- Payments for web-hosting services are in the nature of business income.

- Payments do not constitute royalties for "use of industrial, commercial or scientific equipment".

- No withholding tax applicable.

Recently, the Pune Bench of the Income Appellate Tax Tribunal ("Tribunal") ruled that payments ("Payments") for web hosting services ("Services") are not in the nature of royalties. The Tribunal held that the Payments are is in the nature of business income and in the absence of a permanent establishment ("PE") of the non-resident payee in India, the Payments would not be subject to a withholding tax in India.

Background

The payee, Amazon Web Services LLC ("AWS") is a company incorporated in the USA and is a subsidiary of Seattle headquartered Amazon.com Inc. It provides on-demand cloud computing services to individuals, companies and governments, on a paid subscription basis. The payer, EPRSS Prepaid Recharge Services India Private Limited ("ESIPL" or the "Taxpayer") is a company incorporated in India and is a distributor of online recharge solutions for mobile phones, dish-to-home connections etc.

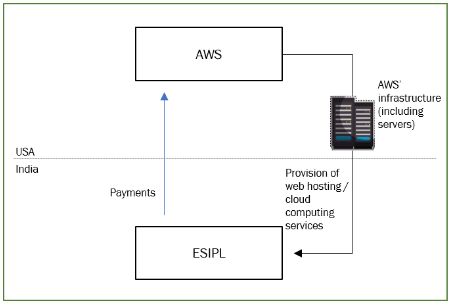

ESIPL uses servers to provide its online recharge solutions. Due to the prohibitive costs of purchase/maintenance of servers on its own account, ESIPL entered into an agreement (the "Agreement") with AWS for the provision of the Services (involving the use of AWS' servers). Believing that the Payments for the Services constituted neither royalties nor fees for technical services ("FTS"), ESIPL did not withhold tax. The arrangement between AWS and ESIPL is set out in the diagram below.

On the basis that the Agreement granted ESIPL a limited license to use and access the Services, the AO concluded that the Payments were for the "use or right to use any industrial, commercial or scientific equipment ("ICS Equipment") i.e., AWS' servers, constituted royalties under Explanation 2 ("Explanation 2") to section 9(1)(vi) of the Income Tax Act, 1961 ("ITA")1, were taxable in India, and ESIPL should therefore have withheld on the Payments. The AO relied on Explanation 5 ("Explanation 5") to section 9(1)(vi) of the ITA2 to depart from established precedents requiring use of ICS Equipment to involve control, possession or physical access to the ICS Equipment.

Due to ESIPL's failure to withhold tax, the Payments were disallowed (under section 40(a)(i)3 of the ITA) as deductions from the Taxpayer's taxable income. On appeal by the Taxpayer, the Commissioner of Income Tax (Appeals) upheld the order of AO. Aggrieved, the Taxpayer appealed to the Tribunal.

The Agreement

Key extracts are set out below.

8. Proprietary Rights

8.3. Service Offerings. We or our licensors own all right, title, and interest in and to the Service Offerings, and all related technology and intellectual property rights. Subject to the terms of this Agreement, we grant you a limited, revocable, non-exclusive, non-sublicensable, non-transferrable license to do the following: (a) access and use the Services solely in accordance with this Agreement; and (b) copy and use the AWS Content solely in connection with your permitted use of the Services. Except as provided in this Section 8.3, you obtain no rights under this Agreement from us, our affiliates or our licensors to the Service Offerings, including any related intellectual property rights. (Emphasis supplied)

14. Definitions.

"AWS Content" means Content we or any of our affiliates make available in connection with the Services or on the AWS Site to allow access to and use of the Services, including APIs; WSDLs; Documentation; sample code; software libraries; command line tools; proofs of concept; templates; and other related technology (including any of the foregoing that are provided by our personnel). AWS Content does not include the Services or Third-Party Content.

"AWS Marks" means any trademarks, service marks, service or trade names, logos, and other designations of AWS and its affiliates that we may make available to you in connection with this Agreement.

"Service Offerings" means the Services (including associated APIs), the AWS Content, the AWS Marks, and any other product or service provided by us under this Agreement. Service Offerings do not include Third-Party Content.y

Issues

- Whether the Payments should be characterized as business income or royalties.

- Whether tax should have been withheld on the Payments made to AWS for the Services.

Tribunal's Ruling

The Tribunal addressed the following points in its ruling:

- Receipt of the Services did

not involve the Use of ICS Equipment. The Tribunal

followed past precedents4 to hold that

payments for web-hosting services would not amount to payments for

"use of ICS Equipment".

The Tribunal interpreted the phrase "use of ICS Equipment" as used in the US Treaty definition of royalty to mean that possession and control of the equipment (in this case, AWS's servers) should vest with the payer (in this case, ESIPL). On that interpretation ESIPL could not be said to have paid royalties to AWS since it did not possess or control AWS' servers, and consequently, the Payments would not be taxable. - Withholding Tax Obligation cannot be imposed Retrospectively. The Tribunal rejected the tax department's argument on retrospective applicability of Explanation 5. Relying on a ruling of the Bombay High Court in NGC Networks5, the Tribunal observed that the law cannot compel a person to do something which he cannot possibly perform and held that the insertion of Explanation 5 with retrospective effect could not impose a withholding tax obligation on the Taxpayer for payments made in years that had already elapsed prior to the insertion.

- Treaty Override. Relying on a ruling of the Delhi High Court in New Skies Satelite BV6, the meaning of royalty (as clarified retrospectively by Explanation 5 would not override the definition of royalties in the US Treaty.

