Eight of the top ten fines ever issued under the Foreign Corrupt Practices Act (FCPA) were levied on European companies. How can non-US companies be prosecuted under US anti-corruption laws?

All companies using US bank accounts are subject to US anti-corruption laws. A transaction involving payment in US dollars is enough to give rise to the jurisdiction of US enforcement authorities. The recent global bribery resolution between the US Securities and Exchange Commission (SEC), the US Department of Justice (DOJ), Dutch authorities and Swedish firm, Telia Company AB underscores the US Government's continued commitment to robust white-collar crime enforcement, a commitment which extends beyond the geographical boundaries of the US.

US ENFORCEMENT AUTHORITIES: THE SEC AND DOJ

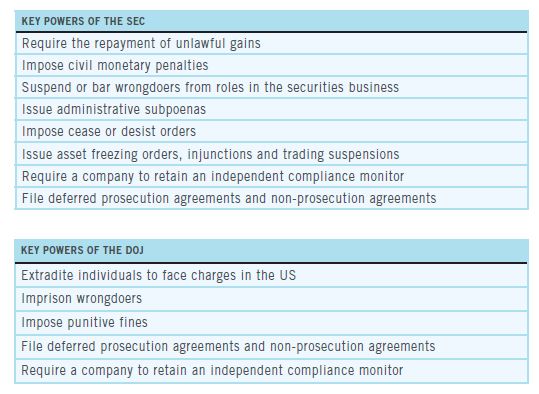

The SEC and the DOJ share enforcement authority for the FCPA. While the SEC enforces civilly, the DOJ is responsible for criminal enforcement. Potential penalties under the DOJ regime are more severe and include imprisonment. The SEC will often, as it did in the Telia case, refer a matter to the DOJ and provide assistance to the DOJ in its investigation of a matter. An individual may be a witness in an SEC investigation and subsequently become a subject and/or target in a DOJ prosecution. Successfully defending a civil prosecution does not mean that criminal prosecution is not a possibility. A company or individual can be subject to both civil and criminal prosecutions.

THE TELIA CASE

Telia, a Swedish telecom company whose securities historically traded publicly in New York, participated in a bribery scheme with Uzbek government officials, paying approximately US$331 million in bribes to acquire access to the Uzbek telecommunications market. Telia and its Uzbek subsidiary, Coscom LLC later found themselves the subject of civil and criminal investigations in the US. US authorities instituted civil and criminal investigations in the US against Telia and Coscom. On 21 September 2017, the third largest global FCPA resolution in history was announced – a settlement of just under $1 billion.

THE LONG ARM OF THE SEC

The SEC had the power to investigate Telia and Coscom for a number of reasons:

- Telia was a US issuer of publiclytraded securities at the time the bribery scheme was entered into;

- improper payments were made in US dollars (through an offshore company based in Gibraltar);

- US-based email accounts were used (some of the conspirators sent emails while in the territory of the US); and

- unnamed US citizens and companies helped establish the relationship with the government official in Uzbekistan.

These are not the only criteria upon which US agencies can become involved.

PENALTIES AWARDED

In the SEC proceedings against Telia, the company made a settlement with the Public Prosecution Service of the Netherlands and the SEC – agreeing to pay civil penalties of approximately US$457.2million.

In proceedings initiated by the DOJ, Coscom pleaded guilty to conspiracy to violate the FCPA anti-bribery provisions. Telia was charged by the DOJ with the same offence and entered into a threeyear deferred prosecution agreement to pay a criminal penalty of approximately $548.6 million.

The total amount of criminal and regulatory penalties levied on Telia and Coscom by US, Dutch, and Swedish authorities is reported as US$965.8million, the third largest global FCPA resolution in history.

AVAILABILITY OF COOPERATION CREDIT

Telia received mitigation credit for its cooperation with the DOJ criminal investigation and for engaging in extensive remedial measures, including terminating the employment of the individuals responsible for the wrongdoing. Telia's remedial efforts – and its existing compliance program – led to a DOJ determination that an independent compliance monitor was unnecessary. If it had voluntarily self-disclosed its misconduct to the DOJ, Telia may have received greater mitigation credit.

COMMENT

US authorities will vigorously pursue any alleged violations of US anticorruption law in foreign jurisdictions. Where violations exist, the long arm of the SEC knows no boundaries. And when you meet the SEC, the DOJ is never far behind.

This article contains a general summary of developments and is not a complete or definitive statement of the law. Specific legal advice should be obtained where appropriate.