In Hong Kong, there is a general perception in the market that deregistration is simpler, quicker and less expensive when disposing a private limited company. TMF Hong Kong Corporate Secretarial Director Frances Chan looks at the options.

A private limited company in Hong Kong (HKCo) can be disposed by either:

- Members' Voluntary Liquidation (MVL) under the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap 32), or

- application for deregistration under Section 750 of the Companies Ordinance (Cap 622).

According to the Hong Kong Companies Registry, and historically, the number of de-registration cases far exceeds the MVL cases. The chart below shows the number of dissolution by both the application of deregistration and MVL.

Application for deregistration

Before making the application, a HKCo must comply with all of the following:

- seek approval from all of its shareholders

- have never commenced operation, or have ceased to carry out business for more than three months

- have no outstanding liabilities

- not be a party to any existing legal proceedings

- not have assets consisting of any immovable property situated in Hong Kong (if the company is a holding company, none of its subsidiary's assets can consist of immovable property situated in Hong Kong)

- have obtained a confirmation from the Commissioner of Inland Revenue that it can proceed with the deregistration.

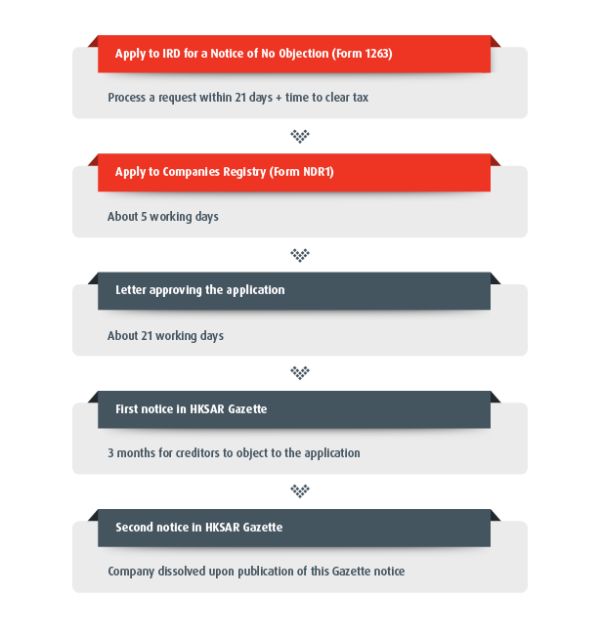

Outline of major procedures:

Find out more: Deregistration of a Defunct Solvent Company, Companies Registry

Members' Voluntary Liquidation

MVL is a process of winding up a solvent company. This means that the company is in a net asset financial position, and is able to pay its debts (present or future, known or contingent) in full. The motion to wind up HKCo by MVL is proposed by directors and approved by a special resolution of the members.

Outline of major procedures:

Note: The above is prepared on the assumption that the liquidation process can be finalised within one year.

Find out more: Companies (Winding Up and Miscellaneous Provision) Ordinance (Cap 32)

Deregistration or MVL?

The best method can be different for each situation, as there are advantages and drawbacks for both.

Compared with MVL, deregistration appears to be easier and cheaper when disposing a HKCo. The deregistration approach is not applicable to the HKCo unless it never commenced business, or ceased business for more than three months and its balance sheet is "cleaned-up" to nil liability prior to applying for deregistration. Management needs to be careful when "cleaning up" the remaining assets of the HKCo, because assets remaining at the time of its dissolution are deemed to be bona vacantia and shall vest in the HKSAR Government.

Deregistration cannot help return paid-up share capital to members of a HKCo, as procedures prescribed under the Companies Ordinance (Cap 622) must be followed in order to reduce capital. A HKCo is obliged to comply with all relevant statutory requirements, such as holding annual general meeting and filing annual return with the Companies Registry, unless it has been formally deregistered.

Deregistration causes great concern because an aggrieved person can make application to the court to reinstate a HKCo within 20 years of its deregistration. Anyone in connection with the application for deregistration, knowingly or recklessly, gives any false or misleading information to the Registrar of Companies in a material particular, will commit an offence and will be exposed on either of the following:

- conviction on indictment to a fine of HK$300,000 and imprisonment for two years

- summary conviction to a fine at level 6 (currently HK$100,000) and imprisonment for six months.

When a HKCo is no longer required, and in terms of time and costs, dissolving it by MVL could be more efficient than arranging for a capital reduction before dissolving by application for deregistration.

Although MVL is more costly, it is generally considered to be a clear-cut disposal method. Unless there is an act of negligence or fraud, creditors may not be able to receive anything from the liquidation if their claim is submitted to the liquidators outside the time period prescribed in the notice to creditors, and after the completion of liquidation.

There is a misconception that the deregistration process is quicker than MVL. Provided that there is no unforeseen complication, both of these options take approximately the same time (normally six to nine months) to complete. Except for obtaining a final tax clearance, the majority of the liquidation process under MVL is under the liquidators' control, which means the process can be expedited if required. For deregistration, most of the processing time is taken by the Inland Revenue Department as well as the Companies Registry for considering and approving a HKCo's application. There is little room to expedite the process if head office has a deadline to complete the process.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.