Recent events in the capital markets leading to successive liquidity and credit crises have caused many financial institutions to consider issuing hybrid capital securities in order to replenish balance sheets and improve regulatory capital ratios.

Hybrid capital securities are financial instruments which combine features of both debt and equity obligations and occupy a mezzanine position in an issuer's capital structure. Examples of hybrids range from permanent interest bearing shares to mandatory convertible bonds. They may also take the form of trust certificates as well as limited partnership interests. Where precisely a hybrid capital security sits in the spectrum between debt and equity will depend upon an analysis of the securites' capital characteristics.

A particular attraction with hybrid capital securities is that they are eligible to contribute to a bank or insurance company's capital regulatory requirements and are highly cost effective as coupon payments can be structured as tax deductible.

WHAT ARE HYBRID SECURITIES?

Hybrid capital securities have mixed capital characteristics but need to include sufficient equity-like qualities to be treated as part of an issuer's permanent capital base.

Permanence

Hybrid capital securities may be issued either indefinitely as perpetual securities or with very long dated maturity dates such as 50 years or more.

Call Option

Hybrid securities will frequently be issued subject to the right (but not the obligation) of the issuer to redeem the securities at par after the expiration of an initial 10 year no call protection period.

Step-up Coupon

The terms of issue will typically provide that, if the securities are not redeemed in whole on the first occurring call date, in order to compensate investors against extension risk they become subject to a step-up coupon of up to 100 basis points.

Replacement Capital Covenant

To maintain an appropriate level of permanency on its balance sheet, an issuer may be required by a regulator or rating agency to commit to issuing substitute securities of equivalent capital strength and equity characteristics in order to replace any securities which are redeemed.

Loss Absorbing

Hybrid capital securities are intended to provide protection for creditors and depositors or policyholders of regulated financial institutions and to provide a capital cushion to absorb unexpected potential losses arising from an issuer's operations.

Subordinated

Hybrid capital securities will contractually be subordinated to the claims of external creditors and on a liquidation of the issuer the principal amount of the securities would rank as junior to conventional debt but senior to pure equity.

Coupon Deferral

If the issuer runs into financial difficulties, coupon payments may be deferred. Similar to the position with fixed income preference shares, non-payment of a periodic coupon by an issuer will not trigger an event of default. There are, however, variable consequences of non-payment. Tier One capital securities will typically be non-cumulative whereas with Tier Two securities coupon deferral tends to be cumulative. The difference between cumulative and non-cumulative securities is becoming less distinct as a result of the use of Payment In Kind notes and Alternative Coupon Payment Mechanisms which can defer accumulated amounts until the redemption or maturity of the securities. Terms of issue may also provide that if there is a deterioration in the issuer's business and certain financial tests fail to be met, this will trigger mandatory deferral and non-recoverability of coupon which makes a hybrid perform more like equity.

Dividend Stopper

The economic rights attached to the ordinary share capital of an issuer are intended to be postponed to those which apply in relation to hybrid securities. Accordingly, the issuer may be required to covenant that dividends will not be paid on its ordinary shares if there is any deferral on the hybrid securities' coupon.

ADVANTAGES OF HYBRIDS

By combining sufficient equity features required to satisfy the regulatory requirements with the necessary debt characteristics to qualify for tax deductibility, hybrid capital securities can be used to optimise an issuer's capital structure. The key benefits associated with hybrid capital are:

- long term mezzanine finance which is cost effective in

comparison to ordinary share capital;

- non-dilutive capital in relation to ordinary share

capital.

- coupon payments on qualifying hybrid capital securities are tax

deductible against an issuer's operating income;

- balance sheet management flexibility and the ability to improve

an issuer's return on equity and other financial performance

ratios;

- access to the fixed income investor base and diversification of

funding sources.

