On 14 November 2022, the Central Bank of Ireland ("Central Bank") hosted a seminar on the Sustainable Finance Disclosures Regulation ("SFDR") for the asset management sector, a further step in the ongoing constructive engagement with the regulator in relation to the implementation of the SFDR and the related EU Taxonomy Regulation. The seminar included a presentation on the data challenges relating to principal adverse impact indicators ("PAIs"), performing the do no significant harm ("DNSH") test with respect to sustainable investments and good governance assessments and a panel discussion on key investor protection issues and industry challenges.

"High expectations" of the Funds Sector

In a speech delivered at the seminar, Deputy Governor Derville Rowland made a number of references to the Central Bank's "high expectations" and high standards for the asset management industry. In her speech, Ms Rowland refers to the Central Bank's Dear CEO letter of November 2021 setting out the Central Bank's supervisory expectations with regard to climate, environment and ESG issues. The five key areas of focus highlighted in that letter were governance, risk management framework, scenario analysis, strategy and business model risk and disclosures.

"Where investments or financial products are described as green or sustainable, this must be meaningful and accurate and based on reliable parameters that are consistently applied both within jurisdictions and across Europe."

Derville Rowland, Deputy Governor, Central Bank of Ireland, 14 November 2022

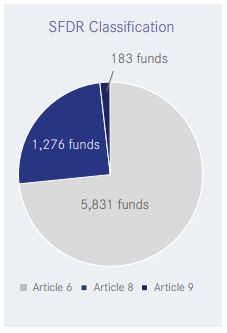

The speech notes that Article 8 and Article 9 SFDR funds remain a small but significant part of Ireland's funds sector, noting that the proportion of these funds is expected to grow over time given investor demand for investment products which are considered sustainable. Ms Rowland notes that the Central Bank is already seeing this in practice, with current authorisation applications being more likely to be structured as Article 8 or Article 9 products.

In relation to the fast track filing process for changes to fund documentation required as a result of the SFDR Level 2 requirements applying from 1 January 2023, Ms Rowland notes, "[O]ur tolerance for any disclosures that do not meet the requirements will be low considering the length of time industry has now to comply with these key regulatory changes."

The speech also confirms that work on the Central Bank's thematic review of funds' compliance with the SFDR requirements has already commenced, although we understand that this will not now be concluded by year end, as had originally been indicated.

Gatekeeper Review of Disclosures

Ms Rowland also referred to the publication of an information note by the Central Bank on the same date, which includes findings of the gatekeeper review of the investment fund disclosures – including good practices – and Central Bank expectations in relation to the implementation of the next phase of SFDR. The note is designed to inform and assist the funds industry in ensuring that investors and the market have a high degree of trust and confidence in green and sustainable products produced and sold from Ireland.

Having conducted a review of a sample of the submissions received since the application date of SFDR Level 1 on March 2021, the Central Bank has helpfully set out the main disclosure issues encountered and outlined the risks that it has observed in terms of potential greenwashing or areas where there has been a lack of transparency or clarity. The paper also sets out identified good practices and the Central Bank's general expectations.

Key Findings of Gatekeeper Review

| Nature of Finding | Relevant Requirement | Finding | Expectations |

| SFDR Classification |

Paragraph 28 European Securities and Markets Authority ("ESMA") Supervisory Briefing May 2022 "Without giving the impression of a "label" to investors, an indication as to under which Article of SFDR (and if relevant, the TR) the UCITS/AIF discloses the relevant information should be mentioned in the fund documentation." |

Where an existing investment fund proposes a change in its SFDR classification, the post authorisation submission should include a detailed rationale and justification explaining the basis for the proposed change. |

Fund managers should:

The Central Bank would not expect numerous changes to a fund's SFDR classification to take place. |

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.