TYPES OF COLLECTIVE INVESTMENT VEHICLES AVAILABLE IN LUXEMBOURG

UCITS

stands for undertakings for collective investment in transferable securities and designates those investment funds which have been set up in compliance with the provisions of the amended Luxembourg Law of 17 December 2010 implementing EU Directive 2009/65/EC ("UCI Law"). UCITS benefit from a European passport in that, once authorised by the supervisory authority in Luxembourg, they can, using a standardised notification procedure, be sold to the public in all other EU Member States1 . UCITS also benefit from facilities for registration with authorities in numerous non-EU Member States which recognise the UCITS label and the investor protection regime it entails. They are subject to the prior authorisation and ongoing supervision of the Luxembourg supervisory authority ("CSSF"). In order to protect the retail investors to which UCITS can be marketed, UCITS are subject to specific rules as regards the assets in which they can invest and the diversification and concentration rules with which they have to comply. These aim at ensuring an appropriate liquidity of the UCITS investment portfolio allowing investors to redeem their units/shares at least twice a month.

refers to collective investment undertakings governed by Part II of the UCI Law, which do not qualify as UCITS either because of their investment policy or because of the rules applicable to the distribution of their units/shares. Although Part II Funds can be sold to the public, they do not have access to the UCITS passport. They will, however, benefit from the AIFMD passport2 under certain conditions. They are subject to the prior authorisation and ongoing supervision of the CSSF. Yet, they have increased flexibility as regards the type of assets they can invest in, the investment strategies they can employ, the diversification rules they are subject to and the liquidity they offer to investors.

SIF

stands for specialised investment funds organised under the amended Luxembourg Law of 13 February 2007 ("SIF Law"). SIFs are reserved to so-called well-informed investors, i.e. in substance institutional investors, professional investors and other sophisticated investors meeting certain criteria such as subscribing for a minimum of EUR 100,000 in the SIF. They are subject to prior authorisation and the ongoing supervision by the CSSF. Because of the sophistication of their investors, they benefit from a pretty flexible regime. Among other things, SIFs have to invest in accordance with the principles of risk-spreading but otherwise have full flexibility as regards the type of assets in which they invest and the strategies which they employ. Like Part II Funds, they will also benefit from the AIFMD passport under certain conditions.

SICAR

stands for investment companies in risk capital governed by the amended Luxembourg Law of 15 June 2004 ("SICAR Law"). SICARs operate under a regime that is tailor-made for private equity/venture capital investments, including a tax treatment which differs from that applicable to UCITS, Part II Funds and SIFs. SICARs are not required to operate under the principle of risk-spreading. They are reserved to well-informed investors and are subject to prior authorisation and the ongoing supervision by the CSSF in a similar manner as SIFs. SICARs will, under certain conditions, also benefit from the AIFMD passport.

SV

stands for securitisation vehicles organised under the amended Luxembourg Law of 22 March 2004 on securitisation ("Securitisation Law"). They can be used in certain circumstances as an alternative to the investment vehicles mentioned above or as a complement to the investment structure, mainly depending on the objective of the transaction and the way it is structured. SV may be offered to any type of investors, but those that issue securities to the public on a continuous basis, fall under the CSSF supervision. SV will not be subject to the AIFMD regime when qualifying as "securitisation special purpose entities" as defined therein3 or issuing debt instruments only.

A new securitisation regime which reflects the requirements of Regulation (EU) 2017/2402 on securitisations ("SR") has applied since 1 January 2019. Three different securitisation regimes are therefore available in Luxembourg: (i) the SR general regime for all securitisations which meets the criteria set forth in the definition of securitisation provided in the SR, (ii) the specific SR regime provided for securitisations which qualify as simple, transparent and standardised ("STS") securitisations under the SR, and (iii) the Luxembourg securitisation regime for securitisations other than (i) and (ii).

RAIF

stands for reserved alternative investment funds governed by the amended Luxembourg Law of 23 July 2016 ("RAIF Law"). Its regime is based on the SIF regime with the important exception that the RAIF is not subject either to authorisation or supervision by the CSSF as a product, which makes it an attractive vehicle from a time-to-market perspective. On the other hand, the RAIF must designate a licensed AIFM, thus benefiting from the AIFMD passport as well as from the protection of the AIFMD framework.

