From being the youngest self-made billionaire to being the CEO of a company hanging on by threads, Elizabeth Holmes had witnessed her rise and fall so transiently that the world over was scandalised. Right from a tender age, the mercenary and determined Holmes had always tried to make money by selling C++ compilers to Chinese schools[1] and thereafter had a vision of creating a technology miniaturizing traditional labs in portable forms to test blood samples, which would change the world to befit the needs of mankind. With a finger prick and a drop of blood, she claimed that the technology ('Edison') which she created at Theranos could carry out 200 types of tests, something which sounded impossible to the world, yet was too utopic to become unrealistic.

To chase her dream of bringing such miniaturized technology into the health care sector, she dropped out of Stanford University at the age of 19 and began working on Theranos mission right from 2003. The company claimed to have performed as many as 70 different tests from a single draw of 25 to 50 microliters collected in a tiny vial the size of an electric fuse, which Holmes had dubbed a "nanotainer." Such a volley of tests with conventional techniques would require numerous tubes of blood, each containing 3,000- to 5,000-microliter samples[2]. To further her goals, she began raising money and by 2005, she raised about $ 6 billion. By 2010, she was able to secure partnerships with Walgreens and Safeway. As a staunch supporter of Steve Jobs, rather than just following his ideals, she began living him right from initial years of Theranos, new partnerships meant Edison should be able to perform more than one class of tests, Theranos developed the minilab, which was a miniscule version of the conventional labs, which was nicknames as "4s" just like the iPhone model. Early 2012, witnessed Theranos taking over a blood testing at Safeway employee health clinic as a beta run. Even after protests from scientists and the world over, Theranos was valued at $9 billion by February, 2014. Shortly after, John Carreyrou – an investigative reporter working for the Wall Street Journal published an article to highlight the company's struggle for blood testing, marking the first downfall of a billion-dollar company that was too determined to bring a change when the gap between the carpeted world and the real world became too narrow to cover.

Shortly, the company's COO, Sunny Balwani was removed and Holmes was the only top executive and by 2017, the world witnessed crashing down of the Silicon Valley Unicorn start-up when Holmes was banned from lab testing industry and settled with the FDA for $30, 000 and was asked not to operate or own a clinical lab till 2019[3]. She had a vision to help the mankind with its miniaturized technology, named the Edison which looked similar in size to bread making machine[4], however the claims she made of her technology fell short of reality, the Edison was capable of performing few tests rather than 200 which she claimed to the world over. Moreover, her finger prick technology had inaccuracies, which unravelled shortly as scientists smelt suspicion in the way Edison worked. With a secretive approach and her tireless determination towards Theranos, she did not go out for vacations, nor took any holidays and when asked about getting married, she would always reply in her pretentious heavy voice, that she was married to Theranos.

Timeline

The following timeline explicates the Theranos' Voyage from being a start up to being a Billion Dollar company and thereafter, being dissolved.

|

Year |

Milestone |

|

2003 |

Holmes Dropped Out of Stanford, Founded Theranos |

|

2004 |

Raised Capital of about $ 6 billion to live her vision |

|

2005 |

Development of Theranos 1.0, a catridge and reader System based on microfluidics and biochemistry |

|

2007 |

Tested Premature Theranos 1.0 on cancer patients, Suing 3 employees for infringement of inteelectual property; Development of a new prototype named Edison. |

|

2010 |

Approaching Walgreens and Safeway for partnership |

|

2011 |

Creation of MiniLab to perform more than one type of tests |

|

2012 |

Surprise checks by CMS; Rising Concerns over Theranos technology |

|

2013 |

Ian Gibbons, chief Scientist at Theranos, committed suicide; Premature Lauching of the 4s model, though many were concerned about the underfunctioning of it. |

|

2014 |

Theranos Valued at $ 9 billion; Holmes had a net worth of almost $5 billion, became the cover for Fortune and Forbes |

|

2015 |

Carreyrou began investing about the Theranos technology; Theranos got its first FDA Approval |

|

2016 |

Regulators found problems with Theranos technology; SEC started investigating into the company; Walgreen ended partnership with Theranos and closed all centres at Arizona and California |

|

2017 |

Made a deal with Fortress Investment Group for $100 million to get it through 2018 |

|

2018 |

SEC charges Theranos, Holmes and Balwani with fraud; Holmes lost control of Theranos, had to return millions of shares; Holmes and Balwani were charged for Massive Fraud with fine and cost of not being a director for 10 years of any publicly traded company; September 2018, Theranos was shut down for good, and Holmes was also charged with 11 criminal offences, including wire fraud and conspiracy |

