Overview

This article is the first of a series analysing the African Continental Free Trade Area (AfCFTA) and its implications for the Mauritian business community. This first article explores the Protocol on Trade in Goods.

The AfCFTA is a landmark trade agreement, constituting the largest free trade area in the world in terms of the number of participating countries. The Agreement, which brings together 54 African countries and eight regional economic blocs, represents a combined population of 1.3 billion and total GDP estimated at USD 3.4 trillion. The AfCFTA aims to eliminate tariffs and non-tariff barriers on almost all trade in goods and services.

46 Member States have ratified the Agreement as of July 2023. The Agreement comprises the following protocols: Trade in Goods, Trade in Services, Dispute Settlement, Competition Policy, Investment and Intellectual Property Rights. The Protocol on Digital Trade and the Protocol on Women and Youth in Trade are expected to be finalised later this year (end 2023).

Table 1: AfCFTA Framework

| Phase I (adopted) | Protocol on Trade in Goods | Annex 1: Schedules of Tariff Concessions Annex 2:

Rules of Orgin Annex 3: Customs Cooperation and Mutual Administrative Assistance Annex 4: Trade Facilitation Annex 5: Non-Tariff Barriers Annex 6: Technical Barriers to Trade Annex 7: Sanitary and Phytosanitary Measures Annex 8: Transit Annex 9: Trade Remedies |

| Protocol on Trade in Services | Schedules of Specific Commitments Most-favoured Nation Exemptions Annex on Air Transport |

|

| Protocol on Rules and Procedures on the Settlement of Disputes | Annex 1: Working Procedures of the Panel Annex 2:

Expert Review Groups Annex 3: Code of Conduct for Arbitrators and Panelists |

|

| Phase II (adopted) | Protocol on Competition Policy | Adopted in February 2023 |

| Protocol on Investment | ||

| Protocol on Intellectual Property Rights | ||

| Phase II (under negotiation) | Protocol on Digital Trade | To be concluded in 2023 |

| Protocol on Women and Youth in Trade |

Source: Author's elaboration based on African Union website

Although the AfCFTA entered into force on May 30, 2019, trading under the Agreement only started in January 2021. The Protocol on Trade in Goods requires progressive liberalisation of tariffs by Member States on at least 97% of tariff lines that account for at least 90% of intra-African imports. It should be noted that procurement by governmental bodies for the state and not intended for commercial re-sale are excluded from the scope of the Protocol on Trade in Goods. Mauritian exporters can trade on preferential terms under the AfCFTA with the countries who have ratified the Agreement and submitted their market access offers. These countries include members of the Economic and Monetary Union of Central Africa (CEMAC), the Eastern African Community (EAC) and the Southern African Customs Union (SACU), Egypt and Sao Tome and Principe. Additionally, all imports originating from an AfCFTA Member State are exempt from customs duties upon entering Mauritius.

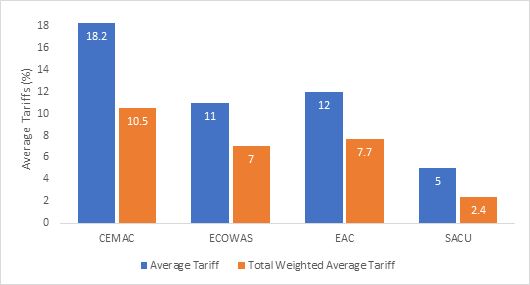

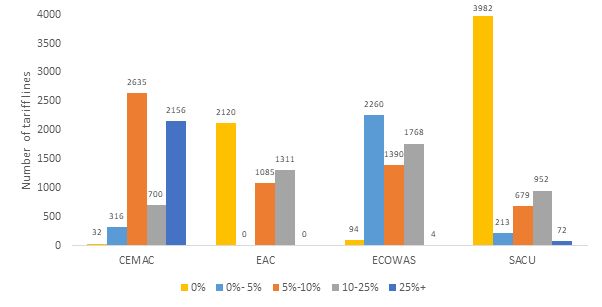

The figures below summarise the tariff offers that Regional Economic Communities have submitted to date. The Economic and Monetary Community of Central Africa (CEMAC) provides an average tariff preference of 18.2% compared to average preferences of 11% for the Economic Community of West African States (ECOWAS), 12% for the Eastern African Community (EAC) and 5% for the Southern African Customs Union (SACU). A significant number of EAC's and SACU's schedules offer 0% tariff preference. Most regions' offers provide a tariff preference between 10% and 25%. The AfCFTA e-tariff book is a good resource to determine tariff preferences offered by Member States.

