The Italian Simple Partnership ("Società Semplice" or "SS") is one of the most widely used corporate structures in Italy as a vehicle for managing investments in the real estate sector, especially by family offices or private individuals.

This corporate structure was also chosen by the Agnelli family (one of the Italian wealthiest families) for their 'Dicembre Società Semplice'.

The Dicembre Società Semplice is the family safe, placed at the top the group that owns control of Stellantis, Ferrari, Cnh Industrial, Juventus, Gedi Group, Iveco, Louboutin, The Economist and others for a total value of around 28 billion Euros. This certifies the ductility of this tool.

Let's delve now into the concept of Società semplice in Italy.

|

The use of this corporate structure is advisable for the following reasons:

|

1. Società Semplice: Civil Law Aspects

The Società Semplice is the most basic type of partnership recognized in Italian law, characterized by simplicity and flexibility. Its main characteristic is that it can only have as its object the pursuit of non-commercial gainful economic activities. But what does it mean?

The Italian law is concerned with delimiting the scope of operations of a Società Semplice only in negative terms. It establishes that "a Società Semplice cannot engage in commercial activities". As a result, the activities listed in Article 2195 of the Italian Civil Code are prohibited for a Società Semplice, namely:

- Industrial activities involved in the production of goods or services;

- Activities involved in the intermediation of goods circulation;

- Land, water, or air transportation activities;

- Banking or insurance activities;

- Any other auxiliary activities related to the aforementioned ones.

However, a Società Semplice can engage in other activities not included in the aforementioned list, such as:

- Agricultural activities;

- Intellectual professions (whether requiring registration in a professional register or not);

- Real estate asset investment activities.

Characteristics |

Description |

Entities |

|

Commercial activities |

Activity carried out in an economic manner and with "industrial" characteristics, meaning in a complex manner that involves the use and coordination of one or more means of production. |

Commercial Companies |

|

Non-commercial gainful economic activities |

Activity carried out without the need for coordination of means of production, in the absence of an industrial-type organization. Its purpose is to generate a profit, and it excludes the possibility for partners to directly use the company's assets (for example, a company that owns multiple properties intended for stable rental without the provision of additional ancillary services). |

Commercial companies AND Società Semplice |

Before delving into the practical applications of a partnership as

a vehicle for managing real estate assets, it is appropriate to

provide a brief overview of the legal characteristics of this

entity.

|

In summary, a Società Semplice is characterized by the following aspects:

|

The incorporation of a Società Semplice does not

require any formal procedures and a minimum capital.

It can be established through a simple written agreement between the partners, although a notarized agreement is highly advisable. The agreement should outline key aspects of the partnership, such as the nature of the business, capital contributions, profit and loss sharing, decision-making procedures, dispute resolution mechanisms.

It is It is also possible to insert clauses concerning the participation of the single shareholders in profits and losses as well as clauses containing rules to be observed in the event of the death of a shareholder. In the event of the death of one of the partners, only the shares of the company (which may also have a very low value) will be included in the succession, and not directly the properties owned by the company, thus avoiding paying property transfer taxes.

The following table displays some of the most relevant clauses that can be included in the articles of association of a Società Semplice:

Type of Clause |

Explanation |

|

Profit-sharing and loss-sharing rules |

Italian law prescribes the criteria for distributing profits and losses among the shareholders. The articles of incorporation of the Società Semplice may, however, provide for different rules on distribution. |

|

Shareholders' Waiver of Profit Distribution |

Shareholders may waive the distribution of profits in whole or in part. Such a waiver may take place on a case-by-case basis or, once and for all, in the articles of association. |

|

Rules to be observed following the death of a shareholder ("Continuation clauses", company dissolution or "consolidation clauses") |

Following the death of a shareholder, we can identify these types of clauses: - Clauses imposing the necessary continuation of the company with only the superseded partners (consolidation clause); - Clauses imposing the necessary continuation of the company with the heirs of the deceased (continuation clauses); - the dissolution of the company |

Liability in a "Società Semplice" is typically

joint and several among the partners. This means that each partner

is personally liable for the partnership's debts and

obligations, and creditors can pursue any partner individually for

the full amount owed. It will still be possible to establish

'limited' liability for non-managing shareholders in the

articles of association.

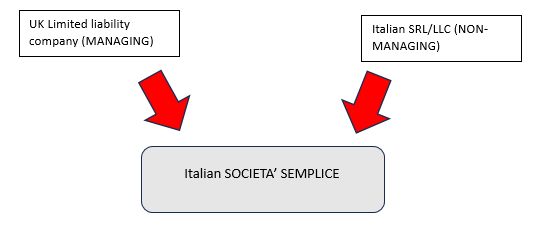

In any case, it is always possible for the partners of a Società Semplice to be two corporations with limited liability (Italian or foreign).