Patent Analytics

Theranos kept on filing patents on a technology was not at all effectual in delivering results which Holmes claimed to, all kudos to the loopholes in the US Patent system which virally let Holmes take over and lure potential investors into a company built around patents on a hollow technology. It is pretty interesting how such unrealistic inventions did really materialise into actual patents, on brief history of patent applications, one can easily get into the ambiguities in the requirements of the US patent system. An invention has to meet substantive conditions in order to be patent-eligible. One of the conditions is that the invention must be useful (the others are that the invention must be of patent-eligible subject matter, new, and non-obvious).[5] The usefulness requirement is said to be met if the invention has an industrial application or if it provides some benefit to the public[6]. An invention does not need to be the best way to provide the stated benefit, but an invention or technology that does not work is certainly not useful and hence not patent-eligible.

When an inventor files an application for a patent, the Patent Office must presume that the invention works to provide the stated benefit.[7] To reject an application because the invention is inoperable, the Patent Office must provide evidence showing that a person with knowledge in the technical field would reasonably doubt that it works.[8] Thus, if an inventor files an application for an invention that does not yet work, it is quite possible that the Patent Office will not challenge it as inoperable[9]. The utility requirement requires that the invention should work and the enablement requirement, under 35 U.S.C. Section 112, requires that the invention should be described in depth for any person in the field to use and build the same[10], if the applicant can't build it in limited time, the enablement requirement is not satisfied. Though examiners do not have much time to carry out complex experiments to see whether the inventions actually work, yet such grants can prove to be fatal when the USPTO fulfils a fantasy which Holmes had drafted through the first patent application in 2003, when she was 19. This can be illustrated by Richard Fuisz,

Elizabeth's childhood neighbour, getting his patent registered which Carreyrou called as 'Theranos Killer' much before than Theranos could ever patent it, a technology which does blood analysis and transfers the data to physicians. The Patent bargain system that mandates the inventor to sufficiently disclose the invention, enables the public to understand how the invention works, giving the patent holder right to exclusivity[11], however the Theranos case study has proven to be a mockery to this system, where Elizabeth is being so secretive of her technology that even employees have been provided with limited information.

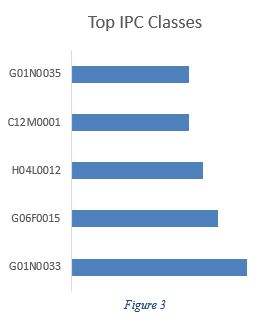

Figure 1

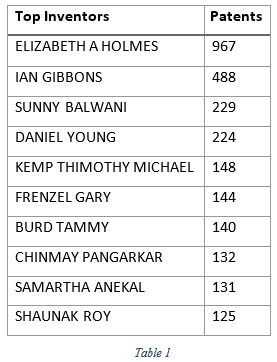

If one looks at the Figure 1, it is pretty clear that most of the priority wise applications were filed by the end of 2013, where the company had almost reached up to $9 billion mark, with its vision to miniaturize the health care technology with about just one droplet of a blood to conduct 70 variants of tests. In 2016, just 2 were filed, as the Wall Street Journal article just made it impossible for Theranos to survive, with a stringent trade secret policy, scientists became suspicious about the automation and miniaturization and the revolutionary technology which can conduct about 70 different tests with just microns of blood samples.

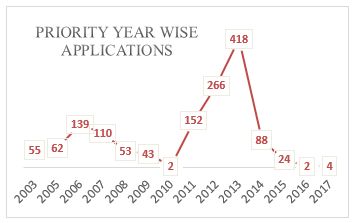

The demise of a $9-billion-dollar company had already begun by 2015, as can be inferred from Figure 2, the highest number of application were filed in the year 2014, where there were high chances of acceptances due to increased goodwill as Elizabeth Holmes bloomed with a net worth of about $5 billion, which diminished gradually from 2015 to just 1 in 2019.