LIMITED PARTNERSHIPS4

Limited Partnerships refer to a category of investment vehicles which are governed by the amended Luxembourg Law of 10 August 1915 on commercial companies ("Luxembourg Company Law"). They are not supervised by the CSSF and thus may be formed very rapidly. These vehicles are used for their flexibility and characterised by the contractual freedom in their structuring, similarly to the well-known Anglo-Saxon model of limited partnerships. Limited Partnerships also offer a competitive tax environment and may benefit from the AIFMD passport under certain circumstances. Limited Partnerships can be used to set up investment vehicles under specific sector laws such as Part II of the UCI Law, the SIF Law, the SICAR Law or the RAIF Law. As such, all flexibilities offered by these legal forms (the main features of which are detailed in the following tables) are also available for a Limited Partnership qualifying as a Part II Fund, SIF, SICAR or RAIF (as long as those sector specific laws do not specifically derogate therefrom).

For further details on the various types of Luxembourg collective investment vehicles, you may consult the following memoranda and legal texts which are available on our website:

www.elvingerhoss.lu/publications

UCITS AND PART II FUND

Memorandum: Part II Funds: Luxembourg regime for alternative investment funds accessible to non-professional investors

Legal text: The amended Law of 17 December 2010 on Undertakings for Collective Investment (UCI)

SIF

Memorandum: Specialised Investment Funds: Luxembourg regime for investment funds dedicated to sophisticated investors

Legal text: The amended Law of 13 February 2007 on Specialised Investment Funds (SIF)

SICAR

Memorandum: SICAR: Luxembourg regime for investment funds investing in risk capital and dedicated to sophisticated investors

Legal text: The amended Law of 15 June 2004 on the Investment Company in Risk Capital (SICAR)

AIFMD

Legal texts:

- The Alternative Investment Fund Managers Directive and its implementation in Luxembourg

- The amended Law of 12 July 2013 on Alternative Investment Fund Managers (AIFM)

ELTIF

Memorandum: European Long-Term Investment Funds (ELTIFs) in a nutshell

Legal text: The European Long-Term Investment Funds Regulation

RAIF

Memorandum: Reserved Alternative Investment Funds: Luxembourg regime for investment funds not supervised by the Luxembourg regulator and dedicated to sophisticated investors

Legal text: The amended Law of 23 July 2016 on Reserved Alternative Investment Funds (RAIFs)

LIMITED PARTNERSHIP

Memorandum: Luxembourg Partnerships in the asset management industry

Legal text: The amended Law of 10 August 1915 on commercial companies

Footnote

1. For the purposes of this flyer, the terms "European Union", "EU" and " Member States" also refer to and include the European Economic Area ("EEA") and the States that are contracting parties to EEA agreement other than the Member States of the European Union, within the limits set forth by this agreement and related acts.

2. "AIFMD passport" refers to the EU passport introduced by directive 2011/61/EU on alternative investment fund managers ("AIFMD") for the marketing of alternative investment fund(s) ("AIF(s)") to EU professional investors, as implemented in Luxembourg domestic law.

3. Securitisation special purpose entities are defined in Article 4 (an) of the AIFMD.

4. "Limited Partnership", for the purpose of this flyer, refers to the société en commandite simple (common limited partnership) and the société en commandite spéciale (special limited partnership).

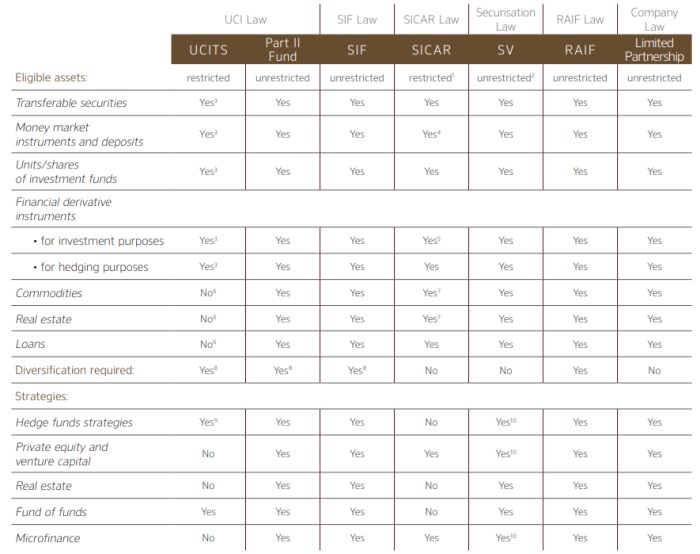

ELIGIBLE ASSETS

Footnotes

1. Restricted to investment in assets which, or the underlying of which, represent risk capital.

2. No restrictions in terms of underlying assets, but risks securitised must exclusively result from third parties assets/claims/obligations and cannot be generated by the securitisation vehicle.

