Enforcement of loans continues to be a challenge, particularly, enforcement by the purchasers of debt. Equally, there have been helpful developments for secured and unsecured lenders and receivers appointed by them.

Key developments during 2016 include:

- Increased judicial restraint on repeat litigation and the narrowing of issues in appeals

- Greater clarity in relation to jurisdiction in possession proceedings

- Procedural changes in relation to substitution applications

- The introduction of rent control in certain areas

Restraint on repeat litigation and limitation of issues in appeals

The trend for vexatious litigation continued during the course of the year. The courts' increased willingness to appropriately address litigants in these types of cases is a positive development.

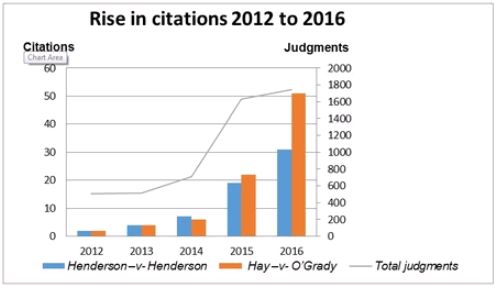

In that regard, to limit repeated litigation of the same issues and to limit the issues in appeals, parties typically rely on the rule in Henderson v Henderson1 and the principles set out in Hay v O'Grady2, respectively.

It is illustrative to note that the past two years have seen a steep rise in the number of judgments which reference those cases.3

Repeat litigation - the rule in Henderson v Henderson

This rule, with limited exceptions, prevents:

- the same parties (or slight variations in parties - for instance by adding a company controlled by the original parties4 or adding a defendant5);

- from re-litigating issues in new proceedings;

- where the grounds on which they propose to contest the issues could have been pleaded in earlier proceedings;

- even where the issues were not pleaded in error.

Appeals - the principles in Hay v O'Grady

These principles may be summarised as follows:

- were the findings of fact made by the trial judge supported by credible evidence? If so, the appellate court is bound by the findings, however voluminous and apparently weighty the testimony against them?

- did the inferences of fact depend on oral evidence of recollection of fact? If so, the appeal court should be slow to substitute its own different inference?

- in regard to inferences from circumstantial evidence, an appellate court is in as good a position as the trial judge in that regard. Did the judge draw erroneous inferences?

- was the conclusion of law drawn by the trial judge from a combination of primary fact and proper inference erroneous? If so, the appeal should be allowed.

Helpfully, during 2016, the Court of Appeal made it clear that these principles also apply to findings made by the Financial Services Ombudsman.6

Comment

Awards of costs normally act as a deterrent to litigants issuing proceedings that are bound to fail, especially repeat proceedings. Unfortunately, such awards have no effect as regards litigants with no assets. The increased citation, in particular of Henderson v Henderson, indicates that the courts are becoming more willing to respond to repeated litigation by these parties.

Where can repossession proceedings be issued?

Over the past few years, mortgagees seeking possession of secured properties have encountered well-publicised difficulties due to various judgments which created uncertainty as to whether the Circuit Court or the High Court are the appropriate venues for such proceedings.

Many of these difficulties stemmed from the fact that the jurisdiction of the Circuit Court is limited by statute. For example, the Circuit Court has jurisdiction in relation to property where the rateable valuation did not exceed a set maximum. Rating of residential properties ended in 2001.

In Permanent TSB v Langan7, the Court of Appeal decided between two conflicting High Court judgments and held that the Circuit Court did not have jurisdiction based on rateable value where the property is not rated. This decision is being appealed to the Supreme Court.

Following the end of domestic rating, the Courts Act 2004 provided jurisdiction to the Circuit Court based on market values. That legislation languished for over a decade as it was not commenced. However, it was amended slightly by the Courts Act 2016 and finally commenced on 11 January 2017 thereby bringing clarity to the situation.8

The Circuit Court now enjoys jurisdiction in relation to property the value of which does not exceed €3,000,000.

It is now relatively clear when new possession proceedings may be commenced. However, as the legislature cannot interfere in existing proceedings9, these proceedings need to be considered on a case-by-case basis.

Omnibus substitution applications

Where loans are sold and the interest in the loan and/or the security is vested in the purchaser, it is necessary for an application to be made to substitute that purchaser for the original lender in any on-going proceedings where the original lender is the plaintiff.

Given the volume of cases that are involved, particularly in the very large loan sale transactions, an established practice had developed whereby omnibus substitution applications were brought to substitute the purchaser as plaintiff in all proceedings brought by the vendor against borrowers. This was in ease of the applicant and the courts to avoid a multiplicity of almost identical applications.

However, in IBRC v Kennedy, the Court held that there was no basis on which omnibus applications could be brought in respect of proceedings in the Circuit Court. For further information, please see this article.

Following this judgment, the High Court has become resistant to these applications being issued in the High Court.

While this approach increases the amount of paperwork and costs for the acquirers of loans, it has no substantive effect on substitution applications.

Rent control

The Planning and Development (Housing) and Residential Tenancies Act 2016, introduced in December 2016, introduced effective caps on increases in rent in private rented accommodation in 'rent pressure zones' at 4 % per annum. The Dublin and Cork regions were designated as rent pressure zones and additional zones have been added.

The Act also introduces restrictions on terminating multiple tenancies in the same development to facilitate sale. This provision has now been commenced and it clearly has the potential to materially affect a secured lender's ability to dispose of a portfolio of assets with vacant possession.

We note that a previous statutory rent control regime was subject to a successful challenge as being unconstitutional. Accordingly, we anticipate that a challenge may be mounted in relation to the new regime.

Footnotes

1. [1843] 3 Hare 100.

2. [1992] 1 IR 210.

3. Based on written judgments available on Westlaw.IE, across cases of all types, not discounting for judgments available as unreported and also listed in law reports.

4. O'Donnell & Ors v Bank of Ireland & Ors [2016] IECA 273

5. Kearney v Allsop Ireland & Ors [2016] IEHC 166

6. Derek O'Regan v Financial Services Ombudsman [2016] IECA 165.

7. [2016] IECA 229.

8. S.I. No. 2 of 2017.

9. Buckley v Attorney General [1950] IR 67 at 84.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.