Key Takeaways

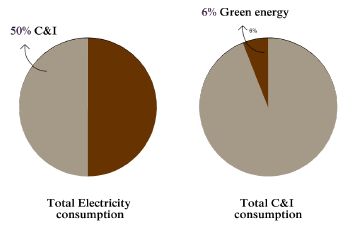

- C&I market significantly untapped – accounts for just 6% of the total renewable power purchases

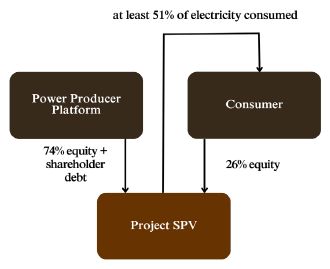

- Captive open access the most preferred route – i.e. procuring power for captive consumption from private renewable players using govt. transmission facilities

- C&I consumer perspective – low investment, significant cost savings, return of upfront investment in 2-3 years, green energy credentials

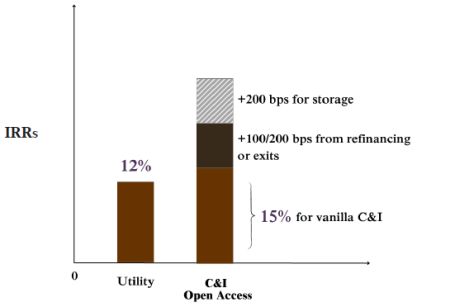

- Investor perspective – well-diversified risk, stronger IRRs (15%-17%) vis-à-vis utility play, easily available project financing (65% - 75% of each project)

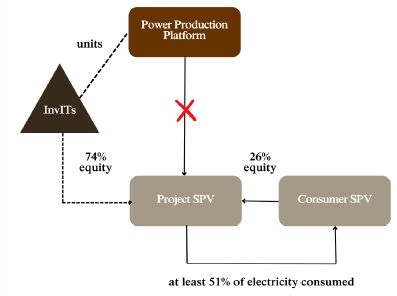

- InvIT play possible from day 1, effectively making it a development platform and increasing returns further

Introduction

The largest consumers of electricity in India are what are known as "C&I users" – i.e. the commercial and industrial users. But who are these people in simple terms, especially in the renewable energy context? Let us say that you operate a manufacturing unit in Coimbatore and consume about 1 lakh units per month at Rs. 8 per unit. Now, a renewable power producer based out of Rajasthan approaches you and agrees to meet your power requirement fully – but at Rs. 5 per unit. You agree and become what we call a "C&I" consumer.

C&I category is very vast – scaling from restaurants to steel plants – and consume more than half of the total electricity produced in the country. Unlike retail users who largely depend on the state DISCOMs for their electricity needs, C&I consumers follow a more diversified approach in sourcing their electricity. This ranges from traditional DISCOMs to direct purchase of power from a power producer and even producing electricity for their own consumption.

However, buying power from a third party or producing your own power comes the challenge of actually transmitting that electricity from the place of production to the place of consumption. For large industrial plants which have onsite power generation, this is naturally not an issue. But, if you are indeed the Coimbatore manufacturing entity hoping to get cheaper power from Rajasthan, expecting you to setup transmission lines is commercially unviable.

This is where open access steps in. Simply put, open access is a provision that allows such consumers to use existing infrastructure to transport their electricity, for which they are charged an access fee, significantly reducing costs.

What is the opportunity for renewable power producers?

Cheaper Cost. Open access has been around for some time but has seen relatively lower uptake due to a variety of factors. However, with the rapid rise of renewable production and its emergence as a significantly cheaper source of electricity, there has been a marked increase in C&I consumers looking to tap into green energy through the open access route. Specifically, under the group captive open access route, the savings for C&I consumers can range between Rs. 1.5 – 2.5 per unit with very minimal upfront investment. In addition, projects can also be structured such that the entire equity contribution of the C&I consumers is recovered within 1 – 2 years through cost savings.

Round-the-clock supply. With renewables, there is always the challenge of intermittency. Hence, large C&I consumers mainly relied on grid connected electricity despite sourcing green power from IPPs (Independent Power Producers – referring to private power producers). However, IPPs are now offering a hybrid solution – of providing energy along with storage – to ensure round-the-clock supply of electricity. Storage solutions are still nascent – so, IPPs have viewed this as the perfect opportunity to aggressively pursue the technology play and increase market share.

Constructive regulatory environment. This increasing engagement from consumers has been helped along with an increasingly supportive regulatory environment. Simplified approval mechanism for green energy open access projects, facilitating sale of renewable power through the GTAM and RTM markets, and operationalizing effective net metering policies are a few examples of constructive regulatory action.

What does the commercial story for investors look like?

Huge Untapped Market. At the beginning of 2023, only 6% of the total C&I consumption in India was fulfilled through renewable power. So, the C&I sector's ability to absorb large amounts of capital is probably second to none.

