DEAL STATISTICS

LATEST TRENDS

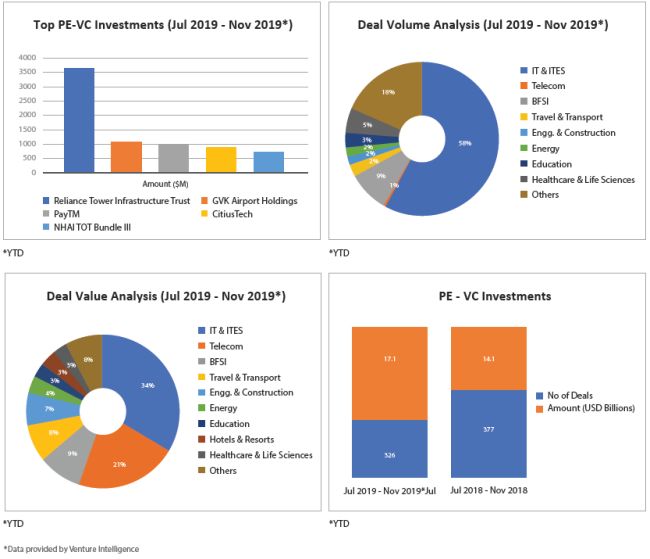

- Value of Buyout transactions more than doubled (USD 5.1 billion) during Q3'19.

- Drastic drop in the number of deals in the range USD 0-5 million (65 v 104 in Q3'18).

- The median investment size doubled to USD 9.9 Million (USD 5 million in Q3'18). The average median investment size over the previous five quarters was USD 5 million.

- The value of PIPE transactions fell to its lowest of the last five quarters (USD 400 million), one-third of Q3'18 (USD 1.3 billion).

- VC investment volume hit the sub-100 figure for the first time since 2015.

- Mumbai took the top city spot as investments in Bangalore slumped by 60%.

- At 45 deals, new company investments hit 5-year low.

- Early stage investments declined 32%; Series A declined 40%.

- In a first, B2B companies overtook investment share of B2C startups, as B2C companies saw 43% fall in investments.

LATEST LEGAL & REGULATORY DEVELOPMENTS

New Foreign Investment Rules

The Ministry of Finance on October 17, 2019 issued the Foreign Exchange Management (Non-Debt Instruments) Rules, 2019 (the Non-Debt Instruments Rules) and the Reserve Bank of India (RBI) issued the Foreign Exchange Management (Debt Instruments) Regulations, 2019, & the Foreign Exchange Management (Mode of Payment and Reporting of Non-Debt Instruments) Regulations, 2019. The Non-Debt Instruments Rules and the two regulations supersede the Foreign Exchange Management (Transfer or Issue of Security by a Person Resident Outside India) Regulations, 2017 (FEMA 20(R)) and the Foreign Exchange Management (Acquisition and Transfer of Immovable Property in India) Regulations, 2018.

Following are some of the key changes:

| Powers of Central Government | Under FEMA 20(R), the

RBI had discretionary power to approve certain transactions. Under

the Non-Debt Instruments Rules, RBI will have to now consult with

the Central Government in relation to the following:

|

| Pricing Guidelines | The following

explanation in relation to the provision on pricing guidelines has

not been reflected in the Non-Debt Instruments Rules. ".. Explanation: in case of convertible capital instruments, the price/ conversion formula of the instrument should be determined upfront at the time of issue of the instrument. The price at the time of conversion should not in any case be lower than the fair value worked out, at the time of issuance of such instruments, in accordance with these Regulations." |

| Non incorporation of changes proposed in Press Note 4 | The Non-Debt Instrument

Rules have not incorporated the changes introduced in Press Note 4

issued by the Department for Promotion of Industry and Internal

Trade (DPIIT). Vide Press Note 4, changes to the

FDI norms have been introduced in the following sectors:

|

Company Law Committee - Decriminalizing Offences

The Ministry of Corporate Affairs (MCA) has released the Report of the Company Law Committee (2019) which was formed to make recommendations to the Central Government on re-categorization of certain compoundable offences to civil wrongs. The Committee has also recommended certain other changes to facilitate and promote ease of doing business.

