Introduction

Just as profits drive business, incentives drive the managers of business. Not surprisingly then, in a fiercely competitive corporate environment, managerial remuneration is an important piece in the management puzzle. While it is important to incentivize the workforce performing the challenging role of managing companies, it is equally important not to go overboard with the perks and the pay. In India, to keep a check on unnecessary profit squandering by companies and, at the same time, to ensure adequate and reasonable compensation to managerial personnel, the law intervenes to do the balancing act.

The Companies Act, 1956 ("the Act"), lays down the specifics of managerial remuneration viz. the ceilings, pre-requisites, penalties and the related legalities. This newsletter explains the relevant statutory provisions of the Act to highlight the legal framework within which Indian companies ought to operate while remunerating their managerial workforce. The scope of the newsletter is on an unlisted public company and a private company, which is a subsidiary of a public company. Listed companies are further governed by the listing agreement norms, which have not been covered in this newsletter.

1.0 Important definitions

At the outset, certain important terms relevant for this newsletter are defined below:

1.1 Managerial Personnel - As such, the term "managerial personnel" is not explicitly defined in the Act. However, based on interpretation of the various statutory sections, it includes the following:

(i) Managing Director - means a director who, by virtue of an agreement with the company or of a resolution passed by the company in general meeting/Board of directors or, by virtue of its memorandum or Articles of Association ("AOA"), is entrusted with substantial powers of management. A managing director can exercise his powers subject to the superintendence, control and direction of its Board. Powers to do administrative acts of a routine nature1 is not deemed to be substantial powers of management.2

(ii) Manager - means an individual who, subject to the superintendence, control and direction of the Board has the management of the whole or substantially the whole of the affairs of a company. It includes a director or any other person occupying the position of a manager, by whatever name called, whether under a contract of service (i.e. an employee) or not.3

(iii) Whole-time Director - this includes a director in the whole time employment of the company who devotes his entire time and attention in carrying on the business affairs of the company.4 He cannot be an employee of another company.

Further, section 197A of the Act prohibits simultaneous appointment or employment by a company (public and private) of both a managing director and a manager. Hence, at a given point of time, a company can either have a managing director or a manager but not both. In addition to one of the above, a company can also appoint a whole-time director. While there is no restriction in the number of managing and whole-time directors that a company can employ, there cannot be more than one manager. The Act specifically refers to the manner and extent of remuneration payable to managerial personnel, as discussed in section 2 below.

1.2 Remuneration5 - "Remuneration" to managerial personnel includes any expenditure incurred by the company in providing: (i) rent-free accommodation, benefit or amenity in respect thereof; (ii) any benefit or amenity free of charge or at a concessional rate; (iii) payment for any obligation or service on their behalf; (iv) life insurance, pension, annuity or gratuity provided to managerial person, his spouse or child. Therefore, "remuneration" includes both salary and perks (barring few exceptions6).

2.0 Managerial pay - statutory stipulations

2.1 Managerial personnel - Appointment and remuneration - Section 269 mandates every public company with a paid-up share capital of INR 50 million (USD 919,453 approximately)7 or more to have a managerial person. This obligatory appointment can be made only upon procuring central government's approval unless it is made in terms of Schedule XIII. Where approval is essential, it must be obtained and a return in the prescribed form (e-form 25C)8 filed with the Registrar of Companies ("ROC"), within ninety (90) days from the date of appointment. The central government can reduce the tenure or disapprove the appointment altogether. Disapproval can be on account of the person being unfit for the position, appointment being against public interest, or due to unreasonable terms of appointment. In case of rejection of appointment, the appointed person has to vacate his office failing which a monetary penalty is leviable.

