The GST Council, in its 23rd meeting held at Guwahati on 10th November 2017, recommended various facilitative measures for taxpayers. The Council also recommended major relief in GST rates on certain goods and services. These recommendations are spread across sectors and commodities.

Key Recommendations

- Annual turnover eligibility for composition scheme to be increased to Rs 2 crore

- List of 28% GST rated goods to be pruned from 224 tariff headings to only 50 tariff headings

- Reduction in GST rates applicable on restaurants

- Further simplification of return filing process

- Clarification on inter-state movement of goods like rigs, tools, spares, etc.

Changes in Composition Scheme

Annual turnover eligibility for composition scheme will be increased to Rs 2 crore from the present limit of Rupees 1 crore under the law. Thereafter, eligibility for composition will be increased to Rs. 1.5 Crore per annum. Supplier of goods rendering services up to Rs. 5 lakh shall also be entitled to avail said composition scheme.

Currently, the GST law provides that the Government can increase the annual turnover limit for opting composition levy up to one crore rupees only. Therefore, the increase in turnover limit will be implemented only after the necessary amendment of the CGST Act and SGST Acts.

A uniform rate of tax @ 1% under composition scheme has been recommended for both manufacturers and traders (for traders, turnover will be counted only for supply of taxable goods). No change in rate for composition scheme for restaurant has been recommended.

Changes in GST Rates

The Council has recommended reduction in GST rate from 28% to 18% on goods falling in 178 headings at 4-digit level (including 4 tariff heading that are partially pruned). After these changes, only 50 items will attract GST rate of 28%.

Further, the Council has recommended changes in GST rates on other goods as well, so as to rationalise the rate structure with a view to minimise classification disputes. On the services side also, the Council recommended changes in GST rates to provide relief to aviation & handicraft sectors and restaurants.

The Council has also recommended providing exemption from IGST on imports of lifesaving medicine supplied free of cost by overseas supplier for patients and imports of specified goods by a sports person. Exemption is also to be extended to temporary import of professional equipment by accredited press persons visiting India, broadcasting equipments, sports items, testing equipment under ATA carnet system, provided these goods are re-exported after the specified use is over.

Reduction in GST Rates Applicable on Restaurants

As per the recommendations of the GST Council, all stand-alone restaurants irrespective of air conditioned or otherwise, will attract 5% without ITC. Food parcels (or takeaways) will also attract 5% GST without ITC.

Restaurants in hotel premises having room tariff of less than Rs. 7500 per unit per day will attract GST of 5% without ITC. Restaurants in hotel premises having room tariff of Rs. 7500 and above per unit per day (even for a single room) will attract GST of 18% with full ITC. Outdoor catering will continue to be taxed at 18% with full ITC.

Simplification of Return Filing Process

The GST Council has recommended further simplification of the return filing process, especially for small taxpayers. Filing of monthly return in FORM GSTR-3B has been extended to March, 2018. For filing of details in FORM GSTR-1 till March 2018, taxpayers would be divided into two categories. Details of these two categories along with the last date of filing GSTR 1 are as follows:

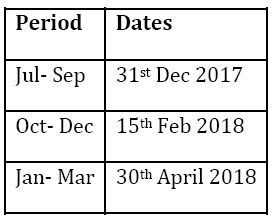

(a) Taxpayers with annual aggregate turnover up to Rs. 1.5 crore need to file GSTR-1 on quarterly basis as per following frequency:

(b) Taxpayers with annual aggregate turnover more than Rs. 1.5 crore need to file GSTR-1 on monthly basis as per following frequency:

The time period for filing GSTR-2 and GSTR-3 for the months of July, 2017 to March, 2018 would be worked out by a Committee of Officers. However, filing of GSTR-1 will continue for the entire period without requiring filing of GSTR-2 & GSTR-3 for the previous month/period.

Clarification on Inter-State Movement of Goods

The GST Council has clarified that inter-state movement of goods like rigs, tools, spares and goods on wheel like cranes, not being in the course of furtherance of supply of such goods, does not constitute a supply.

This clarification gives major compliance relief to industry as there are frequent inter-state movement of such goods in the course of providing services to customers or for the purposes of getting such goods repaired or refurbished or for any self-use. Service provided using such goods would in any case attract applicable tax.

Other Changes

i) Facility for manual filing of application for advance ruling to be introduced for the time being;

ii) Suppliers providing services through an e-commerce platform to be exempted from obtaining compulsory registration provided their aggregate turnover does not exceed twenty lakh rupees;

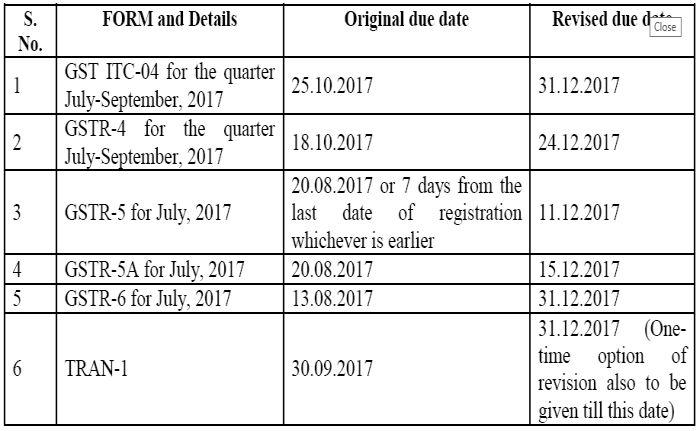

iii) Due dates for furnishing the following forms to be extended:

These recommendations are expected to take effect from 15th November, 2017 subject to issue of relevant notifications.

Originally published July 14, 2020.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.