Recently, the Chennai Income-tax Appellate Tribunal (ITAT or Tribunal) in the case of Cognizant Technology Solutions India Pvt. Ltd (Company or the assessee or the taxpayer)1 held that the purchase of own shares under a scheme of arrangement approved by the High Court was a colorable device devoid of commercial substance and was undertaken to evade taxes by resorting to treaty shopping. It further held that the Assessing Officer (AO) is empowered to adopt a "look through" approach rather than 'look at' approach.

The ITAT has ruled that Dividend Distribution Tax (DDT) under section 115-O read with section 2(22)(d) of the Income-tax Act, 1961 (Act) was applicable to the said transaction by characterizing it as 'Capital Reduction'.

Interestingly, it is pertinent to note that the taxpayer's stand was that the Scheme for Purchase of its own shares was neither a 'Buy-back' nor a 'Capital Reduction' in a strict sense, but it was a contract between the Company and its shareholders for Purchase of shares against payment of consideration. It was pursuant to the legal mandate under the law that the shares so the purchase had to be canceled/extinguished, and such cancellation could not be considered as Capital Reduction, nor the payment of consideration out of profits could be considered as 'distribution' of accumulated profits to trigger the provisions of Section 2(22)(d) of the Act.

While the ruling pertains to AY 17-18 prior to the applicability of the GAAR provisions, this is an ideal case of invocation of judicial GAAR by the tax authorities by adopting a 'look through' approach. The ruling will act as a guiding force in structuring M&A deals, especially under the GAAR regime, considering the 'look through' approach adopted by the tax authorities. Accordingly, in this article, we have attempted to summarize some of the key facts and grounds that were the driving factors for the Tax Tribunal in holding that the Scheme was a colorable device to evade taxes.

Key Facts and Grounds

In AY 2017-18, a Scheme of Arrangement (Scheme) under Section 391 – 393 of the Companies Act, 1956 (Co. Act) was approved by the Madras High Court whereby the company purchased 94,00,534 equity shares from its shareholders for a total consideration of INR 19,0802.6 million.

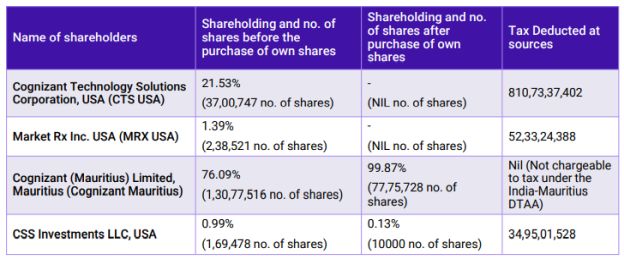

Below is the shareholding structure of the Indian Company before and after the transaction in question:

The company deducted taxes on payments made to the US shareholders under the premise that the payment is taxable as capital gains in the hands of shareholders as per Section 46A of the Act, as there was no relief available under the India-US tax treaty. However, no taxes were deducted on payments to shareholders resident of Mauritius by virtue of the benefit available on capital gains as per the India – Mauritius tax treaty. It is in this context that the tax authorities have viewed the transaction as a tax avoidance tool.

Summary of issues, grounds and the observations of the Tax Tribunal

The transaction was a colorable device to avoid tax

The Tax Tribunal reached to this conclusion, especially in light of the following facts:

A. Firstly, it was alleged by the tax officer that the entire scheme was moved in a hurried manner basis the dates and events brought on record:

- Amendment (proposed) to Section 115QA (introducing a tax on the buy-back of shares in the hands of the company) was announced in the public domain on 29 February 2016 and was to come into force w.e.f. 1 June 2016. The taxpayer immediately convened a Board Meeting on 10 March 2016 and filed a scheme for the purchase of its own shares, which was approved by the High Court on 18 April 2016.

B. Past Restructuring measures undertaken by the taxpayer:

- The taxpayer was a wholly-owned subsidiary of CTS USA. In FY 2011-12, by way of a scheme of amalgamation, two group entities were merged into the assessee company, which resulted in a substantial dilution of the stake of US shareholders, and in the resultant shareholding structure, Mauritius shareholders assumed a significant stake.