|

IPC Class |

Description |

|

G01N0033 |

Investigating or analysing materials by specific methods |

|

G06F0015 |

Digital computers in general |

|

H04L0012 |

Data switching networks |

|

C12M0001 |

Apparatus for enzymology or microbiology |

|

G01N0035 |

Automatic analysis not limited to methods or materials |

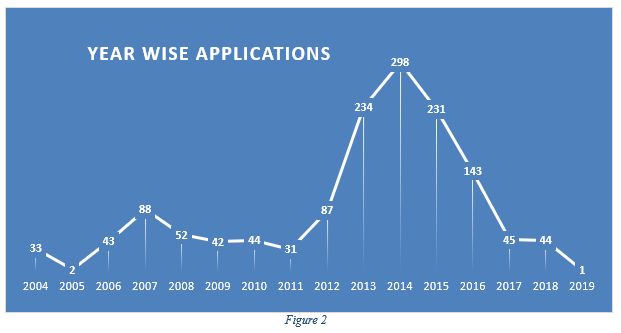

The top IPC classes as depicted by Figure 3 showcase the top technologies covered by Theranos patents. Table 2 gives definitions of the corresponding IPC classes. It shows the broad technologies Theranos tried to protect through its inventions.

The highest number of patent applications have been filed in USA, as it's the home country for Theranos, sufficiently higher number of applications have also been filed in Europe, Australia, Korea, and China as can be seen in Figure 4.

Figure 4

All these figures and tables have depicted that the year for Theranos to bloom was in 2014 wherein it had captured the maximum possible market and its stock prices had shown a remarkable hike. The downfall began from 2016 when a Wall Street Journal article was published by Carreyrou, the author of Bad Blood. That article had doomed Theranos, as even after repeated defences and FDA approvals the company was not able to convince scientists and other counterparts that the technology it had invented really changed this world.

Patent Battles

The myth that Theranos had a hit a boom on the basis of a revolutionary technology was no longer accepted, the way Holmes deceived the stakeholders. The investors do highlight her persuading skills and determination to change the world, however getting Patents to lure them emphasized how far she can go for her dream to become a reality. Her Patent battles were mostly fought by the top most lawyer in Silicon Valley, Mr. David Boies, who also defended her in suits by patent holders and maintained the hollow status quo which she had claimed to the world over[12]. Mr. Boies was no longer in conventional client-firm relationship with Theranos as he had accepted stock in place of his legal fee, yet the in-house legal team were incapable of having much knowledge about the firm's affairs due to the toxic culture, an excessively authoritative leader and an overwhelming cult of secrecy, yet Boeis acted as a linchpin of Theranos[13]. Because of his admiration for Holmes and what her company is trying to do, Boies said, he agreed to personally represent Theranos in its first challenge from patent holders claiming infringement. It was something of a coming-of-age ritual for tech startups as what she claimed to have invented was something which already existed, the only advance being the miniaturization and optimizing chemistry which made it stand apart. In a rare - if not unprecedented - route this past March, the patent holders unconditionally surrendered midtrial, stipulating to the invalidity of their own patent. As a kicker they agreed – though the presiding judge would have been powerless to order such a thing himself – to bring no additional patent suits against Theranos for five years.

The biggest Patent battle that Theranos ever witnessed was with Richar Fuisz, her childhood neighbour who was too startled by her success and the fact that she never consulted him as he was the only person in her vicinity who was so much engrossed into the medical devices, troubled him. In Theranos Inc. and Elizabeth Holmes v. Fuisz Pharma LLC & Ors., Theranos alleged various patent and state law claims (one in California and the other in Delaware) against the defendants concerning US patent no. 7,824,612 (hereinafter referred to as 'the said patent') based on theories of invalidity and unenforceability, in California action, Holmes alleged that Joseph Fuisz, a lawyer, Richard's son had access to Mc Dermott's documents prior IP for Theranos, who had earlier filed patents on behalf of Theranos, thereby seeking correction on inventorship on the said Patent. The said patent reads as: Bodily Fluid Analyzer, and System Including Same and Method for Programming Same. The four-page Delaware Complaint alleged generally that "Theranos has infringed and is infringing the Asserted Patent under 35 U.S.C. [section] 271 by making, using, offering for sale, selling, importing, and/or exporting without authority, personalized biomonitoring and informatics systems to monitor the effects of prescription medicines (the `Theranos accused devices')." As per the US Patent Local Rule 3-1[14], the one claiming infringement has to crystallize the theories in the case earlier and to adhere them and disclose the facts known to them in pre-filing inquiry to provide a reasonable defense opportunity to the defendant[15] Theranos has alleged the contention of Fuisz are non sensical and the limitation identified has no relationship to the claim element cited, moreover the compliance required under PLR 3-1 (b) and (c) have not been adhered to. Theranos also claimed that the parrot language used by Fuisz has made the response on belief and information, which is insufficient to shoe the identification of "specific limitation" showing that they did not conduct prior inquiry. Fuisz replied stating that the claims asserted were presumptive. Fuisz further opposed the Motion on the ground that discovery should not be stayed because "Theranos technical information goes to the heart of its inventorship, damages and unfair competition claims it has affirmatively asserted against Fuisz Pharma." They also argued that because Theranos initiated litigation in the first instance, Fuisz is thereby "entitled to technical information about the conception and reduction to practice of the any Theranos technology that allegedly uses the '612 Patent"[16].The court had refused Theranos' claim to substitute the inventorship on the said patent.

