The Council of the European Union (EU) has adopted a new regulation "establishing a framework for the screening of foreign direct investments into the Union" (the Regulation). This is the first time the EU is equipping itself with a comprehensive framework to monitor investments into EU businesses by investors from outside the EU.

The new rules create a cooperation mechanism where EU member states and the European Commission are able to exchange information and raise concerns. The Commission will have the possibility to issue opinions in cases concerning several member states, or where an investment could affect a project or program of interest to the whole EU. However, EU member states remain in charge of reviewing, and potentially blocking, foreign investments on grounds of security or public order. The decision to set up and maintain national screening mechanisms also continues to be in the hands of individual member states.

In the following, we give an overview of the main features of the Regulation.

The New Regulation

Until recently, there were no measures at the level of the EU on the review and control of foreign direct investments. At the national level, such measures have existed in several member states – and amid growing concerns about the impact that certain foreign investments may have on national interests, some member states have made their review procedures significantly more stringent in recent years. However, the decentralized and fragmented nature of the national review procedures raised questions about their effectiveness in addressing adequately the potential (cross-border) impact of foreign investments in sensitive sectors.

To respond to such concerns, the European Commission proposed the Regulation in 2017.

The objective of the Regulation is not to harmonize the formal foreign investment mechanisms used in EU member states, or to replace them with a single EU mechanism. Rather, it provides a mechanism for EU-wide cooperation and information sharing to allow member states to make informed decisions taking into account all relevant risks and protect pan-European interests. The decision on whether to set up a review mechanism or to review a particular foreign investment remains the sole responsibility of the member states.

The EU Council adopted the Commission's proposal on March 5, 2019. The Regulation will enter into effect after a transitional period of 18 months following its publication in the Official Journal, expected to take place on March 21, 2019.

Under the Regulation, the competent authorities of the EU member states remain in charge of screening foreign direct investments under the applicable national laws. The role of the European Commission is to facilitate coordination and to advise member states where it considers that an investment would likely affect security or public order in one or more member states.

Transactions Subject to Review

The Regulation does not put in place a review requirement for foreign investments; rather, it sets up a procedural framework for screening mechanisms created by the EU member states. The rules of the Regulation apply to any national "procedure allowing to assess, investigate, authorize, condition, prohibit or unwind foreign direct investments."

The definition of "foreign direct investments" is broad and does not require an investment above a defined threshold of shareholder rights or the acquisition of control in the target company. Any investment "aiming to establish or to maintain lasting and direct links" with a business in "in order to carry on an economic activity" in an EU member state is sufficient. The investment must be made by a "foreign investor," defined as "a natural person of a third country or an undertaking of a third country." Third countries are countries outside the EU. Therefore, the Regulation does not apply to the screening of cross-border investments inside the EU.

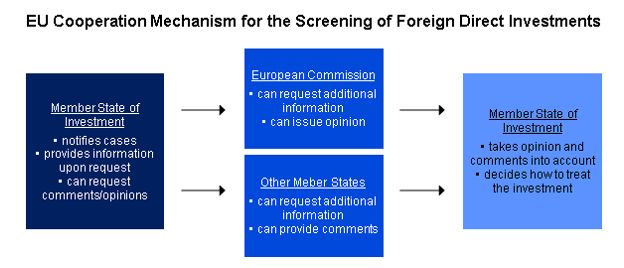

The aim of the Regulation is to enhance cooperation and increase transparency between EU member states and the European Commission. To this end, it creates a "cooperation mechanism" that requires member states to inform each other and the Commission of incoming foreign direct investments affecting security and public order (→ EU Cooperation Mechanism for the Screening of Foreign Direct Investments):

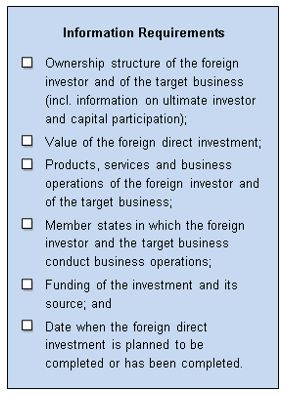

- Where a member state screens a foreign direct investment, it is obliged to notify the other member states and the Commission by providing, "as soon as possible," certain information on the investment (→ Information Requirements). The other member states can then comment and the Commission can issue a (nonbinding) opinion within certain time limits, normally within 35 calendar days following the notification (this period is extended if other member states or the Commission request additional information).

- Where a foreign direct investment in a member state is not undergoing screening and other member states or the Commission considers that the investment is likely to affect security or public order, the latter may request from the former certain information on the investment (→ Information Requirements). The other member states and the Commission may then provide comments or a (nonbinding) opinion, respectively, to the member state receiving the foreign direct investment. The time limit for comments and opinions is 35 calendar days following the receipt of information on the investment, although extensions are possible.

Although the final screening decision is the sole responsibility of the member state receiving the foreign investment, it is required to give "due consideration" to the comments of the other member states and the opinion of the Commission. Moreover, in cases where the Commission believes that the foreign direct investment may affect projects or programs of "Union interest," the member state receiving the investment is required to take "utmost account" of the Commission's opinion and provide an explanation if the opinion is not followed. Project and programs of "Union interest" are defined in the Annex of the Regulation. They currently include:

- European GNSS programs (Galileo & EGNOS);

- Copernicus;

- Horizon 2020;

- Trans-European Networks for Transport (TEN-T);

- Trans-European Networks for Energy (TEN-E);

- Trans-European Networks for Telecommunications;

- European Defence Industrial Development Programme; and

- Permanent structured cooperation (PESCO).

In addition to creating the cooperation mechanism, the Regulation also imposes certain minimum standards for the national screening mechanisms of EU member states. These include:

- National rules and procedures must be transparent and not discriminate between third countries.

- Member states must set out the circumstances triggering a screening, the grounds for screening and the applicable detailed procedural rules.

- Member States must apply timeframes that allow them to take into account the comments of other member states and the opinions of the Commission under the coordination mechanism.

- Confidential information must be protected.

- Foreign investors and the undertakings concerned must have the possibility to seek recourse against screening decisions of the national authorities.

- National screening mechanism must include measures necessary to identify and prevent circumvention.

Substantive Assessment

The Regulation does not attempt to harmonize national rules on foreign investments in the EU member states. However, it does provide a list of factors that the member states and the European Commission may take into consideration when conducting their assessment. This includes potential effects on the following:

- critical infrastructure (incl. energy, transport, water, health, communications, media, data processing, finance);

- critical technologies and dual use items (incl. artificial intelligence, robotics, semiconductors, cybersecurity, aerospace, defense, energy storage, quantum, nuclear, nano- or biotechnologies);

- supply of critical inputs (incl. energy, raw materials, food);

- access to sensitive information (incl. personal data); or

- freedom and pluralism of the media.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.