- It was observed that the shares were allotted on a 1:1 swap based on the number of shares held by the shareholders of all entities, and the swap was not in proportion to the market value of the shares in the individual companies. This resulted in CTS, USA (assessee's shareholder) holding only 21.92% of shares, whereas CTS, Mauritius (shareholder of amalgamating entity), held 76.68% of the amalgamated entity. This is despite the fact that shares held by CTS, USA, had a book value/net worth of INR 22,581.91 per share prior to amalgamation while CTS, Mauritius, had a book value/net worth per share of only INR 84.45. The tax authorities alleged that if the shares were to be distributed as per net worth/book value, then CTS USA ought to have held 98.3% of the amalgamated entity.

- It was concluded that there had been an artificial shifting of the shareholding base from the USA to Mauritius solely with the aim of claiming DTAA benefits.

Basis the same, the Tax Tribunal concluded it is necessary to 'look through' the scheme in light of relevant provisions of the Companies Act, 1956 and the Act to analyze the tax implications.

Purchase of own shares under Section 391 of the Companies Act, whether a buy-back or capital reduction or none?

Taxpayers contentions

The taxpayer claimed that Section 230(1) of the Companies Act, 2013, notified w.e.f. 15 December 2016, specified that a company cannot buy-back/purchase of its own shares under a 'Scheme of Arrangement & Compromise' unless the buy-back/purchase of its own shares is in accordance with Section 68 of the Companies Act, 2013 (corresponding to Section 77A of the Companies Act, 1956).

Therefore, from the aforesaid, it follows that prior to 15 December 2016, there was no restriction on the powers of the Hon'ble High Court to sanction a scheme of arrangement for the purchase of its own shares under Section 391 of the Companies Act, 1956, independent and de horse of Section 77 of the Companies Act, 1956.

It was further argued that the scheme of arrangement for the purchase of shares cannot be said to be a scheme for the reduction of capital under Section 100- 104/402 of the Companies Act. It emphasized that a consequent reduction of capital cannot be said to be a causa causansor (proximate/direct cause) of the payment to the shareholder, but causa sine qua non since the extinguishment/cancellation of shares is a consequence of the purchase of own shares. Thus, the reduction of capital and the purchase of one's own shares are distinct and separate legal concepts and cannot be construed as being synonymous with one another.

Tax Tribunal's observations and conclusion

The Tax Tribunal ruled that there cannot be a buyback of its own kind that is possible under Section 391-393 de hors reference to any other provision of the Companies Act, 1956.

Reference was drawn from the Bombay High Court's decision in the case of Capgemini India Private Limited2 wherein it was held that the company may either follow procedure under Section 391 r.w.s 100-104 of the Companies Act or procedure under Section 77A of the Companies Act.

The Tax Tribunal further observed that provisions of Section 391-393 of the Companies Act are only a single window through which arrangements are undertaken. However, the purchase of own shares will still have to relate back to either Section 77A or Section 77 r.w.s 100-104 of the Companies Act. Since the scheme itself says that it is not a buy-back and given that the conditions under Section 77A are not satisfied (the 25% threshold cap provided by the section was exceeded), hence, it should automatically fall back under Section 391-393 r.w.s. 100 to 104 of the Companies Act and was a capital reduction.

Applicability of section 46A on purchase of shares up to 31 May 2016 and section 115QA post 1 June 2016

Taxpayers contentions

The taxpayer contended that Section 46A applies to all kinds of buy-back/purchase of own shares by the company from its shareholders. The reference to Section 77A of the Companies Act, in the explanation to Section 46A is in the context of qualifying the specified securities (other than shares buyback, which would be taxable under that Section).

For ease of understanding, the relevant extract of Section 46A is reproduced below:

"Capital gains on purchase by company of its own shares or other specified securities.

