Economic Review

GDP Growth

- The GDP growth rate of the Indian economy is estimated to be 6.8% in FY18-19, as compared to 7.2% in FY17-18. However, the GDP growth rate is projected to pick up to 7.2% in FY19-20, according to the Reserve Bank of India (RBI) and the Asian Development Bank (ADB)

- The moderation in GDP growth momentum is attributed to both domestic and global causes. At a domestic level, it is mainly attributed to the lower growth in the Agriculture and the services sector (except financial, real estate, and professional services).

Index of Industrial Production (IIP)

- FY18-19 witnessed a slowdown in production in the manufacturing sector as measured by IIP, slowed down to 3.5% in FY18-19 compared to 4.6% in FY17-18. This is also attributed to the slow growth of the automobile sector, with car sales at a five-year low growth rate as well as the slow growth of the eight core industries.

Inflation

- Overall, India has contained inflation within 4%, which enabled macroeconomic stability over FY18-19.

- Headline inflation, based on Consumer Price Index – Combined (CPIC) declined to 3.4% in FY18-19 from 3.6% in FY17-18, indicating lower price volatility in food and energy products over a 5-year trend.

- The Wholesale Price Index (WPI), which indicates the average inflation stood at 4.3% in FY18-19, down from 3.0% in FY17-18, with Inflation estimated at 2.5% in May'19.

- WPI food inflation is estimated at 0.6% in FY18-19, down from 1.9% in FY17-18, with the last estimate for May'19 at 5.1%.

Trade

- The value of India's merchandise exports (customs basis) stood at USD 329.5 billion in FY18-19, up by 8.6% from USD 303.5 billion in the previous year.

- Imports stood at USD 513.1 billion in FY18-19 compared to USD 465.6 billion in the previous year, marking an increase of 10.2%, driven by an increase in international crude oil prices. " The growth both – merchandise exports and imports slowed down in FY18-19, but the decline in growth in imports was steeper than that of exports.

Fiscal Deficit

- The fiscal deficit saw a slight decline to 3.4% (targeted 3.3%) in FY18-19 from 3.5% (targeted 3.2%) in FY17-18, showing better fiscal discipline.

- India's current account deficit (CAD) increased from USD 35.7 billion (1.8% of GDP) in Q1-Q3 FY17-18 to USD 51.9 billion (2.6% of GDP) in Q1-Q3 FY18-19. The trade deficit, however, increased by ~22.7% from USD 118.4 billion to USD 145.3 billion at the same time.

- Capital expenditure of Central Government grew by 15.1% in FY18-19 showing heavy investment in infrastructure to accelerate future growth.

Foreign Investments

- Growth in investment, which had slowed down, has gained momentum since FY17-18. Growth in fixed investment increased from 8.3% in FY16-17 to 9.3% in FY17-18, and further to 10% in FY18-19. FDI inflows amounted to USD 64.4 billion in FY18-19.

- The government is aptly introducing additional measures, including easing of FDI norms, to accelerate FDI growth.

Foreign Exchange Reserves and External Debt

- As of December 2018, foreign exchange reserves stood at approximately USD 395.6 billion.

- The Central Government debt is estimated to be at 48.4% of the GDP in FY18-19, as compared to the reported 49.5% in FY17-18. The government targets to further reduce it to 48% in FY19-20.

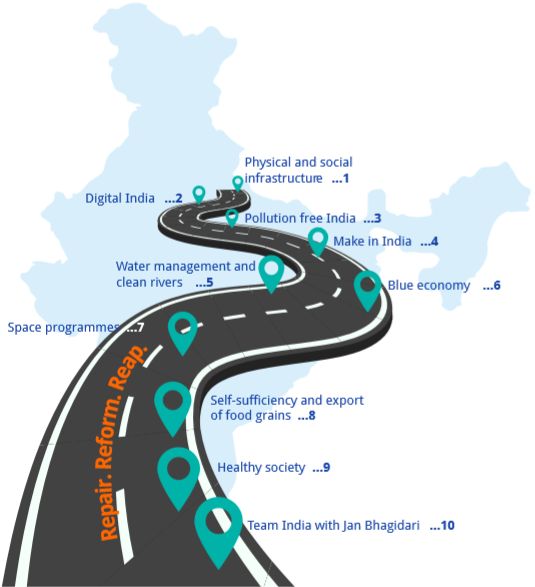

Vision 2030

Key Direct Tax Proposals

The amendments mentioned below are applicable for AY 2020 – 21, unless otherwise specified.