TAX ANALYSIS

Interest payments on conventional debt are generally allowable as a deductible expense in calculating taxable income. For tax purposes, a key structuring objective will be for the hybrid securities to be legally characterised as debt so that the issuer can obtain tax relief on coupon payments. In many jurisdictions, however, legislation may prevent interest on hybrids being tax deductible if they are:

- treated as equity for accounting purposes;

- deemed to be equivalent to long-dated debt securities;

- non-cumulative in the event that a coupon payment is

missed;

- used to finance an underlying loan relationship if one of the

purposes was to obtain a tax advantage.

For optimisation of the tax position, in addition to coupon payments being tax deductible, there should be no withholding tax or stamp duties payable on the issue or transfer of the hybrid securities. Investors generally wish to avoid exposure to issuer tax risk and, ideally, the issuer should be zero-rated for tax.

INDIRECT ISSUES

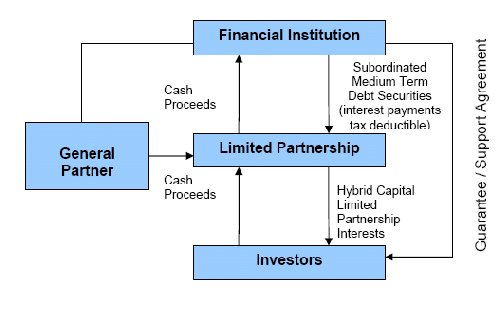

As a result of the complexity arising out of corporate tax legislation in many EU jurisdictions (for example, section 209 of the Income Incorporation Taxes Act 1988 in the UK), the direct issue of hybrid capital securities by a parent or group holding company runs the risk of being not deductible for tax. An increasingly used solution has been to develop an indirect issuance structure which results in a clearer separation of the technical debt and equity characterisations and may also facilitate cross border distribution of securities. Indirect issues involve the use of an intermediate subsidiary company or limited partnership (the "Hybrid Issuer") controlled by the regulated financial institution to issue the securities. A Hybrid Issuer will generally be established in a tax neutral jurisdiction such as Jersey, which has been the preferred location for Tier One structures in recent years. Under the indirect issue model the Hybrid Issuer issues preferred capital securities to investors. The Hybrid Issuer then will apply the issue proceeds to subscribe for subordinated medium term notes ("MTNs") issued by the parent bank or insurance company. Interest payments on the MTNs by the parent will be tax deductible and receipts are used by the Hybrid Issuer to finance coupon payments on the preferred securities. On maturity of the MTNs the redemption proceeds will be used to retire the preferred securities issued by the Hybrid Issuer. In order to enhance the credit rating of the preferred securities, the Hybrid Issuer may have the benefit of a guarantee from the parent institution. In certain circumstances, the preferred securities may also be convertible into shares in the parent.

Limited Partnership Issuer Model

LEGAL INFRASTRUCTURE

One of the key requirements in selecting a suitable jurisdiction in which to establish a Hybrid Issuer is the existence of a modern statutory framework to support the enforceability of the transaction documents. The Bankruptcy (Netting, Contractual Subordination and Non-Petition Provisions) (Jersey) Law 2005 provides for statutory recognition of contractual subordination and payment deferral provisions, regardless of the insolvency of a party to any contractual agreement. The effectiveness of the subordination provisions on the insolvency of an issuer is critical to the efficacy of the hybrid capital proposition. The existence of specific statutory provisions for the enforceability of subordination and deferral clauses provides a high degree of comfort to arrangers and investors that the terms and conditions of securities issued by a Hybrid Issuer established in Jersey will be operative.

ISSUER LOCATION

Jersey has proved to be a popular jurisdiction in which to establish Tier One capital transactions. Its advantages include:

- tax neutrality for issuing vehicle and absence of withholding

tax or stamp duty on securities.

- modern finance and company laws based upon, but more flexible

in application than English law.

- rating agency and investor acceptance of the jurisdiction based

on previous experience of Tier One capital transactions.

- integrated legal and administrative service providers with

in-depth expertise of setting up and running complex finance

transactions.

- time zone convenience with London which facilitates closing of

transactions and on-going administration.

Ogier Hybrid Capital Securities experience

|

|

|

|

|

|

|

|

|

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.