Figure 1 Average and Trade Weighted Tariffs offered by RECs under the AfCFTA

Source: AfCFTA Secretariat and UNDP (2021)1

Figure 2 Number of tariff lines applied across different tariff preferences by RECs

Source: AfCFTA Secretariat and UNDP (2021)2

In Mauritius, the Agreement is being implemented through the amendment of the Customs Tariff Act and the enactment of the Customs (Export to the African Continental Free Trade Area) Regulations 2021. According to the Regulations, no person other than the Director-General of the Mauritius Revenue Authority can print or cause to print an AfCFTA Certificate of Origin. Exporters should apply for Certificates of Origin electronically on the TradeNet portal and attach a copy of the export invoice and any other documents, evidence or sample that the Director-General of the Mauritius Revenue Authority may require. The Regulations also allow Approved Exporters to complete an Origin Declaration on an invoice or any other Commercial document. The Director-General may withdraw the Approved Exporter status at any time if the latter no longer complies with the required conditions, makes inappropriate use of the authorisation or contravenes the Regulations.

The AfCFTA's Rules of Origin

Part 1 of this series focuses on the preferential Rules of Origin (RoO) applicable under the Agreement. RoO determine the national origin of a product by establishing the specific criteria that must be met for the product to be considered originating from a country and to therefore benefit from tariff preferences. These criteria are based on several factors, including the sourcing of inputs, any manufacturing process involved and the value addition. According to the Marrakech Agreement establishing the World Trade Organisation in 1995, "[preferential] Rules of Origin shall be defined as those laws, regulations and administrative determinations of general application applied by any Member to determine whether goods qualify for preferential treatment under contractual or autonomous trade regimes leading to the granting of tariff preferences going beyond the application of paragraph a of Article 1 of GATT 1994." Annex 2 of the AfCFTA agreement details the criteria for determining eligibility for preferential treatment. Article 4 of Annex 2 states that a product will be considered originating from a country if it has been wholly obtained or has undergone substantial transformation in that country.

Article 5 of the Annex on RoO of the AfCFTA Protocol on Trade in Goods specify which products must be wholly obtained, i.e. entirely "produced" in a given country, to be considered made in the country. Article 5 includes products such as mineral products and natural resources, plants, live animals born and raised in the Member State; products obtained from live animals raised in the Member State, etc.

Products, which are not wholly obtained, have to fulfil the following criteria to be considered as sufficiently worked or processed:

- Value-addition;

- Non-originating material content;

- Change in tariff heading (CTH);

- Specific processing (SP).

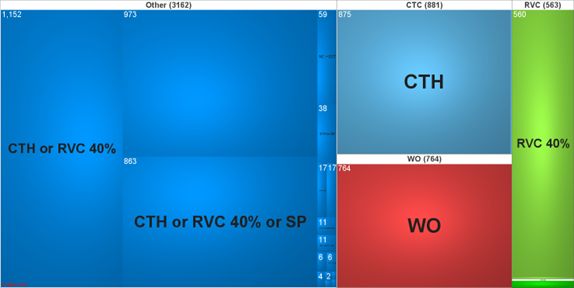

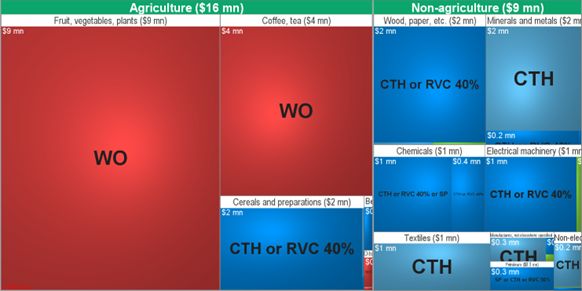

Appendix IV to the Annex on RoO details the working or processing required by the Harmonised System (HS) Chapter, heading or sub-heading. The figures below show that WO applies to 14% of tariff lines, primarily agricultural products. CTH applies to 16% of tariff lines, including textiles, minerals and metals, and other manufactures. CTH or Regional Value Content (RVC) of 40% applies to 21% of the tariff lines, such as cereals and preparations, wood, paper, chemicals and electrical machinery. CTH or RVC 40% or SP applies to 16% of tariff lines, including chemicals.