Rate of Income Tax For Individuals

- No change in personal income tax slab rates.

- A surcharge of 25% is leviable in

case the income exceeds INR 20 million but does not exceed INR 50

million. Similarly, surcharge of 37% shall be leviable in case the

income exceeds INR 5 million.

- Surcharge of 10% and 15% for incomes above INR 5 million and INR 10 million respectively continues to exist.

- Marginal relief is provided wherever surcharge is leviable.

For Companies

- The tax rate has been reduced from 30% to 25% for companies with turnover/gross receipts of INR 4,000 million or less in the Financial Year (FY) 2017-18. Earlier the threshold was INR 2,500 million.

- No reduction in the rate of Minimum Alternate Tax (MAT).

WIDENING AND DEEPENING OF TAX BASE

TDS on payment by Individual/HUF to contractors and professionals

- Currently, payments in respect of contractual work or for professional service, made by individuals or HUFs who are not liable to tax audit, are not required to withholding tax.

- It is proposed to insert a new provision, to levy TDS at the rate of 5% on the amount paid for the said services by such individual or HUFs if such sum, or aggregate of such sums, exceeds INR 5 million during the year.

- Further, to ease the compliance burden, it is proposed that such individuals or HUFs could deposit the tax deducted using their Permanent Account Number (PAN) and they would not be required to obtain a Tax Deduction number (TAN). This amendment is proposed to be effective from 1 September 2019.

TDS at the time of purchase of immovable property

- Under the current regime, tax is required to be deducted at the rate of 1% on the amount of consideration paid for the transfer of certain immovable property other than agricultural land. The law, however, does not define 'consideration for immovable property'.

- It is now proposed to insert a new explanation and provide that the term 'consideration for immovable property' would include all charges in the nature of club membership fee, car parking fee, electricity and water facility, maintenance fee, advance fee or any other charges of similar nature, which are incidental to the transfer of the immovable property.

This amendment is proposed to be effective from 1 September 2019.

Deemed accrual of gift made to a person outside India

- Under the existing provisions of law, a gift of money or property received by a resident donee is taxed his hands, except for certain specified exemptions.

- It is now proposed that similar provisions would be made applicable to the non-resident donees with respect to any sum of money paid or any property situated in India transferred on or after 5 July 2019. The specified exemptions provided for resident donees would be applicable to non–residents as well.

The amendment is proposed to be effective from AY 2020-21.

Mandatory furnishing of return of income by person other than a company or a firm

- Currently, persons other than companies and firms are required to file their return of income only if their total income exceeds the maximum amount not chargeable to tax.

- It is, however, proposed to expand

the tax base by including the following categories of persons in

the mandatory return filing list:

- Persons claiming capital gains tax exemption i.e. rollover benefit by investing in specified assets such as residential houses, bonds, etc.

- Persons depositing an amount or aggregate of amounts exceeding INR 10 million in one or more current accounts maintained with a banking company or a cooperative bank; or

- Foreign travel expense exceeding INR 0.2 million lakhs for himself or any other person; or – Electricity expense of an amount or aggregate of amounts exceeding INR 0.1 million; or

- A person fulfilling other such conditions, as may be prescribed.

PAN and Aadhaar Interchangeability

- Currently, PAN is required not only for purposes of filing of return of income but also for certain specified financial transactions.

- It is proposed to widen the tax base by requiring persons who intend to enter into certain prescribed transactions to obtain PAN.

- It is proposed that a person, whether or not he has a PAN, may quote his Aadhaar number.

- It is also proposed to have a detailed procedure for quoting and authentication of PAN/Aadhaar by both the parties entering into a prescribed transaction.

- It is proposed that a penalty of INR 10,000 be levied in case of non-compliance of provisions of quoting of PAN/ Aadhaar.

- It is further proposed that the requirement of linking of PAN and Aadhar needs to be carried out to avoid inactivation of PAN.

The aforesaid amendments are proposed to be made effective from 1 September 2019.

Widening the scope of Statement of Financial Transactions

- The law obligates furnishing of statement of financial transaction (SFT) or reportable account by specified person.

- It is proposed to enhance the list of such persons to enable the pre-filling of return of income of other assessees.

- Currently the filing requirement is for transactions in excess of INR 50,000. It is now proposed to do away with this threshold limit.

- Penalty provisions currently applicable only to financial institutions are now proposed to cover all the reporting entities.

This amendment is proposed to be effective from 1 September 2019.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.