3. Subject to the limits and conditions set out, inter alia, in the UCI Law.

4. On an ancillary basis only.

5. Only where such transactions are necessary for the realisation of its investment policy but cannot constitute the object of its policy.

6. UCITS are subject to strict rules regarding eligible assets. They may, however, gain exposure to alternative asset classes such as commodities or real estate through eligible assets such as transferable securities, financial derivative instruments on financial indices (including hedge fund and commodity indices under certain conditions).

7. Although direct holding is not allowed, indirect investment via intermediary entities is possible if representative of risk capital.

8. UCITS may invest, under certain conditions, no more than 10% of their assets in one single issuer. For Part II Funds this limit is, in principle, 20% and for SIFs 30%, both with the possibility to obtain derogations (the 30% limit will also probably apply mutatis mutandis to RAIFs).

9. Under restrictive conditions.

10. Subject to being compatible with a securitisation structure.

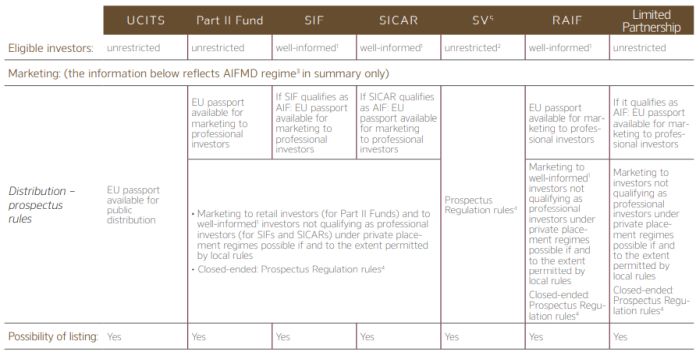

DISTRIBUTION

Footnotes

1. A "well-informed investor" is defined as an institutional investor, a professional investor or any other investor who meets the following conditions: a) he has confirmed in writing that he adheres to the status of well-informed investor, and b) (i) he invests a minimum of EUR 100,000 in the SIF, SICAR or RAIF, or (ii) he has been the subject of an assessment made by an EU credit institution, MiFID investment firm, UCITS management company or authorised AIFM certifying his expertise, his experience and his knowledge in adequately appraising the contemplated investment in the SIF, SICAR or RAIF.

2. Under the SR, the sale of securitisations to retail investors is subject to certain conditions.

3. Those funds qualifying as AIF benefit from the AIFMD passport, subject to certain conditions.

4. "Prospectus Regulation" means Regulation (EU) 2017/1129 on the prospectus to be published when securities are offered to the public or admitted to trading, as may be amended.

5. We are only referring here to SVs qualifying as "securitisation special purpose entities" or issuing debt instruments only, i.e. not subject to AIFMD regime.

