Review of the Policy on Foreign Direct Investment in the Civil Aviation Sector

The Ministry of Commerce and Industry, Department of Industrial Policy and Promotion (DIPP) vide Press Note No. 6 (2012 Series) dated September 20, 2012 has changed the position with respect to foreign airlines investing in Indian companies, operating scheduled and nonscheduled air transport services.

Para 6.2.9.3 of Circular 1 of 2012- Consolidated FDI Policy' (FDI Policy), relating to air transport services has been reviewed and subsequently amended. The Government of India has decided to permit foreign airlines to invest, in the capital of Indian companies, operating scheduled and nonscheduled air transport services, up to the limit of 49% of their paid-up capital.

Investments by foreign airlines in the capital of Indian companies, operating scheduled and nonscheduled air transport services will be subject to the following conditions:

(i) All investments will be made under the government approval route.

(ii) The 49% limit will subsume FDI and FII investment.

(iii) The investments so made will need to comply with the relevant regulations of the Securities and Exchange Board of India (SEBI), such as the Issue of Capital and Disclosure Requirements Regulations and the Substantial Acquisition of Shares and Takeovers Regulations, as well as other applicable rules and regulations.

(iv) A 'Scheduled Operator's Permit' can only be granted to a company: (a) that is registered and has its principal place of business within India; (b) whose chairman and at least twothirds of its directors are citizens of India; and

(c) whose substantial ownership and effective control is vested in Indian nationals.

(v) All foreign nationals likely to be associated with Indian scheduled and non-scheduled air transport services as a result of such investment must be cleared from a security view point before deployment.

(vi) All technical equipment that might be imported into India as a result of such investment will require clearance by the relevant authority of the Ministry of Civil Aviation.

Nothing contained in the revised policy is applicable to Air India.

Prior to the said Press Note taking effect, the Government of India had, with an exception to cargo airlines, placed a complete restriction on foreign airlines participating directly or indirectly in the equity of an air transport engaged in operating scheduled and non-scheduled air transport services.

Review of the Policy on Foreign Investment in Companies Operating in the Broadcasting Sector

The DIPP vide Press Note No. 7 (2012 Series) dated September 20, 2012 has reviewed the extant policy with respect to the foreign investment limits in companies operating in the Broadcasting Sector and has decided to amend it.

The Government of India's revised policy, subject to such terms and conditions, as may be specified by the Ministry of Information and Broadcasting from time to time, is given below:

(i) Foreign investment in: (a) Teleports (setting up up-linking HUBs/Teleports); (b) Direct to Home; and (c)Cable Networks (MSOs operating at National or State or District level and undertaking up gradation of networks towards digitalization and addressability) has been increased from 49% to 74%, provided that:

(a) foreign investment up to 49% will be permitted under the automatic route; and

(b) foreign investment beyond 49% and up to 74% will only be permitted under the government approval route.

(ii) Foreign investment in Mobile TV has been permitted, provided that:

(a) foreign investment up to 49% will be permitted under the automatic route; and

(b) foreign investment beyond 49% and up to 74% will only be permitted under the government approval route.

The foreign investment limit, in companies engaged in the afore stated activities of information and broadcasting, will include in addition to FDI, investment by Foreign Institutional Investors, Non-Resident Indians, and investments through Foreign Currency Convertible Bonds, American Depository Receipts, Global Depository Receipts and convertible preference shares held by foreign entities.

The terms and conditions relating to security and other conditions, have been separately incorporated in the sectoral guidelines of each broadcasting carriage service.

Policy on Foreign Investment in Power Exchanges

The DIPP vide Press Note No. 8 (2012 Series) dated, September 20, 2012 has reviewed and amended the policy on foreign investment in Power Exchanges.

The Government of India has decided to permit foreign investment, up to 49% in Power Exchanges, registered under the Central Electricity Regulatory Commission (Power Market) Regulations, 2010, subject to the conditions specified below:

(i) Such foreign investment will be subject to an FDI limit of 26% and an FII limit of 23% of the paid up capital.

