Financial statement disclosure obligations in Italy are based on company size, taking into account the average number of employees, balance sheet total and turnover.

Foreword

With European Directive 2013/34/EU of 26 June 2013 the EU legislator enacted new undertakings measurement bases, with a view to simplifying the administrative requirements concerning the drafting and publication of the financial statements for small-sized undertakings and harmonising the regulatory framework at an international level, as far as larger-sized companies are concerned.

In fact, art. 3 of the directive establishes the categories of undertakings, separating micro enterprises from small, medium and large enterprises, whereas in the case of corporate groups, small groups are separated from medium and large groups.

The directive was transposed into the Italian legal system by Legislative Decree No. 139 of 18 August 2015,which introduced new financial statement disclosure obligations based on company size regarding the average number of employees, balance sheet total and net turnover.

Categories of undertakings and groups

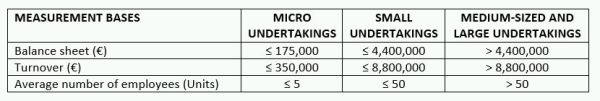

Even though the EU legislator had identified a classification of four categories of undertakings (micro, small, medium and large), the national law-maker, having regarded the size of the Italian market, preferred grouping medium and large-sized enterprises in one single category. As a result of this simplification, three categories of undertakings have been identified for accounting purposes: micro undertakings, small undertakings and medium-sized / large undertakings.

The figures in the table below show the values, at least two out of three, to be complied with at the balance sheet date, in the first financial year or, later, for two consecutive years:

Micro undertakings

Legislative decree No. 139/2015 introduces in art. 2435-ter of the Italian civil code the new simplified measurement bases for "micro undertakings", which are exempted from drawing up:

- the cash flow statement

- the notes to the financial statements, if the information envisaged by the first paragraph of article 2427, numbers 9) and 16) of the Italian civil code is already disclosed at bottom of the balance sheet

- the management report, if the information requested by numbers 3) e 4) of article 2428 of the Italian civil code is already disclosed at bottom of the balance sheet.

As far as the preparation of the financial statements is concerned, micro undertakings can draw up condensed financial statements, in the simplified version already envisaged according to article 2425-ter of the Italian civil code, as amended by Legislative Decree No. 139/2015, in particular:

- in the balance sheet, for tangible and intangible fixed assets, the recording of amortization, depreciation and write-downs is no longer envisaged

- in the profit and loss account:

- The extraordinary part classified under the letter "E) Extraordinary income and expenses" has been eliminated;

- It is possible to group items D18a, D18b, D18c and D18d (write-up of investments, financial assets other than investments, securities recorded as current assets, derivatives);

- It is possible to group items D19a, D19b, D19c and D 19d (write-down of investments, financial assets other than investments, securities recorded as current assets, derivatives);

- the provisions related to the measurement of derivatives at fair value are excluded.

Small undertakings

The provisions of the Civil Code governing the measurement bases of "small undertakings" is indicated in art. 2435-bis of the civil code. They (i) are exempted from the preparation of the cash flow statement and management report, (ii) but are obliged to draw up the notes to the financial statements and, (iii.) for the valuation of securities, receivables and payables they are not required to apply the amortised cost method.

As to the preparation of the accounts, they may adopt abridged financial statements. However, the obligation to disclose any supplementary information where it is necessary to provide a true and fair view of the situation remains valid.

Medium-sized and large undertakings

Articles 2423 and following of the civil code provide the most extensive and analytical disclosure requirements for these categories of enterprises. In fact, both "medium-sized undertakings " and "large undertakings" are obliged to prepare the cash flow statement, the notes to the financial statements and the management report. For the valuation of securities, receivables, and payables they must apply the amortized cost method; if they enter into derivative contracts, they are to abide by the rules established by the IFRS.

As to the basis of preparation of the financial statements, besides being regulated by the Civil Code, they are analytically recalled by the accounting principles (OIC- Italian accounting organization).

In this regard, in case of doubts, to be better informed, it is best to refer to the international accounting principles issued by IASB (International Accounting Standard Board).

For these undertakings, the financial statements are to be made up of: balance sheet, income statement, notes to the financial statement and cash flow statement (which thus becomes an autonomous statement).

In broad terms, in accordance with articles 2424 and 2425 and of the Italian civil code, as supplemented and amended by Legislative Decree No. 139/2015, the structure of the financial statements shall also contain the following:

As far as the balance sheet is concerned

Treasury shares: they are accounted for as a deduction from equity and are no longer entered on the assets side of the balance sheet.

Research and advertising costs: the words "advertising and research" are eliminated from the wording of item B. I. 3.

Payables and receivables to companies subject to the control of parent companies: the items related to investments and receivables/payables to associated companies have been added.

Derivative financial instruments: additional specific items for derivative assets are entered (including both among tangible fixed assets and in working capital) and for derivative liabilities (including among provisions for risks and charges).

Cash flow hedge reserve: a separate item in equity is entered to deal with the cash flow hedge reserve.

Memorandum accounts: the item is deleted and the information on commitments and risks shall be commented in detail in the notes to the financial statements.

Premiums and discounts: these items have been eliminated, due to the introduction of the amortized cost method for the representation of bonds.

As far as the income statement is concerned

Financial income and expenses: some specific items are introduced in the C class for income resulting from relations with companies controlled by parent companies.

Income and expense from derivative financial instruments: some specific items are introduced in the D Class for income and expenses resulting from changes in the fair value of derivatives (which are not treated as hedging transactions).

Adjustments to financial assets: they are replaced by the D Class "adjustments to financial assets and liabilities".

Extraordinary income and expenses: section E- extraordinary items- is deleted from the scheme and therefore no extraordinary items are permitted in the income statement; they must be included as revenue and cost elements according to their nature and are analysed in the explanatory notes, due to their exceptional nature.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.