Introduction

The e-stamping system went live on 1 January 2010. In a previous article, in the November 2009 edition of Irish Tax Review, I examined the risk management aspects of the operation of the e-stamping system. In this article I propose to look at a number of areas where practitioners have experienced practical difficulties in the operation of the e-stamping system.

Uptake

When the e-stamping system was introduced it replaced entirely the system of physical stamping of documents. Under the new system a stamp duty return may be filed online via Revenue Online Service (ROS) or by means of a paper return. According to Revenue's statistics, approximately 85% of returns are being filed via ROS. There continues to be high level of errors in paper returns.

It is understood that the use of the online system for filing stamp duty returns by tax agents and practitioners has been lower than the Revenue Commissioners had hoped for. The reasons for this may be linked to the need for the filer to have a ROS business digicert rather than a TAIN (Tax Adviser Identification Number) digicert and the need to put in place a stand alone Revenue Debit Instruction (RDI) for stamp duty purposes. It is understood that some practitioners are filing the stamp duty return online via ROS but remitting the funds by electronic funds transfer or cheque rather than setting up a separate RDI.

Tax Reference Numbers

In order to submit a stamp duty return, it is essential to have a valid tax reference number and corresponding tax type for each of the parties to the relevant document. Any practitioner who is responsible for filing a stamp duty return should verify the tax reference number by requesting sight of correspondence from the Revenue Commissioners or the Department of Social Protection (DSP; formerly the Department of Social and Family Affairs) showing the tax reference number for the relevant party or parties. This information should be obtained before the relevant document is executed. The general conditions of sale in property contracts have been amended to provide that the vendor must provide his or her tax reference number and appropriate vouching evidence for same as a condition of closing. It would be prudent to follow a similar approach in other types of stampable transaction.

Application and Registration of PPS Numbers

Applications for Personal Public Service (PPS) numbers must be made to the DSP. Irish residents who have not been previously allocated a PPS number must complete the application form REG1 and submit it with the appropriate identity documents to their local DSP office. Proof of identity is a very important aspect of the registration procedure, details of which are set out on the DSP website.

A similar application process applies to non-resident applicants. However, a modified process has been put in place for non-resident applicants in respect of applications for PPS numbers for capital taxes and stamp duty purposes. In such cases applications may be made to the DSP office in Carrick-on-Shannon. The DSP will accept applications from a solicitor acting on behalf of a non-resident party needing a PPS number for capital tax and stamp duty purposes. The DSP will accept certification from the solicitor that the identification documents submitted are correct. This avoids the necessity for a non-resident applicant to have to appear in person at a DSP office.

Once the PPS number has been received from the DSP, it must be registered on the Revenue Commissioners' Central Registration System (CRS) under the relevant tax head before it can be used in a stamp duty return. An unregistered PPS number may cause a stamp duty return to be rejected by the e-stamping system. The DSP notification letter (which should contain all of the information required for registration in the CRS) should be presented to the Revenue Commissioners for registration. The DSP notification letter and a letter requesting registration should be sent to Dublin Stamping Office, Stamping Building, Dublin Castle, Dublin 2, by the PPS number-holder or someone authorised to act on his or her behalf.

Some people may hold a valid PPS number that has not been registered in the Revenue Commissioners' CRS. Such a PPS number must be presented for registration to the Dublin Stamping Office of the Revenue Commissioners before it can be used in a stamp duty return.

"Level W" Format PPS Numbers

The DSP has deactivated "Level W" format PPS numbers (for wives using their husbands' PPS number) that have not already been registered in the CRS and are not in current tax usage. Such numbers will not be accepted by the Revenue Commissioners' systems and could give rise to a delay in completing a stamp duty return. In such cases the person should contact the Client Identity Services section of the DSP in Carrick-on-Shannon to establish whether a replacement number has been issued by the DSP or to arrange the issue of a new PPS number.

Further guidance on this topic is contained in the Revenue Commissioners' guidance notes.

Customer Reference Numbers for Foreign Companies

The Revenue Commissioners have provided a fast-track process for obtaining customer reference numbers for foreign-registered companies that are not registered for tax in Ireland. A customer reference number will allow such a company to be listed as a party on a stamp duty return. Such a number can only be used for stamp duty transactions and cannot be used in returns for any other tax type. Applications for such a number are made to the Dublin Stamping Office and can be made either by the non-resident company itself or by a solicitor acting for the company.

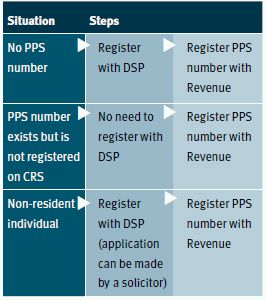

Summary of Steps in Application Process

The Revenue Commissioners have published detailed guidance on their website (www. revenue.ie) on the procedures for applying for various forms of tax reference numbers.