(ii) FII investments will be permitted under the automatic route and FDI will be permitted under the government approval route.

(iii) FII purchases will be restricted to the secondary market only;

(iv) No non-resident investor/ entity, including persons acting in concert, will hold more than 5% of the equity in these companies.

(v) All foreign investment will be in compliance with SEBI regulations; other applicable laws/ regulations; security and other conditions.

Prior to the amendment, FDI, up to 100%, under the automatic route was permitted in the power sector (except atomic energy). 'Power sector' included generation, transmission and distribution of electricity, as well as power trading, subject to the provisions of the Electricity Act, 2003

Policy on setting up of step down (operating) subsidiaries by NBFCs having foreign investment above 75% and below 100%

The DIPP vide Press Note No. 9 (2012 Series) dated October 3, 2012 has reviewed the policy with respect to setting up of step down subsidiaries by NBFCs,

The Government of India has decided to permit NBFCs which have (a) foreign investment above 75% and below 100% and (b) with minimum capitalization of USD 50 million, to set up step down subsidiaries for specific NBFC activities, without any restriction on the number of operating subsidiaries and without bringing in additional capital. Further, the minimum capitalization condition as set out in Para 3.10.4.1. of the FDI Policy will not apply to downstream investments.

Prior to the aforementioned Press Note, NBFCs having 100% foreign ownership with minimum capitalization of USD 50 million, could set up step down subsidiaries for specific NBFC activities, without any restriction on the number of operating subsidiaries and without bringing in additional capital.

External Commercial Borrowing Policy – Repayment of Rupee Loans and/or Fresh Rupee Capital Expenditure – USD 10 Billion Scheme

The Reserve Bank of India (RBI) in circular A.P. (DIR Series) Circular No. 26 dated September 11, 2012 noted that as per the extant guidelines, the maximum permissible External Commercial Borrowing (ECB) that can be availed of by any individual company under the scheme mentioned in A.P. (DIR Series) Circular No. 134 dated June 25, 2012 (Scheme) is limited to 50% of the average annual export earning realized during the past three years.

Upon a review of the extant guidelines the RBI vide the said circular has decided:

(i) to enhance the maximum permissible limit of ECB that can be availed of to 75% of the average foreign exchange earnings realized during the immediate past 3 financial years or 50% of the highest foreign exchange earnings realized in any of the immediate past 3 financial years, whichever is higher;

(ii) that in cases of Special Purpose Vehicles, which have completed at least 1 year of existence from the date of incorporation and do not have a sufficient track record/ past performance for 3 financial years, the maximum permissible ECB that can be availed of will be limited to 50% of the annual export earnings realized during the past financial year; and

(iii) that the maximum ECB that can be availed by an individual company or group, as a whole, under this scheme will be restricted to USD 3 billion.

All other aspects of will remain unchanged.

ECB Policy – Bridge Finance for Infrastructure Sector

The RBI has vide circular A.P. (DIR Series) Circular No. 27 dated September 11, 2012 decided to allow refinancing of bridge finance (if in the nature of buyers'/suppliers' credit) availed of, with an ECB under the automatic route subject to the following conditions:-

(i) the buyers'/suppliers' credit is refinanced through an ECB before maximum permissible period of trade credit;

(ii) the AD Bank evidences the import of capital goods by verifying the Bill of Entry;

(iii) the buyers'/ suppliers' credit availed of its compliant with the extant policy on imports; and

(iv) the proposed ECB is compliant with all the other extant guidelines relating to availing of ECB.

The borrowers will, therefore, approach the RBI under the approval route only at the time of availing of bridge finance which will be examined subject to the following conditions:

(i) the bridge finance will be replaced with all the extant ECB Norms; and

(ii) the bridge finance shall be replaced with all the extant ECB norms.

