity to another. Germany has justified this by referring to its objective to levy tax on the level of the corporation, as well as on that of the ultimate (private individual) shareholder, but to eliminate any additional tax burden at the level of corporations interposed between the Tax Germany Legal Update January 12, 2012 dividend paying company and its ultimate (private individual) shareholder. This argument was rejected by the ECJ because the full taxation requires that the corporate shareholder actually distributes the profits further to the ultimate shareholder; however, if they are accumulated the tax exemption guarantees that no taxation occurs on this level. This is a disadvantage for a comparable EU/EEA shareholder who does not enjoy this tax privilege.

From our perspective, the consequence of this ECJ decision will be that Germany has to reimburse EU/EEA shareholders who have suffered German withholding tax on dividends received from shareholdings in German corporations.

It has to be noted that the ECJ decision concerns corporate shareholders only because the exemption from dividend taxation which causes the discriminatory effect does not apply to private individuals.

Revision of Anti Treaty Shopping Rules

As the ECJ decision applies to European corporate shareholders only, all shareholders outside the EU and the EEC ("Third Country Investor") cannot rely on the ruling, and a refund of withholding taxes is only possible if such a Third Country Investor could benefit from a double taxation treaty.

In the past many, Third Country Investors have established European holding companies, mainly in Luxembourg, The Netherlands or Ireland, for their EU investments. The decision to set up such holdings are based on a variety of reasons; a side effect of such structures is that it may be possible to benefit from the European treaty network or the Parent Subsidiary Directive. The German tax authorities, however, take the position that the main goal of Third Country Investors using EU holding structures is to avoid withholding taxes and, as a consequence hereof, Germany has introduced a strict treaty-override regime to avoid such abuse.

This regime obliges the Third Country Investor to prove that his intermediate holding company has sufficient substance. "Substance" in this meaning requires, inter alia, that the Third Country Investor could prove that the interposition of the (holding) company is justified by an economic or other important (non-tax) business reason or that at least 10 percent of the gross income of the holding company is generated by its own commercial business activities (section 50d paragraph 3 Income Tax Act [ITA]). If the (holding) company fails this substance test, Germany charges the withholding tax rate which would be applicable if the Third Country Investor directly holds the investment. If the investor resides in a country with which Germany has not entered into a double taxation treaty, such as the Cayman Islands or the Bermudas, the statutory withholding tax rate of 26.375 percent without any reduction would be applied.

The European Commission has criticized that these German anti-treaty shopping rules are too strict and go beyond the acceptable scope of anti-avoidance. In particular, the requirement is that more than 10 percent of the gross income of the holding company must be generated out of own commercial activities; a failure to comply with this requirement leads to the consequence that the German tax authorities refuse the refund of the withholding tax paid.

In order to meet the objections of the European Commission the German government has amended section 50d paragraph 3 ITA with effect as of January 1, 2012. The above-mentioned 10 percent rule has been repealed and replaced by a more general rule: pursuant to this a refund of/relief from German withholding tax is generally possible as far as the (holding) company has generated its revenues from own commercial business activities. The phrase "as far as" clarifies that an application for a refund/reduction of withholding tax cannot be rejected by the German tax authorities to the extent that the (holding) company's gross income is derived from own commercial business activities.

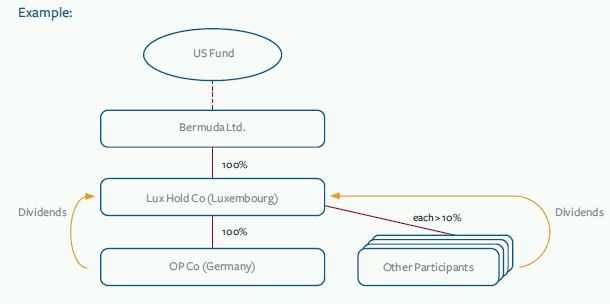

Contrary to the former rules a withholding tax refund/ relief is now also possible even if the (holding) company does not carry out any own commercial business activities but is able to bring evidence to the German tax authorities that (i) there are sound economic or other good reasons for its interposition and (ii) that it generally participates in third party business activities in whatever manner and is sufficiently equipped (office space etc.) to carry out these business activities. The following chart illustrates the mechanism of the new rules:

As mentioned, test steps 2 and 3 apply independently from each other, i.e. the relief from German withholding tax can be based on the fact that part of the income is composed of commercial business activities and for other parts of the income it can be shown that the company is sufficiently equipped and there have been good reasons for its interposition.

German withholding tax has been charged on dividends to Lux Hold Co on the basis of the statutory tax rate of 26.4 percent.

Generally, Lux Hold Co is entitled to get a full refund of the tax withheld pursuant to the Parent/Subsidiary Directive since it is a resident of a EU country and owns at minimum 10 percent of the equity in the German companies. Lux Hold Co's parent, however, would not be entitled to a withholding tax refund if it held the participation directly since it is domiciled in the Bermudas and Germany has not entered into a double taxation treaty which would provide for a refund claim. Based on these circumstances the German tax authorities will require Lux Hold Co to prove that it fulfills either of the substance tests 2 and/or 3 mentioned above. The fact that the shareholders of Bermudas Ltd., the US Fund or possibly its members, are located in the US and may be entitled to rely on the double taxation treaty between the US and Germany is not relevant in this regard.

Under the former rules Lux Hold Co would have failed the substance test as only 9 percent of its gross income (300/3,300) are generated by its own business activities. Even if Lux Hold Co would have been in a position to prove that there are sound reasons for its interposition and that it maintained a sufficiently equipped office with which it participated in business activities this would have not led to a refund of withholding taxes.

Under the new rules, however, Lux Hold Co is entitled to a tax refund in the amount of 9 percent of the German taxes withheld due to the fact that it is able to show that 9 percent of its gross income consist of own commercial activities. Under the new rules no further proof is necessary to obtain such 9 percent refund.

A further refund of withholding taxes could be obtained by Lux Hold Co if it can provide evidence that there are economic or other good reasons for its interposition and that Lux Hold Co is involved in external economic transactions and is sufficiently equipped for these purposes (test 3). If the criteria of test 3 were fulfilled only in relation to its other participations but not in relation to its shares in OP Co, Lux Hold Co would only be entitled to get a refund of the withholding taxes on the dividend distributions received out of these shareholdings, i.e. the 26.4 percent on the 2,000. In relation to its participation in OpCo it will have to prove that its own economic activities out of which it has generated revenues of 300 are solely connected to this shareholding. If that were the case it would be entitled to claim another 30 percent of withholding tax reduction, which reflects the percentage of these revenues in relation to the net dividends it has received out of the OpCo shareholding. In practice these own business activities are often proven by establishing inter-group services to other group entities.

Conclusion

- A refund of German withholding tax for shareholdings of less than 10 percent can be obtained if the recipient (corporate entity) is domiciled within the EU. Clients should now seek such a reclaim.

- The substance test for receiving entities with shareholders resident outside the EU has been facilitated by the legislator based on the intervention of the EU commission.

- The substance test can now lead to at least a partial withholding tax recovery in case of intra-group services even if the revenues out of these activities are less than 10 percent of the total revenues.

- From our perspective, tax structuring still faces the practical difficulties of defining what can be understood as "good economic reasons or other sound reasons" and what is required to show a "sufficiently equipped business for the purpose of taking part in third party transactions."

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2012. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.