Updates regarding the BOI measures can be categorized into three (3) types as follows:

1. New BOI-eligible businesses

The following medical-related activities will be added as businesses eligible for BOI promotions.

1.1 Senior care hospitals and services

It is predicted that, in 2021, persons over the age of 60 in Thailand will number least 13 million (20% of the entire population). In order to prepare for the impending aging society, the following two (2) businesses will be added as eligible businesses, with the particular incentives stated:

- Senior care hospitals: entitled to a five (5) year CIT1 exemption; and

- Senior or dependent care services: entitled to a three (3) year CIT exemption.

1.2 Clinical research

As part of the plan to enhance Thailand's competitiveness in the medical industry and to promote Thailand as an international medical hub, the BOI wishes to persuade world-class medical specialists to conduct their medical research in Thailand, thus creating the opportunity for medical institutions or personnel in Thailand to obtain expertise and knowledge therefrom. The following two (2) businesses will be added as businesses eligible for the BOI promotion granting an eight (8) year CIT exemption incentive with no limit on amount:

- Contract Research Organizations; and

- Clinical Research Centers.

Please note, however, that the following material conditions must be met:

- A total annual salary of not less than 1,500,000 THB for newly hired researchers who are Thai nationals; or

- Investment capital of not less than 1,000,000 THB (excluding cost of land, working capital, and vehicles).

2. Return of previously delisted promoted businesses

2.1 Manufacture of electric vehicles

Following the expiration of the former packages in 2018, the BOI will open applications for new incentive packages for the business of manufacture of electric vehicles ("EV"). The investment packages will cover all kinds of EVs, i.e. four-wheelers, motorcycles, three-wheelers, buses, trucks, and ships (the former investment package covered only EV cars and EV buses).

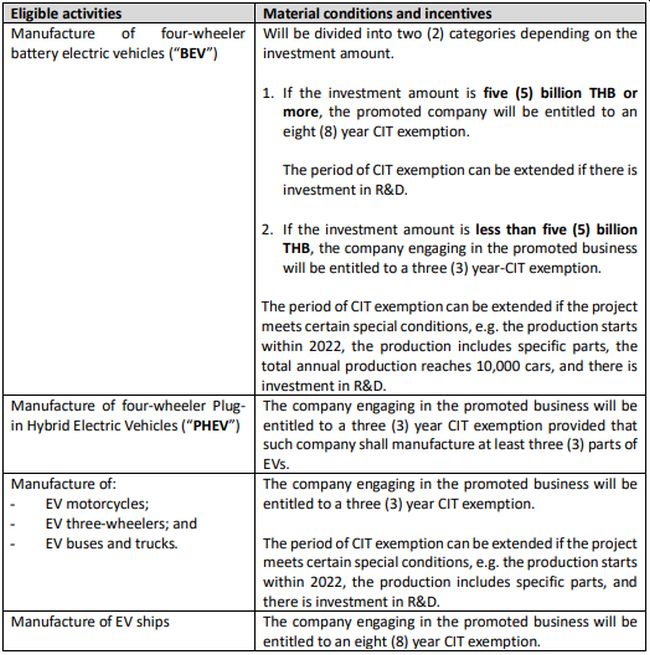

Each type of EV will be subject to different conditions and entitled to different incentives, which can be summarized as follows:

In addition, the BOI approved incentives for four (4) more categories in respect of the manufacture of EV parts, namely: i) high voltage harnesses; ii) reduction gear; iii) battery cooling systems; and iv) regenerative braking systems. Furthermore, in order to promote local EV battery manufacturing, the BOI also approved an additional incentive for the manufacture of both battery modules and battery cells. This incentive involves the granting of a 90% reduction of import duties for two (2) years on raw or essential materials.

2.2 International procurement office

The international procurement office ("IPO") will be restored as the eligible activity again. The functions of the IPO include the procurement of raw materials, parts and semi-finished goods from Thailand and overseas.

A company engaging in the promoted business under the IPO will mainly enjoy exemptions on import duty on machinery and raw materials to be used in production for exports, in addition to other non-tax incentives.

Please note that one of the most important conditions of the IPO in the past is that the applicant must have or rent warehouse(s). Thus, in the past, most of trading companies had to purchase or rent the warehouse from logistic companies to satisfy this condition which might not be so convenient. While, the recent International Business Center: IBC allows a trading company to do the wholesale business without the condition of the warehouse (although there are other specific restrictions in addition to the IPO). However, this point is not yet clarified based on the current information. We will keep you informed upon the issuance of the official BOI notification in the future.

3. Extension and amendment of Productivity Improvement Measure

The BOI will extend, until the end of 2022, the deadline for the application for investors who wish to seek the benefits of what was formerly known as the Production Improvement Measure, and now goes under the new name "Productivity Improvement Measure" ("Measure"). However, the benefits under the Measure remain the same, i.e. a 50% CIT exemption for three (3) years and exemption from import duty for machinery

The Production Improvement Measure was initiated to promote and upgrade technology and machinery for energy conservation, alternative energy utilization or reduction of environmental impacts, as well as to encourage involvement in R&D and advanced engineering design in order to improve production efficiency. The Productivity Improvement Measure is applicable to both of the following:

- Any existing businesses (whether it is a current promoted project or not); however, if it is not a business engaged in a current promoted project, it must be at least a business eligible for the BOI promotions; and

- A promoted project in relation to which the CIT exemption or reduction privilege has already expired, or where the particular promoted project is not entitled to the CIT exemption.

The Measure covers four (4) sub-measures, i.e.:

- Energy conservation and alternative energy utilization;

- Production efficiency improvement through upgrading of machinery for manufacturing;

- R&D and advanced engineering designs for efficiency improvement; and

- Sustainable development for agriculture.

The requirements under this Measure are:

- A minimum investment capital of not less than 1,000,000 THB (excluding cost of land and working capital); and

- Submission of the application by the end of 2022 and implementation of the BOI promoted project within three (3) years from the date of issue of the BOI certificate

Footnote

1. "CIT" means Corporate Income Tax.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.