The designated AD – Category I bank shall monitor the end-use of funds and banks in India will not be permitted to provide any form of guarantees for the ECB.

All other conditions of ECB policy will remain unchanged and should be complied with, The amended ECB policy will come into force with immediate effect and is subject to review.

Trade Credits for Imports into India

The RBI has vide circular A.P. (DIR Series) Circular No 28 dated September 11, 2012 decided to allow companies in the infrastructure sector, where "infrastructure" is as defined under the extant guidelines on ECB to avail trade credits up to a maximum period of 5 years for import of capital goods as classified by DGFT subject to the following conditions : -

(i) the trade credit must be ab initio contracted for a period not less than 15 months and should not be in the nature of short-term roll over; and

(ii) AD banks are not permitted to issue letters of Credit/ guarantees/ Letter of Undertaking (LoU) / Letter of Comfort (LoC) in favor of overseas supplier, bank and financial institution for the extended period beyond 3 years.

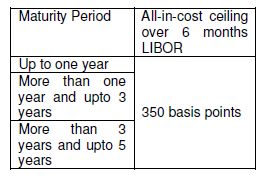

The all-in-cost ceiling of trade credit will be as under:

The all-in-cost include arranger fee, upfront fee, management fee handling/processing charges, out of pocket and legal expenses, if any.

All other aspects of Trade Credit policy will remain unchanged and should be complied with. The amended trade credit policy will come into force with immediate effect and is subject to review based on the experience gained in this regard.

Overseas Direct Investment by Indian Party – Rationalization

The RBI has vide circular A.P. (DIR Series) Circular No 29 dated September 12, 2012 amended the guidelines of Annual Performance Report (APR).

Pursuant to this circular, an Indian party, which has set up / acquired a Joint Venture (JV) or Wholly Owned Subsidiary (WOS) overseas in terms of the Foreign Exchange Management (Transfer or Issue of any Foreign Security) Regulations, 2004 is required to submit, to the designated Authorized Dealer every year, the APR in form ODI Part III in respect of each JV or WOS outside India and other reports or documents as may be specified by the Reserve Bank from time to time, on or before June 30th of each year.

The APR, so required to be submitted, has to be based on the latest audited annual accounts of the JV/WOS, unless specifically exempted from the Reserve Bank.

The exemption granted for submission of APR based on the un-audited accounts of the JV / WOS will be subject to the terms and conditions as specified in the A.P. (DIR Series) Circular No. 96 dated March 28, 2012 shall continue.

Foreign Investment in Single-Brand Product Retail Trading / Multi-Brand Retail Trading / Civil Aviation Sector / Broadcasting Sector / Power Exchanges – Amendment to the Foreign Direct Investment Scheme

The RBI has vide A.P. (DIR Series) Circular No. 32 dated September 21, 2012 reviewed the extant Foreign Direct Investment Policy and has decided as follows:

(i) FDI up to 100% is now permitted in Single-Brand Product Retail Trading by only one non-resident entity, whether owner of the brand or otherwise, under the Government route subject to the terms and conditions as stipulated in Press Note No. 4 (2012 Series) dated September 20, 2012 issued by DIPP.

(ii) FDI up to 51% is permitted in Multi-Brand Retail Trading under the Government route, subject to the terms and conditions as stipulated in Press Note No. 5 (2012 Series) dated September 20, 2012 issued by DIPP.

(iii) Foreign Airlines are permitted FDI up to 49% in the capital of Indian companies in Civil Aviation Sector, operating scheduled and non-scheduled air transport, under the automatic/Government route subject to the terms and conditions as stipulated in Press Note No. 6 (2012 Series) dated September 20, 2012 issued by DIPP.

(iv) FDI limits in companies engaged in providing Broadcasting Carriage Services under the automatic/ Government route have been reviewed and the same would be subject to the terms and conditions as stipulated in Press Note No. 7 (2012 Series) dated September 20, 2012 issued by DIPP.

