Changing political and legal landscapes are prompting life sciences companies to review the location of their regulatory authorisations. Much of this is driven by EU regulatory requirements that necessitate an EU/EEA presence.

REASONS TO INCORPORATE IN IRELAND

- EU Member State

- English speaking

- Common law legal system

- Well-respected regulators

- Highly skilled personnel

- Compelling global life sciences presence

- Competitive tax rates

- IP incentives

HOW TO INCORPORATE?

Irish incorporation is a fairly straightforward process. Once you have identified the type of company you wish to set up (e.g. LTD, Unlimited or DAC), the following is required by the Irish Companies Registration Office (the "CRO") prior to incorporation:

- Constitution or Memorandum and Articles of Association

- Form A1 specifying the Company's name, registered office address, principal activity, various details of the directors and secretary and the company's subscribers and their shares; and

- A fee of €100 (or €50 if done electronically).

WHAT DO YOU NEED TO KNOW?

- The Company must have a registered address in Ireland for correspondence and a place of business.

- The preferred name should be precleared with the CRO to confirm availability.

- A Constitution for the Company must be prepared and filed with the CRO. Pre-authorised forms of Constitutions allow for speedy processing.

- The company must have at least one director (and at least two if a company type other than a LTD is used). The board of the company will need an EEA resident director, or an insurance bond will need to be put in place.

- The company must also have a company secretary.

HOW LONG DOES IT TAKE?

Once the complete paperwork is filed, there is an average 5 working days' time frame for incorporation if a standard Constitution is used. If a tailored constitution is used, the CRO may take up to 2 weeks to process the incorporation.

HOW TO MAINTAIN/TRANSFER REGULATORY AUTHORISATIONS?

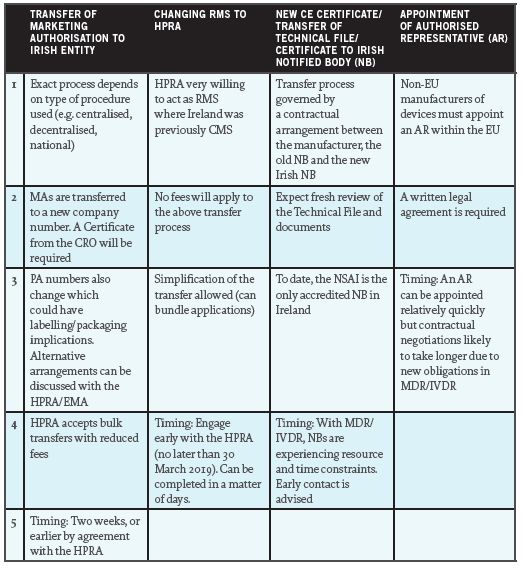

Much of the momentum behind life sciences companies establishing a presence in Ireland is for regulatory purposes. The following table sets out a few conditions and tips to keep in mind if you are going through a regulatory change.

This article contains a general summary of developments and is not a complete or definitive statement of the law. Specific legal advice should be obtained where appropriate.