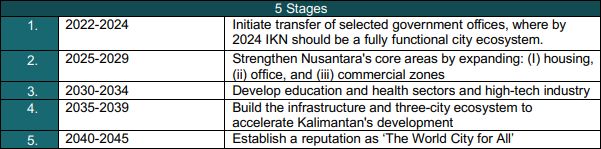

The ambitious plans made by the Government of the Republic of Indonesia (the "Government") to build a new capital city in East Kalimantan is in full-swing. The new capital city, to be named Ibu Kota Nusantara (Nusantara Capital City or "IKN") is being developed in 5 stages, aiming to begin the process of transferring selected government offices in 2024 and finally completing the city in all aspects by 2045.

To support this effort, the government has issued and released various policies to increase investment into IKN and support its development thorough the enactment of various laws and regulations such as:

- Law No. 3 of 2022 on the Capital of the State (the "IKN Law");

- Presidential Regulation No. 62 of 2022 on the Nusantara Capital City Authority (the "IKN Authority Regulation");

- Government Regulation No. 12 of 2023 on the Granting of Business Licenses, Ease of Doing Business, and Investment Facilities for Business Actors in Nusantara Capital City (the "IKN Business Regulations").

(Collectively, the "IKN Regulations")

This Client Alert will provide a broad overview of the general legal framework enacted thus far in order to incentivize and support further investment into IKN.

IKN Priority Sectors

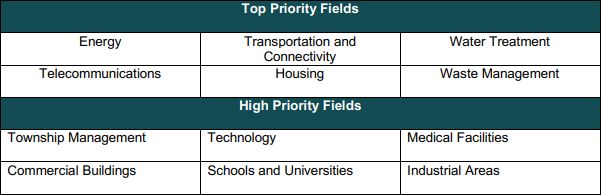

The Government is actively focused in developing the IKN in order to turn it into a livable, world-class city. As such, based on the official information we have received, the Government has set out a number of 'priority sectors', the development of which the Government has planned to focus on.

IKN Authority and their Powers

As part of IKN Regulations, the Government has established the IKN Authority (Otorita Ibu Kota Nusantara) to execute the planning, development, and transfer of the Indonesian capital, and to later administer the IKN as its local government. The IKN Law has also given the IKN Authority special powers and authority compared to those of local governments in general. For example:

- Agrarian Law: The IKN Authority has been given land titles over all state lands (Hak Pakai or Hak Pengelolaan) within the IKN Area. Additionally, they have been given the authority to enter into agreements regarding land entitlements with all other parties in regards to such lands, and to provide guarantees regarding the extension or renewal of land entitlements issued on top of such state lands. Finally, all transfers of land entitlements in the IKN Area must first receive approval from the IKN Authority.

- Environmental Law: The IKN Authority has been given the authority to carry out function related to the protection and management of the environment within the IKN Area, including the supervision, control, and evaluation of the quality of environment in the IKN.

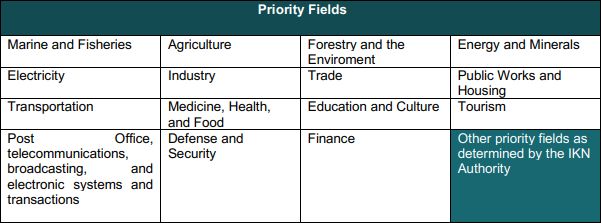

- Permits and Licensing: The IKN Authority has

been given the authority to issue various permits and licenses

usually issued by other institutions in the country. These permits

and licenses will still be issued through the Online Single

Submission (OSS) System usually used throughout Indonesia, the IKN

Authority has the authority to consider and evaluation applications

for these licenses and permits. The IKN Authority has been given

authority to issue the following licenses:

- Zoning Permits (Persetujuan Kesesuaian Kegiatan Pemanfaatan Ruang);

- Environmental Permits (Persetujuan Lingkungan);

- Building Approvals (Persetujuan Bangunan Gedung);

- Certificates of Occupancy (Sertifikat Laik Fungsi);

As well as sectoral business licenses over the following priority fields:

Furthermore, in order to encourage investment in IKN, business actors do not have to confirm their tax payer status with the IKN Authority before beginning business activities in IKN.