(vi) FDI up to 49% is permitted in Power Exchanges registered under the Central Electricity Regulatory Commission (Power Market) Regulations, 2010, under the Government route, subject to the terms and conditions as stipulated in Press Note No. 8 (2012 Series) dated September 20, 2012 issued by DIPP.

Establishment of Liaison Office/ Branch Office/ Project Office in India by Foreign Entities – Clarification

The RBI has vide circular A.P. (DIR Series) Circular No. 31 dated September 17, 2012 clarified that establishment of office in India by foreign Non-Government Organizations/Non- Profit Organizations/ Foreign Government Bodies/ Departments, are under the Government Route as specified in A.R. (DIR Series) Circular No. 23 dated December 30, 2009.

Accordingly, such entities are required to apply to RBI for prior permission to establish an office in India, whether Project office or otherwise.

Establishment of Liaison office/ Branch Office / Project Offices in Indian by Foreign Entities – Reporting requirement

The RBI has vide circular A.P. (DIR Series) Circular No. 35 dated September 25, 2012 decided that in addition to the existing reporting requirements, all new entities setting up Liaison Office (LO)/ Branch Office (BO)/ Project Offices (PO) need to :

(i) submit a report containing information (as set out in the annexure of this circular) within 5 working days of the LO/BO/ PO becoming functional to the DGP of the state in which LO/BO/PO has established its office; if there is more than one office of such entity, in such cases to each of the DGP of the state where it has established office in India;

(ii) A copy of the report shall also be filed with the concerned DGP on annual basis along with a copy of the Annual Activity Certificate/ Annual report required to be submitted by LO/BO/PO, as the case may be.

(iii) A copy of the report filed as above shall also be filed with AD Bank by LO/BO/PO concerned. (iv) Existing LO/BO/PO shall henceforth report the information along with the copy of Annual Activity Certificate/ Annual report to DGP of the concerned state and also file a copy of the same with AD Bank.

The aforementioned instructions will come into force with immediate effect.

Foreign Direct Investment in India – Allotment of Shares to person resident outside India under Memorandum of Association of an Indian Company – Pricing guidelines

In terms of sub-regulation (1) of Regulation 5 of Notification No. FEMA 20/ 2000 – RB dated May 3, 2000, a person resident outside India or an entity incorporated outside India may purchase shares or convertible debentures of an Indian company under FDI Scheme, subject to compliance with the extant pricing guidelines

The RBI has vide circular A.P. (DIR Series) Circular No. 36 on September 26, 2012 stated that in cases, where non-residents (including NRIs) make investment in an Indian company in compliance with the provisions of the Companies Act, 1956, by way of subscription to the Memorandum of Association of the Indian company, such investments may be made at face value subject to their eligibility to invest under the FDI policy.

Filing of Balance Sheet and profit and loss Account by Companies in Non-XBRL for the accounting year commencing on or after April 1, 2011

The Ministry of Corporate Affairs (MCA) has vide general circular No. 30/2012 dated September 28, 2012 extended the due date of filing e-forms 23AC (Non-XBRL) or 23AC (Non-XBRL) as per new schedule VI in the following manner without the payment of any additional fees:-

(i) Companies that have held their Annual General Meeting on or before September 20, 2012, the time limit for filing Form 23AC and Form 23ACA will be November 3, 2012 or due date of filing, whichever is later.

(ii) Companies that have held their AGM or whose due date for holding AGM is on or after September 20, 2012, the time limit for filing Form 23AC and Form 23ACA will be November 22, 2012 or due date of filing, whichever is later.

Filing of form 23B by Statutory Auditor for the accounting year 2012-13

The MCA has vide general circular No. 31/2012 dated September 28, 2012 extended the date for filing of e-form 23B without any additional fees till December 23, 2012 or due date of filing, whichever is later.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.