It's a well-worn joke to describe a statistician as someone who has his feet in the oven and his head in the fridge, and says that on average he's feeling normal.

So it is that the coverage of the latest Survey of Financial Institutions has largely focused on the industry's 30% drop in gross value added (GVA) compared to 2007. Overall the media have reported the survey in a fair and balanced way, but have understandably highlighted this significant fall in value that the finance sector contributes to the economy.

Why have the Statistics Unit chosen 2007 as the benchmark? Because in that year, as the economy was at its hottest, the contribution reached its peak. In real terms (taking into account inflation) the industry's GVA was £2,320 million – £670 million more than in 2016.

Do these figures demonstrate that the industry doing markedly worse than it was in 2007? Have been in a continuous 'freefall' since then, as one journalist put it? I would argue no. We are simply in a very different market and it is very difficult to compare current performance with 2007, which was an extraordinary year and part of a period is now widely accepted as being both exceptional and unsustainable.

Since the economic crisis of 2008, the financial services industry has been operating with greater regulation and caution than pre-crisis. I would argue that the survey shows that, despite a slight annual fall in its overall contribution, the finance industry has adapted to global changes and continues to be the driving force in Jersey's economy, providing strong employment growth and spending in the Island's shops and restaurants.

We saw very good years in 2014 and 2015, and the trend continues to be positive, but the reality is that the cost of business is rising, and firms are needing to work harder to generate the kind of revenues they were used before the 2007-2008 crisis.

I also believe that the survey demonstrates that Jersey is doing well in an uncertain and changing market, and that our buoyancy vindicates our strategy of focusing on good-quality business and meeting international standards.

Gross Value Added

Gross value added is calculated by adding total operating surpluses and employee compensations together to reach the grand total which was generated. In 2016, that figure fell by 2% in real terms compared to 2015, but it rose by 3% compared to 2013. That's because 2014 and 2015 were very good years. They were not as 'good' as 2007, but I don't think we'll see that level of GVA again.

Take a step back and these figures show that financial services continues to be the driving force in Jersey's economy and resilient in a challenging global economy. The structure of our industry, however, is slowly adapting to the changing world.

Jersey's trust and company administration sector was up 10% year-on-year as increased demand for the expertise that we have continued. The world's wealthy are looking for a safe harbour, particularly at this time of uncertainty, and Jersey provides it. The GVA in the steady, stable and profitable legal and accountancy sectors, meanwhile, remained unchanged, as it did in the funds sector.

But it is the banking sector which is the engine room for the whole industry and for Jersey's economy, and it has been performing effectively in the face of low interest rates. Although the 4% fall in banking GVA led to the slight decline in overall financial services GVA, it should be seen against a backdrop of an industry which is still in the process of adjusting to new world conditions. The banking sector is going through a period of global consolidation, rationalising their costs and presence. Overall, despite the number of banking licences falling slightly, Jersey is a 'consolidate to' jurisdiction, and the industry is performing well.

Employment

After the 2008 crash, the number of people employed in the finance sector fell significantly but as confidence grew, so did staff numbers, and in the past year we have returned to the number of staff seen before the world crisis.

Staff numbers are a strong indicator of economic performance, and it is particularly pleasing to note that recruitment of local staff from school or university remains strong, with 39% more recruited compared to 2007, and 45% more compared to 2012. Our members expect there to be an additional 1,000 vacancies by 2021, and one of the jobs for Jersey Finance is to continue to attract the local community to the rewarding careers they can enjoy.

So with more than 300 local school and university students being directly recruited each year for the past four years, significantly more than in 2007, I think this is one measure of success which is being overlooked.

Productivity

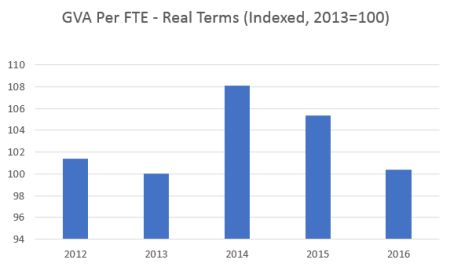

But how productive are all these staff? On the surface, the survey would suggest that it's not as effectively as in previous years. Productivity (inflation-adjusted GVA divided by the number of employees) fell by 4% in real terms compared to 2015, but it would be an error to interpret this as meaning that staff are working less hard or less efficiently.

First, consider the banking community. Their total operating surplus is dependent on interest rates: the higher interest rates climb, the greater the profit made. The same number of employees may be working at exactly the same rate over two years, but if the interest rate falls then so will their productivity. And the banking sector has operated during a period with very low interest rates indeed.

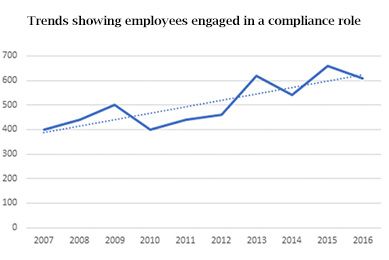

Also consider the environment in which we are operating. It is not a criticism but an observation to say that the increased requirement for regulation and information exchange has affected productivity. There is far more regulation, which brings with it an increase in costs which impacts directly on productivity. Regulatory and compliance staff don't generate revenue and are productive in a way which is measured differently, yet they will have boosted employment numbers, reducing the nominal productivity figure per employee.

Support for the economy

The Survey of Financial Institutions has also shown the support that the industry gives to the rest of the economy. Unlike other research, this survey gives a precise indication of the amount spent by the sector. Total expenditure on employees in 2016 – including salaries, bonus payments, employer social security and pension contributions – remained unchanged compared to 2015, at £780 million. A significant amount of that money went into the local economy, and the survey also shows that the industry spent 15% more on goods and services in 2016 compared to the previous year. Of the £820 million that the industry spent in 2016, more than £1 million per day was spent in Jersey.

Conclusion

So what can we learn from these statistics? The main conclusion should be that the finance sector continues to do well during a time when the global economy is changing. Yes, the total GVA may be significantly lower than it was in 2007, but there is little value in comparing those bald figures. The heat of the economy then has gone and we are operating in a very different environment.

Finally, when interpreting statistics for the real world we should consider the statistician with his feet in the oven and head in the fridge: keep a cool head and take a step back and look at what is really going on.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.