Funding Schemes for IKN

The Government has aimed for only 20% of the costs required to develop IKN to come from the state budget, with the remaining 80% coming from outside the state budget. To encourage further investment into the IKN, the Government has issued a number of regulations setting out the funding schemes available for investing in IKN.

In order to support financing of IKN, private actors may participate through Public-Private Partnerships ("PPP") with the Government, which may be done through the following:

- PPP with User Payments: In this scheme, the return on investment will be given to investors from payments from users. In order to support bankability, the Government may provide support from the state budget, through infrastructure guarantees, support for a part of the construction, and support through viability gap funding.

- PPP with Availability Payments: In this scheme, the return on investment will be through availability payments. the Government may provide support from the state budget, through infrastructure guarantees, support for a part of the construction, and support through viability gap funding.

PPP schemes will be prioritized mainly for infrastructure projects in the IKN.

Other schemes are available allowing investment from state-owned enterprises and other private organizations, from international financing organizations, as well as 'creative financing' schemes such as crowd funding, carbon trading, blended financing and philanthropical grants.

Furthermore, funding for IKN will also be raised from state-owned property, through:

- Rents: Rents collected from the leasing of state-owned property for a particular period of time.

- Utilization Cooperation: When the Government provides land for a particular use, while the construction and operation of the building or facility built on top of such land by developers shall be a form of return on investment.

- Build-Operate-Transfer: Similar to the above, except with a transfer of the assets to the Government after construction period of operations.

Exclusion from Foreign Ownership Restrictions

As a general rule, certain business sectors in Indonesia may be subject to foreign ownership restrictions, as set out in the 'Positive Investment List' under Presidential Regulation No. 10 of 2021 on Investment Business Fields as amended by Presidential Regulation No. 49 of 2021, as well as various other regulations. However, under GR 12/2023, certain business fields in the IKN may be excluded from foreign ownership restrictions that generally apply in Indonesia.

While it is not yet known which business fields will specifically be excluded from foreign ownership restrictions, the exclusion should allow greater access for foreign investors into the Indonesian market through IKN. Further implementing regulations regarding this will likely be promulgated in the near future.

Special Land Entitlements

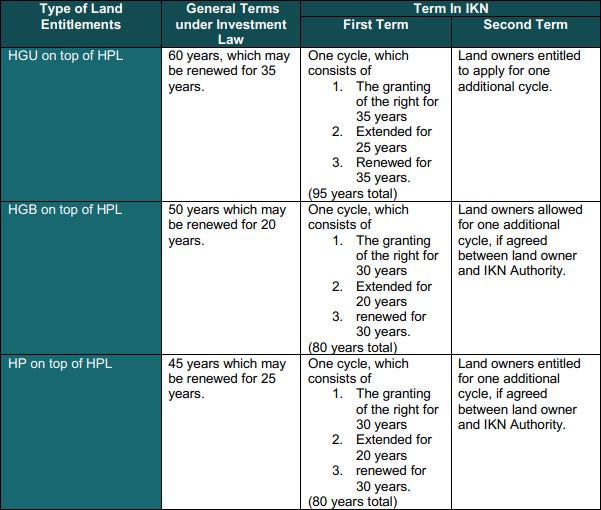

The IKN Business Regulation also allows longer terms for land entitlements in the IKN as compared to the terms generally applicable in Indonesia when investing as set out in Law No. 25 of 2007 on Investment as amended by Presidential Regulation in Lieu of Law No. 2 of 2022 and Constitutional Court Decision No. 21-22/PUU-V/2007 ("Investment Law").

Under the IKN Business Regulations, businesses may obtain land titles in the form of a Right to Cultivate (Hak Guna Usaha or "HGU"), Right to Build (Hak Guna Bangunan or "HGB"), or a Right to Use (Hak Pakai or "HP") on top of the lands the IKN Authority possesses in the form of a Right to Manage (Hak Pengelolaan or "HPL"). The terms provided for under the IKN Business Regulation is as follows:

Furthermore, under the IKN Regulations, the granting and transfer of these land titles is subject to a 0% Acquisition of Land and Building Duty (Bea Perolehan Hak atas Tanah dan Bangunan or "BPHTB") for a period of time which shall later be decided by the Head of the IKN Authority.

Use of Foreign Workers (Tenaga Kerja Asing)

The IKN Business Regulation has also relaxed the requirements for the use for foreign workers based in IKN compared with the generally applicable regulations regarding foreign workers in Indonesia.