In this way, liability is limited for both partners.

Another advantage is that a specific creditor of a shareholder cannot seize the shareholders share in the Società Semplice, as long as it exists.

This means that the Societa Semplici that own family properties can be a valid alternative in terms of asset protection compared to mere co-ownership of real estate held by individuals, as in this case, the debts of an individual co-owner cannot be enforced against the entire property by seizing their share. [Cassazione]

2.. Società Semplice for the management of Real Estate

The Società Semplice may also have as its object the management of real estate provided that the memorandum of association expressly excludes the exercise of any commercial activity.

The Società semplice appears to be an excellent entity for the managing of Real Estate in Italy assets for several Reasons:

- It has full legal capacity, meaning it can hold any kind of rights or assets;

- It can function as an aggregator of wealth from multiple individuals, allowing for unified administration and greater benefits as the assets grow;

- It avoids the issues related to co-ownership of real estate, such as division disputes;

- The partnership shares can be held by foreign companies, thus protecting the investment from personal creditors. This fully addresses the need for asset protection;

- It is subject to a different tax regime than commercial companies, specifically the same as that for individuals;

- It has low management costs;

- There is no requirement for shareholder meetings and no obligation to maintain accounting records or prepare financial statements as specified in Article 2214 of the Civil Code.

The use of a Società Semplice in family contexts seeking to protect their assets finds its greatest expression.

Individuals, who could be wary of the concept of "dispossession" (i.e.: Trust), turn to corporate tools that still allow for direct enjoyment of their assets. They find a valuable ally in the partnership's articles of association, which, as seen before, can be customized to meet diverse needs, especially when the assets are intended exclusively for the benefit of the nuclear family, excluding, for example, non-blood relatives (through written agreement).

3. Società Semplice and Real Estate: tax prospective

A Società Semplice is treated as an individual for tax purposes and will therefore be subject to the same taxation as an individual person.

In addition, a Real Estate Società semplice offers other significant tax advantages.

|

As previously mentioned, the Società Semplice is taxed

similarly to individual persons. This means that if the

Società Semplice earns different types of income, that

incomes will be attributed transparently to the shareholders,

proportionally to their respective share of profit participation,

REGARDLESS of actual receipt.

The partners will apply personal income tax on such income from

their shareholdings on a progressive basis.

The management of real estate assets through the instrument of the Società Semplice presents noteworthy tax advantages that have been confirmed in recent practice provisions. This is also a result of the increased use of the Società Semplice due to legislative measures periodically proposed regarding the "facilitated transformation" of commercial companies engaged in property management into Società Semplici (recently seen in Law No. 232/2016).

Finally, but not least important, is the role that a Società Semplice can play in the context of generational transfer.

It can serve as a valuable tool in facilitating smooth succession planning and wealth transfer between generations. By structuring the ownership of real estate assets within a Società Semplice, it becomes easier to transfer the ownership and management of those assets to the next generation. This allows for continuity in the administration of the properties and the enjoyment of their fruits, as well as potential tax benefits.

In fact, the inheritance or donation of shares to spouses and direct descendants is subject to a tax rate of 4% (with a tax-free threshold of 1 million euros), applied to the value of the assets and rights belonging to the partnership net of liabilities. However, by contributing movable and immovable assets to Società Semplice and subsequently donating the bare ownership of the shares to the heirs, it is possible to achieve tax savings compared to traditional inheritance, as the recombination of bare ownership and usufruct does not incur inheritance tax.

Since the value of the bare ownership increases with the donor's age, the tax savings largely depend on the timely execution of the generational transfer. Finally, this corporate structure allows the donor, as the managing partner, to continue administering the donated assets and enjoying the benefits generated by the partnership's assets.

4. Conclusions

In conclusion, the Italian Società Semplice proves to be an ideal tool for real estate investment in Italy also in the context of generational transfer. Its streamlined bureaucratic procedures, flexibility in management, tax advantages, and ease of succession planning make it a preferred choice for individuals, family offices, and private investors.

The Società Semplice offers the benefits of limited formal obligations, customizable articles of association, and the ability to hold various types of assets.

Furthermore, its tax treatment as an individual entity provides tax advantages such as the certification of rental income with a simple receipt, application of registration tax at reduced rates, and the ability to transfer assets with potential tax savings (i.e: NO CAPITAL GAINS IN CASE OF SALE OF REAL ESTATE ASSETS IN ITALY HELD FOR MORE THAN 5 YEARS)

The Società Semplice also allows for the continued administration and enjoyment of the donated assets by the donor, making it an attractive option for wealth preservation and continuity.

In light of its many advantages, the use of a Società Semplice in real estate management and generational transfers is an effective and efficient solution for individuals and families seeking asset protection and optimal tax planning.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.