The States of Jersey Chief Minister's Office has published a draft law for consultation, which if enacted would see the introduction of US-style limited liability companies ("LLCs") in Jersey (the "Draft Law").

Carey Olsen is pleased to have supported government in the development of the Draft Law. The full consultation paper (the "Consultation") is available to view on the States' website and provides a background and summary of the provisions of the Draft Law. Feedback, both generally and in response to specific questions, is requested by the 12 January 2018. The Consultation, which demonstrates Jersey's continuing status as a leading international financial centre, has been prepared following initial discussions with various stakeholders including Jersey Finance. It also follows the recent introduction of LLCs to both the Cayman Islands and Bermuda.

What is an LLC?

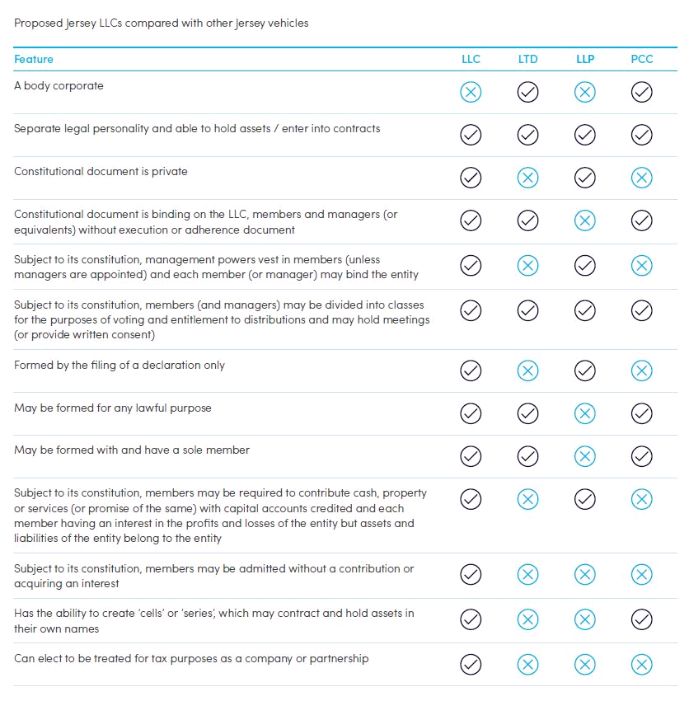

As outlined by the Consultation, the LLC is an entity historically based on mainland-European equivalents (GmbH and S.à r.l). Its popularity means that LLC formations now account for over two-thirds of all transparent vehicle choices in the US each year. A comparison of the main characteristics of the proposed Jersey LLC with other Jersey vehicles is provided in table form at the end of this Article.

Why are LLCs so popular in the US?

LLCs combine the limited liability protection of a company with the constitutional flexibility and privacy of a partnership, whilst also enabling a choice between the management structures and tax treatments of both. LLCs can therefore vary greatly in form depending on the purpose for which they are created and it is that flexibility that helps make them so attractive. As such, they are used for a variety of purposes, from simple businesses undertaken by one or more persons to being the ultimate holding vehicle of large public company structures. They are also popular as special purpose vehicles in many finance and fund structures.

Why does Jersey not already have them?

The available Jersey vehicles tend to mirror those available in England and Wales, where the legislative response to the demand for something akin to LLCs (i.e. separate legal personality to hold assets in its own name but treated as transparent for tax purposes) was the creation of LLPs. Jersey has, to date, mirrored this approach. Use of the LLP is therefore expected to continue however the introduction of LLCs is intended to help cater to our US clients: North American assets and funds administered in Jersey totalled around £169bn in 2016.

If Jersey has LLPs (being the jurisdictional equivalent of LLCs) why introduce LLCs?

Whilst LLPs can be considered the jurisdictional equivalent of LLCs, LLP legislation was brought more into line with existing partnership law in order to achieve tax transparency in the UK. As a result, LLPS are generally more restrictive than LLCs. It is also proposed that Jersey LLCs will have the ability to create "series" within themselves, akin to a protected cell company creating cells (although this feature is not available in all LLC jurisdictions). The LLC can therefore be a much more flexible vehicle, although the LLC agreement can, of course, be made more restrictive. Furthermore, as the introduction of LLCs is predominantly aimed at assisting US investment, the appeal of having a vehicle (and it using terminology) that is consistent with and familiar to that market has obvious benefits. The introduction of LLCs would also mean another potentially transparent vehicle in a world very much conscious of Base Erosion and Profit Shifting (BEPS). Government also believes the Consultation to be consistent with its policy of innovation.

Won't Jersey LLCs run up against the same issues in the UK as US LLCs (which led to the UK and Jersey adopting LLPs)?

In short, yes. However, the LLC is not (currently) aimed at direct investment into the UK, where for those very reasons we envisage the use of LLPs to continue. Recent UK case law also suggests (at least on a case-by-case basis) that the door for recognising LLCs as transparent entities in the UK may slowly be opening. If so, Jersey would be wellplaced to take advantage. The above question also focuses on a scenario where the intention is for the LLC to be treated as transparent for tax purposes. Given some of the advantages of an LLC over a limited company, we may also see LLCs that elect to be taxed as companies being preferred to traditional limited companies.

Do other offshore jurisdictions have US-style LLCs?

Yes: the Cayman Islands and Bermuda both enacted LLC legislation in 2016, which was also reviewed and taken into account when preparing the Draft Law. The Isle of Man also has an LLC law (from 1996) although it is based on the Wyoming version.

How will LLCs be regulated in Jersey?

It is early days but the Draft Law envisages that LLCs will be formed upon registration with the JFSC and required to comply with legislation regarding ultimate beneficial owners and controllers. It is also envisaged that LLCs would be required to engage a Jersey-based financial services provider and therefore Jersey's AML/CFT regime would apply, as well as the usual requirement for a 'COBO' consent in order to raise capital. Providing financial services to an LLC is also intended to be a regulated trust company business under the Financial Services (Jersey) Law 1998. All of this echoes the approach for other Jersey entities and is designed to continue Jersey's reputation as a highly regulated and compliant jurisdiction. As for an LLC conducting any form of regulated financial business itself, this is under review but it is likely that LLCs will be treated the same way as other vehicles in Jersey and legal advice should be taken as to any regulatory requirements for the intended activities.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.