Finance Act, 2021 has made substantial changes to the regime of taxation of partnership firms with regard to outgoing or retiring partners. The taxation is now based on the capital account balance of the outgoing partner in the firm's books. For this purpose, the cash being paid to, or the fair market value of any asset that is being distributed to, such partner is compared to the capital account balance and tax is determined.

Propositions as per the general law of partnership in India

- The partnership is not a distinct legal entity, and it cannot own any property.

- The ownership in partnership assets belongs collectively / jointly to the partners and not to the firm.

- The interest of a partner in the partnership signifies the right of the partner towards the profits of the partnership.

- This right is represented by the credit balance in the capital account of the partners in the books of the partnership.

- The capital account of the partners, aggregated, will always represent the amount that the partners ought to receive upon dissolution of the partnership.

- An anomalous situation is created when a partner receives, upon his retirement or dissolution of the partnership, an amount (in cash or in the form of a partnership asset) greater than that standing in his capital account.

- This anomaly is either met by creating an asset (e.g., goodwill) in the partnership or by reduction in the capital account of the other partners.

- Another anomaly is statutorily created in the Income-tax Act, 1961, by deeming the partnership as a legal entity and enacting consequent provisions dealing with the same (e.g., 45(3), the old s. 45(4) etc.).

- However, the Income-tax Act did not affect the status of legal rights and ownership as per general law of partnership.

Consequences of the clash between general law on partnership and the statutory provision in the Income-tax Act, in case of retirement of a partner

- Capital asset being given to the retiring partner: It has been held that there is no extinguishment of the right / ownership of the asset of the partnership (because, as stated earlier, the partnership never had any ownership in the asset in the first place), and as such there would be no transfer. Consequently, there would be no capital gains arising.

- Cash being given to the retiring partner: Upon the retirement of a partner, when cash was given to the retiring partner, it has been held that it is not due to an extinguishment of the rights of the partner in the partnership, rather the cash is given on account of the mutual adjustment of the rights between the partners. The capital account signifies the same thing.

Scheme of taxation prior to amendment by Finance Act, 2021

- The legislature, with the belief that giving a capital asset to a retiring partner should result in levy of capital gains tax, enacted the erstwhile s. 45(4). The section, inter alia, provided that such a transfer of a capital asset to a retiring partner shall be taxable as income in the hands of the partnership and the fair market value shall be deemed as the full value of consideration for the purposes of computation u/s 48.

- There was no amendment to the definition of 'income', or a deeming fiction, required because firstly, s. 2(24)(vi) already states that capital gains chargeable u/s 45 are included in the definition of income, and secondly, s. 45(4) used the words 'transfer by way of' thereby implicitly considering such distribution as transfer.

- However, the scheme did not deal with situations where both cash as well as capital asset(s) were given to the retiring partner.

The new scheme: ss. 9B, 45(4), and 48(iii)

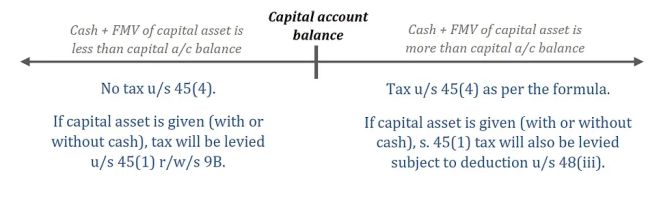

- As explained earlier, the capital account of the partner in the partnership's books is crucial. As such, the intent behind the newly enacted / amended sections 9B, 45(4), and 48(iii) is to create a scheme of taxation wherein the tax levy depends on whether a partner is being paid in excess of his capital account or not, and whether the payment is in the nature of money or capital asset or both.

- The legislature has proceeded on the following intent and presumptions:

- When a partner is paid in cash an amount less than or equal to the capital account balance, he should not be taxed.

- When the partner is paid in the form of a capital asset whose market value is less than or equal to the capital account balance, there is a capital gains resulting and hence tax should be leviable. (This is different from the above scenario since had the firm sold the capital asset itself and then given the partner cash, the firm would have had paid capital gains tax. The legislature wants to bring homogeneity to the two scenarios).

- When the partner is paid more than the capital account balance, either in the form of cash or capital asset, he should be taxed. Section 10(2A) exemption is also in line with the thought that excess amounts should be taxed - what is exempted and protected u/s 10(2A) is the amount that the partner receives as a share of his profit from the firm, and not anything more than that. The legislature had two choices to levy tax on this excess amount:

- A capital gains tax, on the presumption either that the legislature believes that the rights of the retiring partner are extinguished or that the firm purchased some asset from the partner (e.g., goodwill). In both cases, the levy should ideally have been on the partner. It could have, however, been levied and collected from the firm also.

- A tax u/s 56, in case the legislature believed that though the rights are not extinguished nor has any asset been purchased from the partner, the partner has certainly received an excess amount than what he should have.

Out of the two choices above, the legislature has chosen the former approach i.e., taxing the amount as capital gains.

- To implement the above, the distribution of a capital asset to the retiring partner needs to be deemed as transfer.

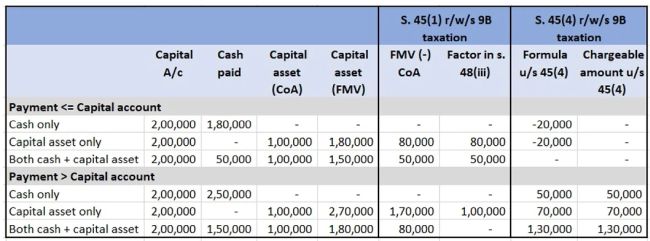

- To illustrate the above, the following scenarios are relevant in light of the new provisions:

- (A) Partner is paid less than or equal to his capital account

- Cash only - no taxation either u/s 45(4) or 9B or 45(1)

- Capital asset only - no taxation u/s 45(4), but tax is leviable u/s 45(1) r/w/s 9B; regular scheme of computation u/s 45 r/w/s 48 to be followed.

- (B) Partner is paid more than his capital account

- Cash only - tax leviable u/s 45(4), but not u/s 9B or 45(1)

- Capital asset only - tax leviable u/s 45(4) as well as 45(1) r/w/s 9B, but in order to make sure that a divide is maintained between the two sections (where s. 45(4) is meant only for taxation of the amount in excess of the capital account) and there is no double taxation, section 48(iii) is needed.

- The above intent, scheme and classification is not expressly evident from the sections. However, it can be concluded from the tax consequences that arise in the abovementioned scenarios, as tabulated below:

- The SC decisions that state that when a partner is paid more than his capital account, there is no transfer since it amounts to only a mutual adjustment or rights, is overcome by s. 9B.

- The enactment of s. 9B alone would have taken care of replacing the old s. 45(4), since s. 9B now deems the distribution of the capital asset as a transfer and also deems the fair market value as the full value of consideration. Thus, s. 45(1) r/w/s 9B would have alone taken care of the erstwhile s. 45(4).

- However, in order to take care of situations involving only cash or cash plus capital asset, s. 45(4) was needed.

Originally published Aug 3, 2021 .

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.