Transfer Pricing (TP) in India, was first introduced in 2001, in the Income-tax Act 1961 (the Act) and has seen various developments in the past two decades. The TP provisions are based on Article 9 of the Organization for Economic Co-operation and Development Guidelines (OECD) and were introduced to prevent the base erosion of India's tax base. Primarily intra-group cross border transactions were covered under the ambit of TP and later vide amendment in 2014 in the Act, the concept of deeming fiction under Section 92B(2) of the Act was introduced in the Indian TP provisions.

In the era of globalization and increasing trade between countries, many multinational companies, in their normal business operations, interact with their group companies for the purpose of global growth and expansion. With this increase in global presence, MNCs also developed a mechanism whereby the Global customer and vendor contracts were entered or negotiated centrally to ensure better synergies on the transactions and also to negotiate better pricing due to their bargaining power at the group level and secure global business.

In achieving the above objective and avoiding certain TP compliances in countries, certain MNCs started interposing a third party in the inter-company transactions. As a result of which, transactions which were required to be determined to be at arm's length, got excluded from scrutiny. To counter this, the deeming provisions were introduced to cover transactions that are disguised as transactions between independent parties but in substance are influenced by the group entities.

Similar to India, Bangladesh has also introduced the concept of deeming provisions.

What does 'deemed international transaction' (DIT) mean?

While India's TP provisions are largely based on the OECD Guidelines, the concept of DIT is not recognized in the OECD Guidelines.

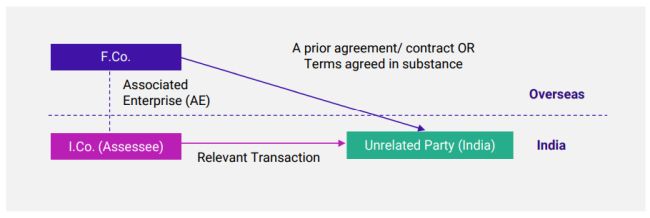

India has specifically defined DIT in Section 92B(2) of the Act as "A transaction entered into by an enterprise with a person other than an associated enterprise shall, be deemed to be an international transaction entered into between two associated enterprises, if there exists a prior agreement in relation to the relevant transaction between such other person and the associated enterprise, or the terms of the relevant transaction are determined in substance between such other person and the associated enterprise where the enterprise or the associated enterprise or both of them are non-residents irrespective of whether such other person is a nonresident or not"

The transactions between two independent entities would come under the purview of DIT if the belowmentioned conditions are satisfied.

- There exists a prior agreement between the AE and unrelated party in respect to the transaction between unrelated party and the assessee in India; OR

- Terms of the transaction for the transaction between the unrelated party and the assessee are determined in substance by the AE

In view of the above, the transactions between assessee and unrelated party in India would come within the purview of the TP laws in India and shall be required to be undertaken having regard to the arm's length standard as required under the Indian TP Regulations.

Unlike in the condition stated in Section 92B(1) of the Act, where either or both the contracting parties should be non-residents in order to constitute the transaction as an international transaction, the provisions of DIT shall apply even if both the transacting parties are resident in India, which was clarified vide amendment in the Finance Act, 20141.

Unlike in the condition stated in Section 92B(1) of the Act, where either or both the contracting parties should be non-residents in order to constitute the transaction as an international transaction, the provisions of DIT shall apply even if both the transacting parties are resident in India, which was clarified vide amendment in the Finance Act, 20141.

Reporting requirements

It is pertinent to note that Section 92B(2) of the Act specifically prescribes that "a transaction entered into by an enterprise with a person other than an associated enterprise shall, for the purpose of sub-section (1), be deemed to be an international transaction.......". Thus, it clearly reflects that the provisions applicable to international transactions covered under Section 92 of the Act would be applicable to such transactions. This would entail reporting of such transactions in the Form 3CEB (under Clause 20) and maintenance of TP documentation to demonstrate that such transactions are undertaken having regard to the arm's length price as required under the Indian TP Regulations for the relevant year under consideration.

While computing the amount of international transactions for the purpose of applicability of Master File provisions, whether DIT would be included in the quantum of international transactions?

As per the Indian TP Regulation, Master File requirement2 (Form 3CEAA- Part A & B) is applicable to the Indian entity that satisfies the following two conditions:

- The consolidated revenue of the group exceeds INR 5 billion for the preceding year; AND

- The value of international transactions of the Indian entity for the reporting period, exceeds INR 0.5 billion OR value of international transactions in respect of intangible property exceeds INR 0.1 billion.

As discussed above, DITs take a flavor of international transactions. Furthermore, the total value of international transactions appear in Form No. 3CEB (which would include the quantum of deemed international transaction). Accordingly, in the absence of specific clarification in relation to the definition of international transaction for the purposes of Master File, a view may be taken to consider the same in the value of international transactions.

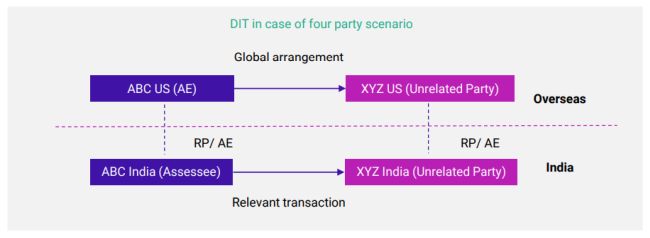

Often, there are situations wherein pursuant to the global arrangements between 2 third parties, actual transactions are undertaken between the counterparts locally in India. Such arrangements require careful examination qua the facts of each situation.