Robust Risk Diversification. The biggest risk with the utility play is the over-reliance on DISCOMs. DISCOMs are perpetually in stress and payment cycles are invariably compromised in many cases. SECI intermediated projects may also face challenges with enforcement timelines, in case of a default. C&I on the other hand has an in-built risk-mitigation algorithm, since the revenue stream is well-diversified and counterparties are chosen carefully to mitigate potential defaults. PPAs are also drafted such that there is sufficient disincentive for the consumer to default on their payment obligations.

Significant lender comfort and availability of non-recourse financing. Banks are increasingly comfortable to provide 65% - 75% project financing for C&I players at competitive rates. In fact, one of the largest banks of India (SBI) has indicated that payment defaults from C&I consumers are negligible. For global investors, the added benefit is that most of these financings are provided on a non-recourse basis – i.e., the only security will be the project receivables and project assets, and no guarantees/ shortfall undertakings are required from the holding company/ controlling investors.

Strong IRRs. IRRs for investors range around 15% on an HTM basis (C&I), unlike traditional utility players which offer around 12%. Open-access coupled with storage has the potential to push this up to 17% - 18%. These are naturally median-case scenarios, and there is of course the scope to extract greater returns as the market matures, interest rates reduce and innovative storage solutions are developed.

What are the key challenges in the sector?

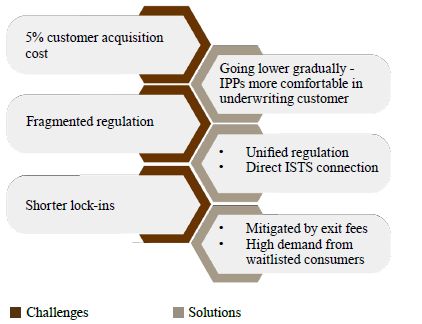

Customer awareness and attendant cost. This remains a challenge, and the cost of acquiring customers (from initial sensitization to signing of PPA) clock in at around 5% of the project capex. Though with the gradual evolution of the sector, power producers are getting more comfortable in underwriting common customer concerns helping speed up the process.

Fragmented regulations. Since electricity is regulated at both the federal and the state level, to navigate the sheer number of legislations governing renewable players can be an onerous task. This is gradually being mitigated by (a) unified regulations on open access and "banking" from the Union Government, which a lot of states are adopting; and (b) larger players bypassing the state utilities altogether by directly connecting to the ISTS (interstate transmission lines) making the whole process of getting an open access license easier with a more stable cost regime.

Shorter lock-ins in PPAs. Customers increasingly negotiate for shorter lock-in for PPAs. While this strikes at the root of revenue visibility, given the overall demand for power in the C&I segment and the current cost differential between grid power and renewable power, IPPs take a commercial risk-calibrated call to proceed as-is. However, in such cases, consumers are subject to an exit levy to discourage exits and are not given the full benefit at most-favoured rates. Also, with a larger list of waitlisted consumers – stranded capacity finds ready consumers.

InvIT play possible? What are the benefits?

C&I projects are essentially non-PPP in nature. This allows for a pure-play greenfield InvIT from day 1 – as these concessions can be rolled over even before construction begins. Such early rollover has two key benefits from a returns perspective for global investors:

- Risk of losing tax assets/ accumulated losses. When assets are rolled over into InvITs post construction, there is a risk that accumulated losses (which can be material due to the structure of cashflows) may lapse due to change in shareholding of the asset. Since the beneficial ownership of the asset remains the same, it's possible to argue that losses such should not lapse. However, an InvIT structure from Day 1 (after rolling over the seed assets) eliminates this risk entirely.

- Accrual of tax assets during construction. InvITs have a special advantage vis-à-vis other holding structures, in that any 'interest' distributed by its SPVs to the InvIT is not liable to any tax (including withholding tax). Tax on such interest is relevant only when the InvIT further distributes the amounts to its unitholders. As a result, during the initial years of most projects, SPVs can legitimately accrue interest in respect of the sub-debt infused by the InvIT and create tax assets. These tax assets are set off against future revenues, effectively increasing the absolute returns rate of such projects.

Also, legacy players employing a HoldCo structure can also benefit from the significantly higher IRRs by rolling over into an InvIT. For further details, please refer our detailed white on InvITs which can be accessed here.

One key concern with the InvIT structure however is the requirement to have at least 25% public investors, unconnected to the sponsors. For captive C&I platforms, this may be an issue and will have to be addressed appropriately.

Conclusion

The focus on green energy production and energy transition is real. Insistence by shareholders on responsible sustainable growth is more than even before. One key step in this direction is the C&I game – which has garnered significant interest because of the increasing cost-savings on offer, the ability to burnish sustainability metrics through direct verifiable sourcing of green energy, the relatively lower entry barriers (as compared to setting up a power plant for captive use), and the benefit for consumers of being able to lock-in electricity prices.

The larger effect for the economy from access to cheaper electricity would be a net positive. Open access coupled with a more efficient grid through full operationalisation of smart meters can drive the shift to a truly functional and resilient smart grid.

The authors would also like to acknowledge and thank Maseeh Yazdani, who will be joining Resolüt Partners as an Associate in 2024, for his contribution to the article.

Originally published November 2, 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.