To deal with the increasing instances of corporate misconduct, the Committee decided that serious violations of law, especially those involving fraudulent misconduct, should be dealt with under criminal law. However, procedural, technical and minor non-compliances and those not involving subjective determination, may be dealt through civil jurisdiction.

Based on the recommendations of the Offences Committee in its Report, The Companies (Amendment) Second Ordinance, 2019 introduced amendments to change 16 non-compliances from criminal to civil. Instead of being under the jurisdiction of special courts, Adjudicating Officers (AOs) will adjudicate these 16 civil violations through the in-house adjudication (IAM) framework. This framework is intended to be cost effective and time efficient.

Companies can now rectify their defaults, pay the penalty and become compliant with the law through the IAM framework, rather than fighting a criminal trial. This will reduce cost of compliance for companies and promote ease of doing business. It also reduces the burden on special courts and allows them to focus on serious offences. Further, it also reduces the regulatory burden to prove default beyond reasonable doubt.

The Committee categorized offences under the Companies Act, 2013 (2013 Act) into the following 8 categories:

| Category A Offences | Non-compliance of the orders of the authorities, Central Government/ National Company Law Tribunal (NCLT)/Regional Director/ Registrar of Companies (RoC) |

| Category B Offences | Defaults in respect of maintenance of certain records |

| Category C Offences | Defaults on account of non-disclosure of interest of persons to the company, which vitiates the records of the Company |

| Category D Offences | Defaults related to certain corporate governance norms |

| Category E Offences | Technical defaults relating to intimation of certain information by filing forms with the RoC or in sending notices to stakeholders |

| Category F Offences | Substantial violations that may affect the going concern value of the company or are contrary to larger public interest or otherwise involve serious implications in relation to stakeholders |

| Category G Offences | Defaults involved in liquidation proceedings |

| Category H Offences | Defaults not specifically punishable under any provision, but made punishable through an omnibus clause |

The committee has decided four possible principles for each offence

- Offences that relate to minor/less serious compliance issues, involving predominantly objective determinations, have been recommended to be shifted to the IAM framework

- Offences that are more appropriate to be dealt with under other laws, have been proposed to be omitted from the 2013 Act

- In relation to some offences that did not seem fit for any of the aforesaid two principles, the Committee recommends them to be dealt with in another manner and has provided alternative methods of imposing sanctions

- For some offences that are based on subjective determinations but are not very serious violations, it has been recommended that punishment be limited to only fine

The Committee has recommended that offences in 23 provisions to be shifted to the IAM framework, 7 offences be omitted, 11 offences to be limited to only fines and 5 offences to be dealt with in an alternate framework.

The Committee also made certain additional recommendations. Some of the recommendations are listed below:

- Allowing appeal against the orders of Regional Directors before NCLT

- Exclusion of certain class of companies from the definition of 'listed company' in consultation with SEBI

- Exclusion of certain companies from Section 89 (declaration of beneficial ownership)

- Exclusion of certain companies from Chapter XXII (companies incorporated outside India)

- Proposing benches of NCLAT

- Reducing timelines to speed up rights issue

- Exemptions to certain classes of NBFCs from filing resolutions under Section 117

- Exemption from certain private placement requirements for QIPs

- Modification of thresholds for applicability of CSR provisions, to enhance the limits

- Allowing payment of remuneration to non-executive directors in case of inadequacy of profits

- Revising provisions on disqualification of directors

- Revising provisions in relation to debarment of audit firms

Thresholds for seeking Shareholder's Approval for Related Party Transactions

The MCA vide notification dated November 18, 2019 amended the Companies (Meeting of Board and its Powers) Rules, 2014, where it has amended the thresholds for seeking shareholders' approvals for related party transactions.

The thresholds for the following transactions are now linked only with 10% or more of the turnover or net worth as against a specific threshold of INR 100 crores or INR 50 crores whichever is lower.

| Sale, purchase or supply of any goods or materials directly or through appointment of agent | Selling or otherwise disposing of, or buying property of any kind, directly or through appointment of an agent | Leasing of property of any Kind | Availing or rendering of any services, directly or through appointment of an agent |

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.