With such struggles and roadblocks when Theranos just began with constructing its road to success, Elizabeth Holmes could not deceive scientists further than she every time claimed to. It was not just the patent battles which seemed an obstacle but the time commitment that she required every employee to give to Theranos, seemed a lot more than required[17].

Trademarks Battle

Trademarks for NANOTAINER also seemed a far-fetched dream when Becton, Dickinson and Company alleged Theranos of trademark infringement for MICROTAINER, a trademark registered since 1945, opposed Theranos while registering NANOTAINER in the US Trademark Office[18].

With a host of difficulties, Elizabeth finally gave up in 2017 when she was charged with massive fraud and was banned from the lab industry till 2019.

Conclusion

Theranos' Voyage, which began with so much of enthusiasm about miniaturising health care technology and bringing a change to the world, did not end well. The company began its winding up procedures in 2018 when all attempts to revamp its bankruptcy failed in 2017 after signing up with Fortress Investment Group, the company could never have saved itself after such deception as doomsday seemed inevitable. With a life span of about 15 years, Theranos duped all its stakeholders without raising their eye brows about the consequences of their attempted audacity about their finger prick blood testing technology which they claimed could run 200 variants of tests. Currently, Holmes and Balwani are facing trial for a maximum sentence of 20 years' imprisonment. What else could be the fate of a Silicon Valley start-up that tried to revolutionise technology and ended up misleading investors based on their patents?

In this age of technology where Uber and Apple have thrived and established monopolies across global markets based on their patented inventions, it's a disgrace to even get reminded of the frivolous hypothetical leaps made by Theranos. Tech companies depend on patents for enhancing their market value, by acquiring and maintaining key Intellectual Property Rights, thereby preventing others from using their inventions. With patent filings in more than 24 countries, Theranos had always aimed to capture global markets and now the company faces numerous charges based on its hollow patents. Holmes leapt over all opportunities to take advantage of every loophole that US Patent system had to offer and misused the patent law which expects every inventor to be honest about working of their invention. The current IP legal systems lack strict enforcement of enablement clause. But such fraudulent acts cannot last forever in any jurisdictions all over the world. Theranos built a mirage, lived it, bloomed till others could live it and finally doomed when the carpeted world could no longer take it.

[1] Avery Hartmans, The rise and fall of Elizabeth Holmes, who started Theranos when she was 19 and became the world's youngest female billionaire before it all came crashing down, The Business Insider (April 21, 2018, 06;05 PM), https://www.businessinsider.in/The-rise-and-fall-of-Elizabeth-Holmes-who-started-Theranos-when-she-was-19-and-became-the-worlds-youngest-female-billionaire-before-it-all-came-crashing-down/articleshow/63859273.cms

[2] Roger Parloff, This CEO is out for Blood, Forbes (Jun 12, 2014), http://fortune.com/2014/06/12/theranos-blood-holmes/

[3] Charlotte Hu & Lydia Ramsey, The rise and fall of Theranos, the blood-testing startup that went from a rising star in Silicon Valley to facing fraud charges over a wild 15-year span, The Business Insider (May 25, 20118, 4: 33 PM), https://www.businessinsider.in/The-rise-and-fall-of-Theranos-the-blood-testing-startup-that-went-from-a-rising-star-in-Silicon-Valley-to-facing-fraud-charges-over-a-wild-15-year-span/articleshow/64319477.cms