46A. Where a shareholder or a holder of other specified securities receives any consideration from any company for purchase of its own shares or other specified securities held by such shareholder .......

Explanation: For the purposes of this section, "specified securities" shall have the meaning assigned to it in Explanation to Section 77A of the Companies Act, 1956 (1 of 1956).

... (Emphasis Supplied)

The taxpayer also placed reliance on Circular No. 779, dated 14 September 1999 of CBDT, which clarified that consideration received on the buy-back of shares between the period 1 April 2000 till 31 May 2013 would be taxed as capital gains in the hands of the recipient in accordance with Section 46A of the Act and no such amount shall be treated as a dividend in view of provisions of Section 2(22)(iv).

Furthermore, the taxpayer submitted that the purchase of own shares amounts to buyback but not under Section 77A of the Companies Act. It is a buy-back that is facilitated through Section 391-393 and, therefore, can only be taxed under the amended provisions of Section 115-QA w.e.f 1 June 2016 and not prior to the amendment3.

Thus, as per the taxpayer, purchase of own shares up to 31 May 2016 is taxable only in the hands of shareholders under Section 46A of the Act.

Tax Department's contention

It was a contention of the tax authorities that Sec.46A of the Act is only applicable to buyback u/s.77A of the Companies Act. and not to any other forms of purchase of shares. This was on the premise that the insertion of Section 46A was contemporaneous to the amendment in Section 2(22) for excluding buy-back under Section 77A of the Companies Act. from the ambit of dividends.

Purchase of own shares would be taxable under Section 115-O of the Act as only buy-back under Section 77A is excluded in the proviso to Section 2(22), and any other form of buy-back would qualify as a dividend under Section 2(22) as it entails the release of assets, reduction of capital and distribution of accumulated profits.

Furthermore, the amendment to Section 115QA was brought in to clarify that the provisions would apply to the buyback of shares under Section 77A as well as to the buyback of shares under Section 391-393 of the Companies Act. It was argued that an amendment could also be brought in to shift tax incidence from one provision to another. If all conditions of Section 115-O r.w.s.2(22) are satisfied, the same cannot be impliedly excluded based on the amendment to Section 115QA. Also, Section 115-O contains a non-obstante clause, which would override Section 46A.

Tax Tribunal's observations

The ITAT upheld the tax department's contentions and held that Section 46A is only applicable for buyback undertaken under Section 77A of the Companies Act. It further upheld that Section 115-O has an overriding effect, and the company was liable to dividend distribution tax.

Conflicting view in different taxpayers

Taxpayers contentions

In the case of Genpact v. DCIT4 , an identical transaction is taxed under Section 115QA.

Reliance was placed on the ruling of Berger Paints India Ltd. vs. CIT,5 wherein the Apex Court held that it was not open to the Revenue to adopt conflicting/contrary views in the hands of the different taxpayers.

ITAT's observation and conclusion

The facts will be different in all schemes. Therefore, it cannot be said that all schemes of purchase of its own shares in terms of Section 391-393 are similar to the facts of Genpact.

There is no estoppel against the law. Even if the AO takes a different view in one case upon incorrect appraisal of facts, it cannot disentitle the other AO to take another view upon appraisal of facts when it comes to the knowledge of the AO that the scheme will attract some other provisions of the Act.

Distribution under Section 2(22)(a)/2(22)(d) of the Act should be without quid pro quo

Taxpayers contentions

According to the taxpayer, Section 2(22)(a)/2(22)(d) of the Act requires distribution, which would only imply distribution without any quid pro quo. Since, the scheme of purchase of own shares is made through offer and acceptance and therefore, this involves an element of quid pro quo, and therefore, there is no 'distribution'.

It was also argued that in the present case, the reduction of capital was only a consequence of the scheme owing to the stipulation under Section 77 that the company cannot purchase its own shares. There has been no distribution on the reduction of share capital.

Tax Tribunal's observations

Distribution means actual division/payment between/to several people6. The definition does not contain any aspect of quid pro quo or lack thereof. Thus, it is observed that the taxpayer is trying to add to the ordinary meaning of the word distribution by adding conditions that do not otherwise exist.

