The Maharashtra Government vide an Order dated 7 December 2023 introduced ' Maharashtra Mudrank Shulk Abhay Yojana 2023' i.e., Maharashtra Stamp Duty Amnesty Scheme – 2023 ("Scheme") to waive stamp duty fees and penalties on the instruments which were executed between 1 January 1980 and 31 December 2020. This Scheme aims to encourage individuals to settle outstanding stamp duty payments by offering discounts on penalty fees for delayed payments. This Scheme applies to the instruments listed in the annexure of the Order and is executed on stamp paper sold exclusively by the government-approved stamp vendors or authorized agencies/competent authorities by the Chief Controlling Revenue Authority. This Scheme applies to documents/ instruments related to property. To apply, applicants must fill out the form attached to the Order and submit it along with the original instrument and self-attested copies.

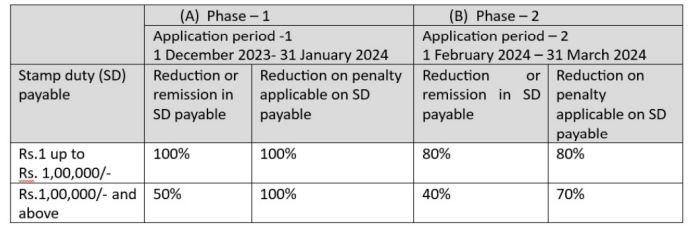

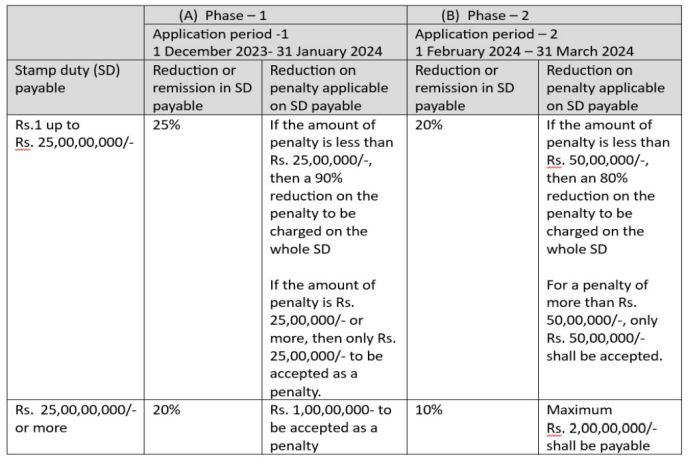

The Scheme will be implemented in two phases to simplify the its execution. The first phase started on 1 December 2023 and will continue till 31 January 2024. For the individuals who could not take advantage of the Scheme, the second phase will follow. The second phase will begin on 1 February 2024 and end on 31 March 2024. Execution period Phase I – Instruments which are executed between 1 January 1980 and 31 December 2000 (inclusive of both dates):

Execution period Phase II – Instruments which are executed between 1 January 2001 and 31 December 2020 (inclusive of both dates)

MHCO COMMENT

This Scheme allows people to pay lower stamp duty and lower penalties. It will motivate people to come forward and get their documents/ instruments adjudicated. However, this Scheme does not allow individuals to register the documents after paying the stamp duty. The Scheme does not give any clarity on the effect on the title of the property. Given this, we are uncertain whether the Scheme is beneficial and its effectiveness will be determined in due course of time.

This article was released on 22 December 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.