- Manner of Payments. The fact that under Clause 5.1 of the Agreement, the Payments could fluctuate on a monthly basis, also aided the Tribunal in arriving at its conclusion. In the Tribunal's view, payments in the nature of royalty would need to be fixed (at least to some extent).

Based on the above conclusions, the Tribunal concluded that tax was not required to be withheld on the Payments, since they did not constitute royalties. Consequently, disallowance was not warranted.

Analysis

One could say that India began expanding its tax base in 2012, starting with the clarificatory amendments to section 9(1)(vi) by Finance Act, 2012, by virtue of which inter alia the definition of royalty under the ITA was broadened beyond the current internationally accepted definition. Explanation 5, for example, does away with the internationally accepted and judicially recognized7 requirement that 'use' involve control / possession of or physical access to the ICS equipment vest with the user.

The Delhi High Court has8, however, generally rejected arguments that the amended definition of royalties in the ITA overrides the definition of royalties in an existing applicable tax treaty (which is essentially the definition of royalty, without Explanation 5), holding that the domestic law remains static for purposes of terms defined in a tax treaty, and amendments to the domestic laws cannot extend to definitions under a tax treaty. An ultimate decision from the Supreme Court is still awaited.

The Tribunal's follows the Delhi High Court's ruling and gives to the words "use of ICS Equipment" in the US Treaty, the same meaning that courts in India have ascribed to them while interpreting the same words in other tax treaties and the ITA (prior to insertion of Explanation 5) i.e., that there must be control, possession, access or an independent right to use. In the context of cloud computing, and web hosting, these conditions are generally not met.

A control / possession / physical access requirement is very relevant to the question of characterization of payments as royalty for the use or right to use ICS Equipment because absent such requirement, every time a non-resident uses a piece of equipment to render services to a resident, the payment for the same will become taxable as royalty, a thoroughly absurd situation.

A few rulings have also considered and rejected arguments that cloud computing services / web hosting services involve the use of a process9, though whether they would involve the use of copyright in software is still in question10. However, very recently the Bangalore Tribunal in Google11 (although in the context of advertisement fees) concluded that even a limited license could be construed as a royalty payment. In this backdrop, the ruling of the Tribunal is a welcome one, which is reasonable to taxpayers, and conforms to international standards.

Footnotes

1 Section 9(1) of the ITA deems certain incomes to accrue or arise in India (a pre-requisite for such incomes to be chargeable to Indian income-tax, where such incomes have been earned by non-resident taxpayers). Subject to certain exceptions that are not relevant in the present context, Section 9(1)(vi) inter alia deems royalties paid by a resident to accrue or arise in India. Explanation 2 to Section 9(1)(vi) defines "royalty" and clause (iva) of Explanation 2 includes 'consideration paid for the use or right to use ICS equipment' within the scope of the definition of royalty.

2 Explanation 5 to section 9(1)(vi) (inserted by the Finance Act, 2012 with retrospective effect from June 1, 1976), clarifies that royalty includes and has always included consideration in respect of any right, property or information, whether or not -

(a) the possession or control of such right, property or information is with the payer;

(b) such right, property or information is used directly by the payer;

(c) the location of such right, property or information in in India.

3 Section 40(a)(i). Section 40 of the ITA sets out certain expenses that are not deductible from a taxpayer's business income. Section 40(a)(i) provides that any sum (including interest, royalty, fees for technical services), payable (i) outside India or (ii) in India, to a non-resident, that is chargeable to tax under the ITA in the hands of the recipient, shall not be allowed as a deduction while computing the income of the payer if the payer fails to withhold the tax payable on that sum. Section 40(a)(i) imports the definition of 'royalty' from section 9 of the ITA.

4 Savvis Communication Corporation, [2016] 158 ITD 750 (the tax authorities are in appeal against this decision before the Bombay High Court, and the matter is currently at the pre-admission stage).

5 ITA No. 397/2015, judgment dated January 29, 2018 (the tax authorities are in appeal against this decision before the Supreme Court of India and the matter is currently pending).

6 ITA No. 473, 474 & 500 OF 2012 & 244 OF 2014; judgment dated February 8, 2016 (the tax authorities are in appeal against this decision before the Supreme Court of India and the matter is currently pending).

7 Court rulings in Kotak Mahindra, [2007] 11 SOT 578, Savvis Communication Corporation, [2016] 158 ITD 750, Atos Origin IT Services Singapore Pte. Ltd., [2011] 46 SOT 52, Standard Chartered Bank, [2011] 47 SOT 191, Dell International Services Private Limited., In re (305 ITR 37 (AAR)), Bharati Axa General Insurance Co Ltd., In re, [2010] 194 TAXMAN 1 etc., have all upheld a requirement that "use" involve an independent right to use, control, possession or physical access to the. See: Cargo Community Network Pte. Ltd. 289 ITR 355 (AAR), IMT Labs, 287 ITR 450 (AAR) and Poompuhar Shipping Corporation Ltd., [2014] 360 ITR 257, for rulings to the contrary.

8 Supra n.6

9 Under most bilateral tax treaties, the process must be 'secret'. Explanation 6 does away with the requirement that the process be secret, but once again, courts in India have refused to allow a clarification to domestic law to override a treaty.

10 See DIT v. Ericsson AB, [2012] 343 ITR 470 (Delhi); DIT v. Infrasoft Ltd, [2014] 264 CTR 329 (Delhi); See CIT v. Samsung Electronics Co Ltd, [2012] 345 ITR 494 (Karnataka) for ruling to the contrary.

11 [2018] 194 TTJ 385

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.