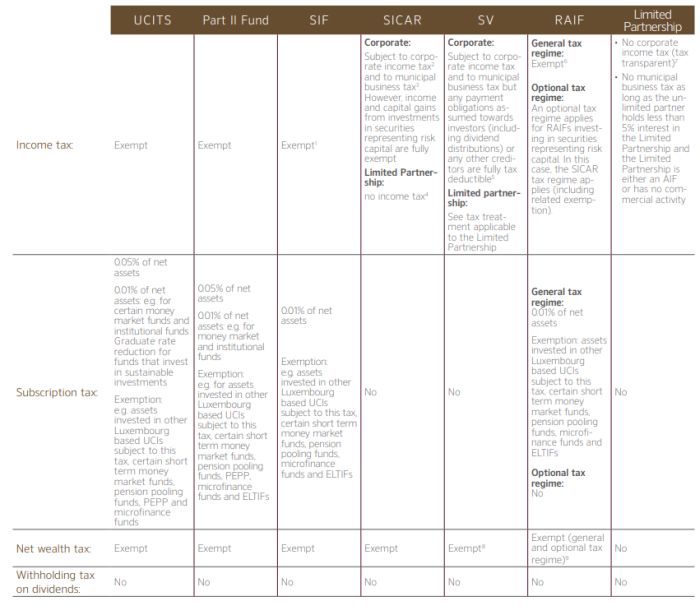

TAX REGIME

Footnotes

1. Anti-hybrid mismatch rules to be monitored for a SIF established as a Limited Partnership.

2. The corporate income tax (impôt sur le revenu des collectivités – "CIT") rate is 17% for taxable income exceeding EUR 200,000. Taking into account the solidarity surcharge for the employment fund, the aggregate CIT rate is 18.19%. Two intermediary CIT rates apply for taxable income below EUR 200,000.

3. Municipal business tax (impôt commercial communal) depends on municipality. The rate is 6.75% in Luxembourg-City.

4. Anti-hybrid mismatch rules to be monitored.

5. Interest deduction limitation rule to be monitored unless the SV qualifies as AIF.

6. Anti-hybrid mismatch rules to be monitored for the RAIF established as a Limited Partnership.

7. Anti-hybrid mismatch rules to be monitored. 8 A minimum net wealth tax is, however, applicable.

9. A minimum net wealth tax is, however, applicable for the optional tax regime.

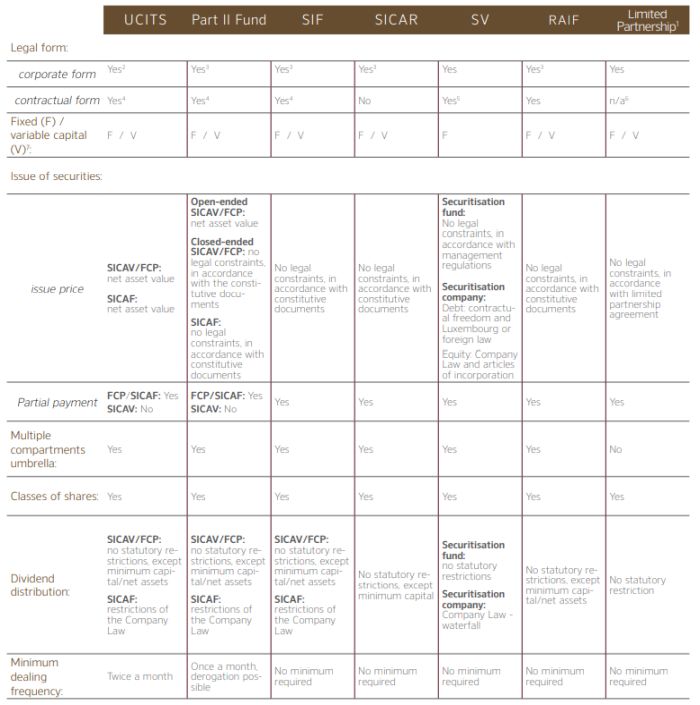

STRUCTURING FEATURES

Footnotes

1. This description of the Limited Partnership is restricted to situations where it is not used to set-up a RAIF, a Part II Fund, a SIF or a SICAR (in these latter cases, the Limited Partnership enjoys the flexibilities offered by the specific law applying to these investment structures (i.e. the RAIF Law, the UCI Law, the SIF Law or the SICAR Law).

2. The corporate form commonly used is the public limited company ("SA" - société anonyme), which is in any case the sole corporate form available for a UCITS SICAV.

3. The corporate forms commonly used are the public limited company ("SA" - société anonyme), the partnership limited by shares ("SCA" - société en commandite par actions), the common limited partnership ("SCS" - société en commandite simple) and the special limited partnership ("SLP" – société en commandite spéciale).

4. The contractual form used is the fonds commun de placement ("FCP").

5. Contractual forms of securitisation vehicles are securitisation fund or fiduciary arrangements.

6. The SLP in particular is very similar to the Anglo-Saxon LP. It has no legal personality and although qualifying as a company, it is characterised by freedom and flexibility in its structuring (e.g. it is subject to a limited number of mandatory provisions).

7. A corporate form with variable capital is referred to as a "SICAV" and a corporate form with fixed capital is referred to as a "SICAF".

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.