In general, foreign workers may only be employed pursuant to a Use of Foreign Wokers Plan (Rencana Pengunaan Tenaga Kerja Asing or "RPTKA") which has to then be approved by the Ministry of Manpower, usually for a period of 2 years, which may be extended. However, under the IKN Business Regulations, approvals of RPTKA's for foreign workers in IKN may be made for 10 year periods, which may also be extended. As such, foreign workers in IKN may also secure residency permits for a maximum period of 10 years, which may be extended in accordance with the validity periods of the relevant employment agreement for the foreign worker. The residency permits of any foreign shareholders also holding position in a company's management may also be granted for as along as that person holds such a position.

Finally, in contrast with the rest of Indonesia, business actors operating within IKN, including those that are engaging in strategic project work for the government within the IKN, are exempted from the obligation to pay into compensation funds for the use of foreign workers for a certain period, to be further decided in implementing regulations.

These provisions will make employing foreign workers in IKN easier, as the IKN Business Regulations simplifies the process for employing foreign workers as well as reduces the amount business must pay in order to employ such workers.

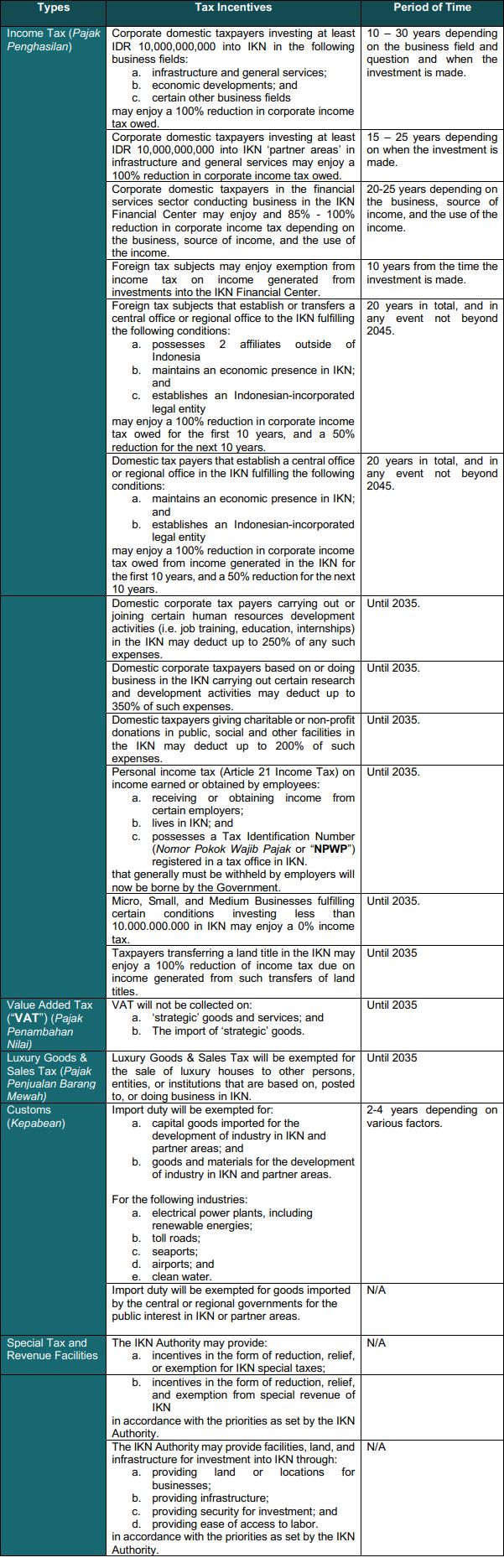

Tax Incentives and Facilities

The IKN Business Regulation has also provided for various tax incentives and facilities for Businesses in the IKN, as follows:

Conclusion

The IKN Regulations provide for a favorable investment climate for investors interested in investing in IKN. Investors may enjoy relaxed requirements for the foreign ownership, licensing and permits, use of foreign workers, and also various tax incentives and facilities. Further details regarding these relaxed requirements and incentives will depend on the further implementing regulations to be issued, especially by the recently created IKN Authority. In any event, the IKN Regulations promises to increase investment and development in IKN, which interested actors may take note of.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.