Figure 3: Origin criteria in AfCFTA across all HS6 codes

Source: Rules of Origin Facilitator

Figure 4: Origin criteria in AfCFTA applied on eligible imports

Source: Rules of Origin Facilitator

Furthermore, Article 7(1) of the Annex on RoO describes a list of operations that are insufficient to confer origin on a product irrespective of whether the requirements of Article 4 on origin conferring criteria are satisfied. These operations include, amongst others, disassembly or assembly; washing or cleaning; basic pressing or ironing' painting; packaging; etc. Additionally, Article 7(2) of the aforementioned Annex states that agricultural products partially or fully obtained from food aid, monetisation or other assistance measures, including arrangements on non-commercial terms, will not be considered as originating in a Member States.

The AfCFTA also allows for cumulation of origin, i.e. raw materials or semi-finished goods originating in one AfCFTA Member State that undergo sufficient working or processing in another AfCFTA Member State, can be considered as originating the Member State where the final processing or manufacturing occurs. Goods manufactured in Special Economic Zones (SEZ) can also be conferred origin if they satisfy the preferential rules of origin and the provisions of Article 23.2 of the Protocol on Trade in Goods, which states that products benefitting from SEZs will be subject to regulations that the Council of Ministers will develop in support of the continental industrialisation programmes.

Regarding the documentation required to show proof of origin, Member States can submit a Certificate of Origin issued per the Member State's national legislation. Alternatively, an Origin Declaration may be submitted as proof of origin by (a) an exporter who frequently exports products covered by the Annex on RoO and complies with all requirements and who is designated as an Approved Exporter by the Member State's competent authority and (b) an exporter of consignments consisting of one or more packages of originating products valued at less than USD 5,000.

Efficient utilisation of RoO is crucial for the Mauritian business community to tap into market access opportunities offered by the AfCFTA. RoO under the AfCFTA do not only extend preferential access through reduced tariffs but also play a key role in enhancing regional value chains. The AfCFTA, therefore, provides a unique opportunity for the Mauritian manufacturing sector to diversify its export portfolio further and improve intra-African trade. Navigating the complexities of RoO can be challenging. The RoO for top Mauritian exports, such as sugar, tuna and clothing have not yet been finalised. It is therefore important for Mauritian companies to stay updated on revisions and new developments to the rules as negotiations and trade facilitation efforts progress.

International Economics Consulting Ltd (IEC) is an independent consultancy firm working with national and international development partners, governments, and the private sector to create value and promote sustainable growth and development. With extensive experience in trade policy, research, and negotiations, IEC can support governments and businesses deal with unfair trade practices and unforeseen consequences of free trade by providing analytical expertise and support.

References

1. About the AfCFTA, African Union, Available from: https://au-afcfta.org/about/

2. Agreement Establishing the African Continental Free Trade Area, African Union, Available from: https://au-afcfta.org/wp-content/uploads/2022/06/AfCFTA-Agreement-Legally-scrubbed-signed-16-May-2018.pdf

3. Compiled Annexes To The Establishment of the Continental Free Area, African Union, Available from: https://au-afcfta.org/wp-content/uploads/2022/01/Compiled-Annexes-to-the-CFTA-Agreement_E-2.pdf

4. Revised Comprehensive Appendix IV to Annex 2 on Rules of Origin, African Union, Available from: https://www.mcci.org/media/297802/annex-iv-revised-comprehensive-appendix-iv.pdf

5. Customs (Export to the African Continental Free Trade Area) Regulations 2021, Mauritius Revenue Authority, Available from: https://www.mra.mu/download/CustomsRegulations2021.pdf

Footnotes

1. These figures have been calculated by the UNDP and AfCFTA Secretariat in the Futures Report 2021.

2. These figures have been calculated by the UNDP and AfCFTA Secretariat in the Futures Report 2021.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.