History

Banks have so far been hesitant to extend loans to certain categories of potential borrowers. These are entities without a proven track record which makes lenders assign them a higher probability of default. For each of such default, the lenders need to create covers in their own annual financial statements under prudential norms to retain their financial health and operability. Such sectors include MSMEs, the wage-earning/working class, agricultural workers, students, and other borrowers with limited or unavailable credit history. This is where fintechs stepped in as lending service providers (LSPs) providing a much needed balance in credit disbursals.

In a somewhat similar model to outsourcing, while banks/regulated entities (RE) with a licence to lend provide the capital, fintechs provide the technology platform meant for facilitating credit by leveraging their client base and reach. In terms of specific functions, the REs would provide the actual financial assistance to customers while the LSPs would be outsourced some of the functions that banks used to undertake thus far, such as customer acquisition, loan underwriting, account monitoring, client servicing and recovery. These activities carried out by digital lending apps/platforms made access easy and universal, as long as the customer had access to a smart phone and the internet. The intent was to bring a vast number of potential customers who remained disenfranchised from the banking system on account of unavailability of track record into the folds of the formal lending system of banks.

However, somewhere in the third quarter of year 2022 there was a realisation that such an arrangement with LSPs was susceptible to 100% exposure. This was leading to a risky situation for the banks and the entire financial system. The RBI, in September 2022, prohibited banks/Regulated Entities from entering into First Loss Default Guarantee (FLDG) arrangements with unregulated entities. It clarified in its communication that the fintech partner was only a loan originator between the bank and the beneficiary. The RBI also communicated its specific concerns with regard to fintechs as under:

- Fintech's financial health and bandwidth for absorbing high credit risk;

- Whether they possessed risk management capability/capacity;

- Whether they met prudential norms for debt : equity, capital adequacy; and

- If they have in place a plan or built in capacity required for tackling bad loans that the process may generate.

The RBI closed the scheme by terming it 'synthetic securitisation'.

The new mandate

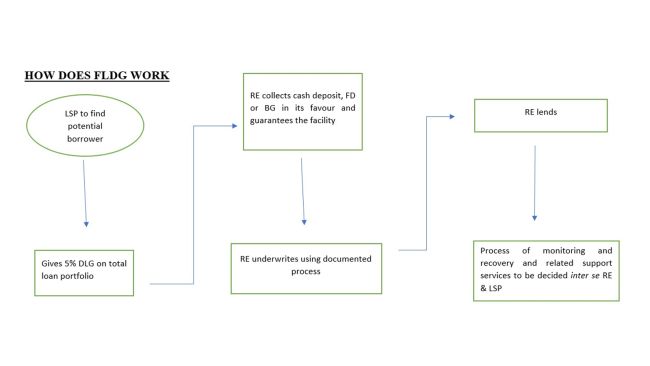

On June 08, 2023, the RBI's Monetary Policy Committee (MPC) revived the popular bank-fintech partnership model and brought FLDG to life, albeit, with a new set of rules and stringent dos and don'ts for all three parties involved in a financial transaction -- the fintech (LSP), the bank (RE) and the actual borrower. What the central bank has now proposed is as under:

- LSP to find the borrower.

- They would do so with a digital lending app. They could use a partner app or create an in-house platform.

- The RE will provide the loan.

- LSP will provide solid guarantees to banks; these could be a cash deposit, a fixed deposit (FD) maintained with any scheduled commercial bank over which a lien will be created in favour of the RE. It could also be a bank guarantee marked in favour of the RE.

The important caveat is that the fintech's guarantee exposure has been capped at 5% of its portfolio amount. The attempt is to ensure that the fintech/LSP backing the guarantee is financially capable of fulfilling its obligations should a default occur.

FLDG flowchart

Conclusion – Dos and Don'ts

- Disclosure requirement for LSPs – they need to publish on their website the total number of portfolios where FLDG has been offered along with amount in such portfolio.

- REs must introduce a board-approved policy for due diligence for each FLDG deal. The policy is to include eligibility criteria for the FLDG provider, extent of the cover, monitoring process, and fees, if any are payable to the FLDG provider.

- Credit underwriting standards to be put in place and documented.

- RE to obtain adequate KYC information, a declaration from the provider duly certified by its statutory auditor on the aggregate FLDG amount outstanding, the number of REs, the number of portfolios and past default information on similar portfolios.

- REs to identify all loan assets as non-performing assets (NPAs), irrespective of the DLG cover.

- Adequate and transparent customer protection measures to be disclosed on their websites.

These new guidelines were published in the official circular on June 8, 2023 and have come into effect since.

Originally published by BarandBench.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.