Directors' remuneration can be determined only by the AOA or by the shareholders meeting. In some cases, the AOA may require that the shareholders pass a special resolution. A company can modify remuneration only at a general meeting. The Board can only recommend. The directors cannot themselves fix the remuneration of all or any one of themselves. In any event, it should be within the overall 11% ceiling stipulated under section 198 of the Act. This section aims to monitor the quantum and covers two specific aspects viz. the overall maximum ceiling and remuneration in case of absence or inadequacy of profits. It sets an upper limit of 11% of net profits payable in a financial year9 and where a company has inadequate or no profits, it has to pay remuneration in accordance with Part II of Schedule XIII.10 If the stipulated conditions of the Schedule are not met, prior central government approval is necessary. Section 198 is applicable to public companies and a private company which is a subsidiary of public company. Thus, private companies are not subject to any statutory ceilings for managerial compensation.

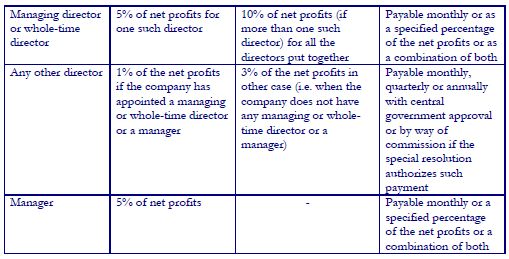

The directors' remuneration, as determined in the manner stated above, is all-inclusive payable for all services rendered either in the capacity as director or in professional capacity. Professional services include that of a lawyer, engineer or accountant. Sitting fees payable to directors for attending Board and committee meetings is excluded. Within the overall 11% ceiling, the limits prescribed for monthly remuneration under sections 309 and 387 have to be fulfilled too. While section 309 exclusively deals with the manner of remuneration of directors, section 387 specifically provides for remuneration to managers. The statutory limits so prescribed are tabulated below, which can be exceeded only with prior central government approval:

2.2 Schedule XIII - This Schedule was introduced with the aim of obviating the need to seek central government approval provided the prescribed parameters are satisfied. It is divided into three parts. Part I deals with the dos and don'ts of appointment viz. age, which should be between 25 and 70 years, resident status i.e. the person should have stayed continuously for twelve months in India immediately before his appointment, clean background i.e. no imprisonment, detention or fine for any offence. Part II deals with the remuneration payable in various circumstances as tabled below. Finally, Part III stipulates the mandatory procedural aspects viz. the requirement of shareholders' approval, resolution for appointment and remuneration and a compliance certificate from auditor or a company secretary.

The Schedule has periodically undergone changes in line with the evolving needs and increased corporate governance standards. The intent is to provide optimum compensation to managerial workforce while ensuring adequate control and protection of stakeholders' interest. Schedule XIII has endeavored to set a uniform standard for public companies. It will be worthwhile to consider and bring private companies under a similar, if not the same, lens of checks and balances.

Conclusion

Evidently, the Indian company law has exhaustive dos and don'ts concerning managerial remuneration for public companies. Besides, listed companies are also governed by listing agreement norms. The primary purpose of regulations over managerial pay is to protect the interest of stakeholders, particularly the shareholders and the creditors. The goal of the law is to monitor and ensure that the managerial remuneration is reasonable and fair and there is a balance between payment and profits of the company.

Footnotes

1 This includes acts such as affixing common seal of the company, endorsing any check/negotiable instrument on company's account or signing share certificate

2 Section 2(26) of the Act

3 Section 2(24) of the Act

4 Explanation to section 269 of the Act

5 Explanation to section 198 of the Act

6 These include leave travel concession, children's education allowance etc.

7 1 USD = INR 54 approximately

8 The form requires details like the name, appointment, terms and conditions of appointment and remuneration of managing director/manager/whole-time director, as the case may be

9 The net profits have to be computed in the manner prescribed in sections 349 and 350 of the Act

10 See column B of the table under section 2.2 of the newsletter

11 Per Explanation I of Section II, "Effective capital" means the aggregate of the paid-up share capital, share premium account, reserves and surplus, long-term loans and deposits repayable after one year minus the investments, accumulated losses and preliminary expenses not written off.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.