It becomes pivotal to see if the negotiations and arrangements between the overseas entities have any specific reference to the Indian taxpayer wherein the prices and contractual terms are discussed and agreed specifically for the Indian taxpayer and unrelated party in India to evaluate the applicability of DIT. Also, it is pertinent to note that similar to a tri-party arrangement, there is no straight jacket answer for such arrangements for the applicability and each arrangement is required to be evaluated specifically to determine the applicability. A mere referral arrangement with the overseas entity under a four-party scenario may not typically be tantamount to DIT as per the provisions of Indian TP Regulations.

Global price lists

There are various multinational group companies that maintain global price lists, which could be used as a reference for group companies to negotiate the terms and pricing of the contract with independent customers. As highlighted above, it becomes prudent to evaluate the following criteria for evaluating the reporting requirements:

- Whether the global price list has any specific reference for the terms and conditions for the Indian taxpayer or is it applicable to the group as a whole;

- Whether the pricelist provides any price band within which the Indian taxpayer is required to conclude on the prices with the end customers;

- Whether the price list has any specific price being agreed on behalf of the Indian taxpayer; and

- Autonomy available with the Indian taxpayer to negotiate the price and terms of the contract with the customer, etc.

Also, in a scenario of global e-commerce space, where the products are sold at a uniform price globally, can it be said that AE takes the pricing decision and the terms of the contract with the customers are decided by the AE and customer, especially in a scenario when the customer doesn't have an option but to accept to the terms in order to buy a particular product or service on the digital platform. Such scenarios need to be evaluated in detail before coming to a conclusion on whether DIT is applicable or not.

Secondment cases

Seconding employees from overseas to Indian affiliates is a common practice among multinational enterprises in India. To determine whether DIT applies, it's essential to assess the contractual terms between the overseas entity, the Indian company, and the employee, as the broad definition of 'enterprise' encompasses individuals.

Restructuring transactions

Domestic enterprises engage in asset or business transfers, especially during global restructuring or division sales to third-party multinational groups. To assess the applicability of DIT, it's essential to analyze how local transactions are influenced by global arrangements in such cases, even if the terms and pricing are determined locally.

Indian tax authorities' approach

Similar to other TP issues, the DIT also has contrary views and judgments given by various Courts across the country. However, the majority of decisions issued by the Higher Appellate authorities (especially Income Tax Appellate Tribunals (ITAT) have been in the favor of the taxpayers, especially where the tax authorities have alleged the existence of DIT in a third-party scenario.

An illustrative list of the judicial precedents in this regard is as follows:

Gujrat Gas Trading Company Ltd. [I.T.A Nos. 3397, 3069/Ahd/14, 2407, 2340, 2339/Ahd/15, 2028, 1887/Ahd/16,1974 & 2006/Ahd/2017 Dy CIT]

ITAT noted that the AE had no agreement with the unrelated party for the purchase of gas and it has provided only "negotiation services" and thus, the provisions of DIT under Section 92B(2) of the Act would not trigger. Considering the AE would benefit from the long-term contract entered into with the unrelated party, the commission was paid to the AE for availing of negotiation services.

Renault India P. Ltd. [I.T.A No. 1078/Mds/2017]

ITAT holds that the master supply agreement between the assessee and the unrelated party, as well as the master license agreement between AE and the unrelated party, does not show any influence of the AE on the price determination for the supply of cars by the unrelated party to the assessee.

Furthermore, considering the AE had only 30% of the shareholding in the unrelated party, the influence that AE could exert on the unrelated party was not such that it could freely decide on the pricing of the latter's products,' holds that the other shareholder (70%) would not have acceded to such predatory pricing strategy unless it was advantageous to them.

Importance of documentation

Email communications, inter-company agreements, and minutes of the meeting are some of the documents that the assessee can maintain, which would be helpful to demonstrate the extent of involvement and influence of the AE in dealings with unrelated parties. Such documentation shall be maintained on a contemporaneous basis. This would also be more prevalent for cases relating to mergers and acquisitions at the global level wherein the consideration of the taxpayer in India is detrained by way of valuation methodologies for the Indian taxpayer. Appropriate documentation (valuation report, minutes of the Board meetings and key discussions, etc.) shall be maintained in this regard.

Unlike related party transactions, where there is a head start in terms of related party transactions disclosure in the financial statements, DITs are not specifically reported on the financial statements. The taxpayer needs to exercise due diligence to identify, evaluate and report such transactions in bonafide belief. The ICAI Guidance Note, 2020, issued by the Institute of Chartered Accountants of India (ICAI), also states that the primary responsibility of identification/analyzing DIT rests with the assessee.

Conclusion

The concept of DITs plays a crucial role in Indian TP Regulations. As our discussion has shown, DITs can encompass a wide range of transactions, from the secondment of employees to dealings with global clients and even domestic asset transfers influenced by global restructuring. The complexity lies in the need for a case-by-case assessment, as the specific circumstances and contractual arrangements greatly impact whether DIT provisions apply.

Navigating the intricacies of DITs requires a comprehensive understanding of both local and international tax regulations, as well as a keen awareness of the global context in which these transactions occur. Tax authorities and MNEs alike must engage in careful scrutiny to ensure that these provisions are appropriately applied, avoiding potential disputes and ensuring a fair allocation of profits.

As the business landscape continues to evolve, the interpretation and application of DITs will remain a dynamic and evolving area within TP. Therefore, professionals, policymakers, and enterprises must remain vigilant, staying up to date with best practices to ensure compliance and promote transparency in the ever-shifting world of international business transactions.

Footnotes

1. Section 92B(2) of the Act

2. Sec 92D of the Act and Rule 10DA of the Rules

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.