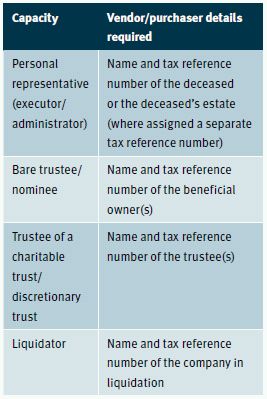

Tax Reference Number in Fiduciary Situations

In the course of designing the e-stamping system, it was recognised that in certain cases the tax reference number of a party acting in a fiduciary capacity would not be required to be included in a stamp duty return. The Revenue Commissioners have issued guidance on what tax reference numbers should be entered in the stamp duty return in certain situations. The table contained in the Revenue Commissioners' current guidance notes is reproduced below.

Business Transfer Agreements

The e-stamping system currently does not allow an apportionment of the assets being acquired in a business acquisition to be entered in a stamp duty return. In many acquisitions of businesses, the assets acquired comprise a mixture of assets, some of which attract a stamp duty charge (for example, land and goodwill) and some of which do not (for example, intellectual property). There is a risk that, if the e-stamping system is used to calculate the stamp duty liability on such transactions, it may give an inaccurate result. The system also requires an address for the business to be provided as a mandatory field entry. In many situations, the business assets being acquired may not include the acquisition of a business premises, and in such cases practitioners may not be able to submit a stamp duty return in the normal way. These problems have been brought to the attention of the Revenue Commissioners, who have indicated that they are working to resolve them, but it may be the end of 2010 at the earliest before they are resolved. In the meantime, it is recommended that practitioners should not rely on the calculation of stamp duty produced by the e-stamping calculator in relation to such transactions but should compare it with their own assessment and, if necessary, seek clarification from the Revenue Commissioners.

Adjudication Cases

Where adjudication is mandatory under the stamp duty legislation, the e-stamping system will automatically select such stamp duty returns for adjudication. In addition, the e-stamping system in practice selects certain other cases for adjudication. The Revenue Commissioners have stated that the e-stamping system is simply applying similar protocols to those that were applied by them before the introduction of e-stamping. There is currently no guidance available on when such non-statutory adjudication cases arise or what criteria are being applied in such cases. These situations can be frustrating for practitioners and their clients because the filer of the stamp duty return does not necessarily receive any explanation in his or her ROS inbox if a return has been selected for adjudication in such a manner. This issue and the general issue of delays in adjudication have been raised with the Revenue Commissioners.

Stamp Duty Audits and Document Retention Policies

Limited guidance on this topic has been issued by the Revenue Commissioners. They have indicated that a certain proportion of stamp duty returns are selected for post-stamping audits and that they will contact the accountable person in the first instance to advise him or her that a return has been selected for audit and to request the person to provide the records to support the information filed in the return.

Although the obligation to retain documents is imposed on the accountable person, it is inevitable that the person will turn to the agent who acted on his or her behalf in filing the stamp duty return for assistance in dealing with the audit. It is very important, therefore, that practitioners engaged in filing stamp duty returns ensure that their client is aware of the necessity to retain records of the relevant transaction.

There is also potential exposure for practitioners to a €3,000 penalty under s8A SDCA 1999 where a practitioner files a return that does not reflect the facts and circumstances of which he or she is aware. The Revenue Commissioners have not issued guidance on the interpretation of "awareness" beyond stating that it is not intended that a penalty will arise in the case of innocent error on the part of the practitioner.

In the context of such potential penalties the Revenue Commissioners have set out in their guidance to practitioners as follows:

"The practitioner is advised to retain a record of the facts and circumstances declared to him/her by the accountable person and subsequently reflected in the stamp duty return by the practitioner."

It is advisable that practitioners at a minimum request their clients to approve a draft of the stamp duty return before filing such return. This, however, may not constitute a comprehensive record of the instructions received because, while preparing a return using the online system, the practitioner has to select from various menu options that ultimately lead to the calculation of the stamp duty liability. These selections will not be visible in the final draft of the stamp duty return that the practitioner proposes to submit. Therefore, it may not be possible for a practitioner to demonstrate that his or her client approved all of the information that the practitioner inputted in the stamp duty return.

Conclusion

The introduction of the e-stamping system, although not without its problems, has been fairly successful overall. Further enhancements are required to the system, and the Revenue Commissioners are working on certain improvements.

LK Shields Solicitors is one of the leading law firms in Ireland. Founded in 1988, today we number some 23 Partners, 70+ fee earners and 130 staff. Our principal areas of practice include corporate, litigation and dispute resolution, commercial property, intellectual property and technology, financial services, employment, pensions and employee benefits.

© LK Shields Solicitors, 2010. All rights reserved.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.