Furthermore, the Tax Tribunal clarified the definition of dividend under Section 2(22) is an inclusive definition. The intent is to cover all scenarios whereby a company distributes its accumulated profits without strictly coming within the term 'dividend' as understood in common commercial parlance.

It further clarified that the key essentials to attract the provisions of Section 2(22)(d) are that there must be a reduction of share capital and distribution of accumulated profits to the shareholders. The section does not make any distinction as to whether capital reduction is the intended result or the resultant consequence of the scheme. Such hyper-technical reading would be contrary to legislative intent.

The scheme provided that the paid-up share capital was to be adjusted to the extent of the face value of equity shares purchased by the company, and the difference between the face value and the consideration paid was to be first paid out of the General Reserve and balanced out of accumulated profits. Based on the same, the ITAT held that it was clear that there was a distribution out of the accumulated profit of the company to its shareholders.

The ITAT further categorically ruled that in any event, assuming without conceding, that it cannot be treated as distribution on reduction of share capital, then it will automatically fall within the ambit of Section 2(22)(a) as there is a distribution of accumulated profits entailing release of assets to the shareholders.

The scheme sanctioned by the High Court is binding on the revenue

Taxpayers contentions

Revenue cannot re-characterize the scheme as there is immunity provided from Section 115-O, 2(22) and 115QA of the Act in the scheme document.

Tax Tribunal's observations

The scheme document clearly provides that the sanction shall not grant immunity to the assessee from payment of taxes under any law for the time being in force.

The role of the High Court approving the scheme is limited to making sure that the scheme is fair and reasonable and that there are no illegalities.

Revenue is not re-characterizing the scheme. AO is fully empowered to analyze the effects of the scheme and to determine whether they attract provisions of the Act7

If the assessee's argument is accepted, it would be as good as rendering all other authorities powerless even if the law permits them to look into the transaction in accordance with relevant provisions.

ITAT held that the purchase of own shares by the assessee under Section 391-393 of the Companies Act amounts to the distribution of accumulated profits under Section 2(22)(d) and alternatively under Section 2(22)(a) of the Act and hence subject to DDT under Section 115-O.

Nexdigm Views

This ruling is likely to have a significant impact on the M&A transactions, especially considering the manner in which judicial GAAR has been invoked by the tax authorities and the Tribunal upholding the powers of AO to adopt a 'look through' approach.

On a technical front, the ITAT has upheld the recharacterization of the transaction as 'capital reduction' based on the fact that the scheme itself provided that the purchase of own shares shall not be regarded as buy-back and that the scheme resulted in the purchase of 54.7% of shares (which was beyond the 25% threshold prescribed for buy-back under Companies Act).

However, it is pertinent to note that the scheme also provided that the same shall not amount to a reduction of capital. Hence, it will be interesting to wait and watch how the High Court views the said transaction, especially under the lens of the Companies Act to determine the power of the High Court to sanction a scheme of arrangement for the purchase of its own shares under Section 391 of the Companies Act, independent and de horse Section 77 and Section 100 to 104 of the Companies Act, especially prior to 15 December 2016. And if so, can the same be covered by provisions of Section 46A of the Act, as the said section is of wide import to include all types of buy-back/purchase of shares by the company from its shareholders.

Footnotes

1. ITA No.269/Chny/2022

2. Company Scheme Petition No. 434 of 2014

3. Up to 31.05.2016, additional tax u/s 115QA was applicable only for purchase of own shares u/s. 77A of the Co. Act. W.e.f. 01.06.2016, the provision was amended to include purchase / buy-back of shares by a company from its shareholders under any applicable provisions of the Co. Act.

4. 419 ITR 440 (SC)

5. 266 ITR 99 (SC)

6. Punjab Distilling Industries Ltd. v. CIT [1965] 57 ITR 1 (SC)

7. Grasim Industries v. DCIT (ITA No.1935/MUM/2020)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.