Impact of increase in withholding tax on rates for Fees for Technical Services and Royalty

As per Indian Tax laws1, payments made to Non-Residents/Foreign Companies for Fees for Technical Services (FTS) and Royalties were liable to tax at the effective tax rate of 10.92% (including surcharge and education cess).

Further, Indian Tax Laws2 also provide that where India has entered into a Double Tax Avoidance Agreement (DTAA) with other countries, provisions of the DTAA or Act, whichever is beneficial shall apply.

Currently, many Tax Treaties signed by India with major countries like the United States of America, the United Kingdom, etc., prescribe a higher tax rate of 15% for Royalty and FTS. Further, many other Treaties with countries like Germany, Japan, Singapore, France, etc, provide for a tax rate of 10%.

Relaxation from filing of tax return in India

Indian local laws provide for relief from the filing of the tax return in India for foreign companies/non-residents if the following conditions are satisfied:

- income earned only from dividends, interest, royalties, or fees for technical services, and

- the tax is deducted as per the local laws of India.

Based on the above, non-residents from countries where the tax rate was 15% were opting to be governed by local Indian laws. Also, for non-residents in the case of countries where the tax rate was 10%, where opting to be governed by Indian local laws as it provided relaxation from filing a tax return in India as the differential cost was only 0.92% (10.92% v 10%).

Recent Amendment under Indian Local Laws

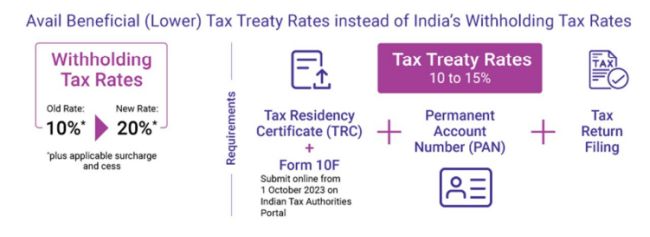

India has recently amended its local laws. One of the critical changes included increase in effective tax rate on Royalty and FTS from 10.92% to 21.84% (including applicable surcharge and cess) with effect from 1 April 2023.

Through this move, the non-residents/foreign companies will be compelled to avail of the tax treaty benefits, as the treaty rates would now be more beneficial in comparison to the earlier scenario.

Typically, to avail of Tax Treaty Benefits, Indian law requires the Non-Resident/Foreign Company to submit a Tax Residency Certificate (TRC) and other declarations. However, where the TRC does not contain all the details as required by Indian Laws, an additional form known as Form 10F is required to be submitted along with the TRC.

It would also be pertinent to note that recently, the Central Board of Direct Taxes (CBDT) in India has mandated electronic filing of Form 10F by non-residents, as applicable. The CBDT had also provided temporary relief for non-residents not having a Permanent Account Number (PAN) (i.e., Indian Tax Registration Number) in India to furnish Form 10F manually but only till 31 March 2023 (now extended till 30 September 2023).

Given the same, for Non-Residents/Foreign Companies it becomes critical to submit all the relevant documents including Form 10F, in the electronic form to avail of the beneficial tax rates under the Tax Treaty.

In order to submit Form 10F electronically, an online account on the Government portal has to be created, which requires a PAN. These changes would indirectly force all Non-residents looking to avail tax treaty benefits to obtain a PAN and submit requisite documents.

In addition to the above, as per Indian Tax Laws3, every company is required to file a tax return in India. From a Foreign Company perspective, logically it can be interpreted that every company earning income from India should be liable to file a tax return in India.

Accordingly, once the Foreign Companies have a PAN in India and is earning income from India/availing Tax Treaty benefits, they would be obliged to file a tax return in India. Further, the exemption provided for filing tax returns would no longer be available as the taxes would have been withheld as per the Tax Treaty and not as per local laws of India. Also, in the case of related party transactions, transfer pricing compliances would also have to be carried out in India.

Way forward

Foreign Companies/Non-Resident earning income from India would have to evaluate the tax impact in India on account of the amendments in India. Also, companies would have to analyze the eligibility to avail of Tax Treaty benefits which would include looking through the beneficial ownership test, substance test, etc. Once the eligibility is clear, they will have to ensure that appropriate registration is obtained in India and all the compliances are carried out in India.

Footnotes

1. Section 115A of the Income Tax Act, 1961

2. Section 90(2) of the Income Tax Act, 1961

3. Section 139 of the Income Tax Act, 1961

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.