[4] Alissa Wilkinson, 2 new documentaries pinpoint the uniquely troubling grift of Elizabeth Holmes and Theranos, Vox (Mar 15, 2019, 1: 50 PM), https://www.vox.com/culture/2019/3/15/18263903/theranos-elizabeth-holmes-documentary-dropout-inventor-podcast

[5] 35 U.S.C. § 101 (2012)

[6] See In re Fischer, 421 F.3d 1365, 1371 (Fed. Cir. 2005).

[7] See Fregeau v. Mossinghoff, 776 F.2d 1034, 1038 (Fed. Cir. 1985)

[8] In re Swartz, 232 F.3d 862, 864 (Fed. Cir. 2000)

[9] Michael James, Is the Patent System to Blame for Rise and Fall of Theranos, Michigan Business and Entrepreneurial Law Review (Jan 19, 2019) , http://mbelr.org/is-the-patent-system-to-blame-for-the-rise-and-fall-of-theranos/

[10] Joe Meckles, Theranos and the Broken Patent System, Global IP and Technology Law Blog (Mar 11, 2019), https://www.iptechblog.com/2019/03/theranos-and-the-broken-patent-system/#page=1

[11] Daniel Nazer, Theranos: How a Broken patent System Sustained its Decade Long Deception, ARS Technica, (Apr 3, 2019, 6: 00 PM), https://arstechnica.com/tech-policy/2019/03/theranos-how-a-broken-patent-system-sustained-its-decade-long-deception/

[12] Nick Stockton, Everything You Need to Know About the Theranos Saga So Far, The Wired ( Apr 5, 2016, 8:00 AM), https://www.wired.com/2016/05/everything-need-know-theranos

[13] Olga V. Mack, Bad Blood: Even More Red Flags That Were Simply Ignored, Above The Law (Feb 4, 2019), https://abovethelaw.com/2019/02/bad-blood-even-more-red-flags-that-were-simply-ignored/

[14] P.L.R 3-1. Disclosure of Asserted Claims and Infringement Contentions: Not later than 14 days after the Initial Case Management Conference, a party claiming patent infringement shall serve on all parties a "Disclosure of Asserted Claims and Infringement Contentions." Separately for each opposing party, the "Disclosure of Asserted Claims and Infringement Contentions" shall contain the following information:(b) Separately for each asserted claim, each accused apparatus, product, device, process, method, act, or other instrumentality ("Accused Instrumentality") of each opposing party of which the party is aware. This identification shall be as specific as possible. Each product, device, and apparatus shall be identified by name or model number, if known. Each method or process shall be identified by name, if known, or by any product, device, or apparatus which, when used, allegedly results in the practice of the claimed method or process;(c) A chart identifying specifically where and how each limitation of each asserted claim is found within each Accused Instrumentality, including for each limitation that such party contends is governed by 35 U.S.C. § 112(6), the identity of the structure(s), act(s), or material(s) in the Accused Instrumentality that performs the claimed function.

[15] Shared Memory Graphics LLC v. Apple, Inc., 812 F.Supp.2d 1022, 1025 (N.D. Cal. 2010)

[16] Theranos, Inc.v. Fuisz Pharma Llc, Case No. 11-cv-05236-YGR, Related Case No. 12-cv-03323-YGR.

[17] Peter Cohan, 4 Startling Insights Into Elizabeth Holmes From Psychiatrist Who's Known Her Since Childhood, Forbes (Feb 17, 2019, 3:42 PM), https://www.forbes.com/sites/petercohan/2019/02/17/4-startling-insights-into-elizabeth-holmes-from-psychiatrist-whos-known-here-since-childhood/#331526d8366b

[18] Mitchell Stein, United

States: NANOTAINER vs. MICROTAINER: Theranos Battles BD Over

Trademarks, But FDA Draws First Blood, Mondaq (Nov 9, 2015), http://www.mondaq.com/unitedstates/x/442326/Trademark/

NANOTAINER+vs+MICROTAINER+Theranos+Battles+BD+Over+Trademarks+but+FDA+Draws+First+Blood

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.