Mexico is comfortably one of the most influential economies in the world and is estimated to be the 7th largest global power in the world by 2050. If you want to incorporate a company in Mexico you will open up opportunities to operate in some of the most dynamic and exciting development spaces in the world with innovation and cutting-edge technology in abundance. The list includes world-class aerospace facilities in Queretaro, a plethora of car manufacturing plants dotted around the country which have turned Mexico's automotive sector into the largest in Latin America as well as a blossoming medical supplies, fintech and renewable energy sectors.

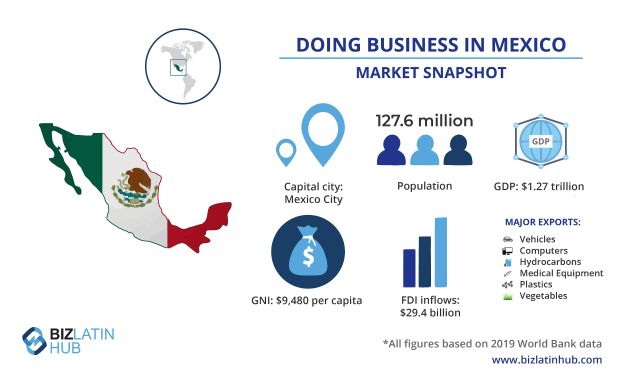

With gross domestic product (GDP) reaching $1.27 trillion in 2019 (all figures in USD), Mexico represents a major market in Latin America. Its proximity with the United States and its access to both Pacific and Atlantic Oceans makes Mexico an ideal trade hub. Many free trade agreements (FTAs) in place with countries and regional associations major market all over the world place it as being the 17th-largest exporter in the world. Mexico's most valuable export goods include computers, vehicles, petroleum oil, medical equipment, and fresh produce. Even if the country export in different market such as Canada, China, Germany, and Japan, more than three-quarters of Mexican exports are destined to the United States.

Incorporate a company in Mexico: Map of Mexico and its main cities

If you are considering doing business in this large and growing market, read on to learn more about incorporate a branch in Mexico, or reach out to us now to discuss your market entry options.

Doing Business in Mexico: Get started with forming your company in Mexico

How to Incorporate / Form a Company in Mexico?

The Mexican Stock Corporation

As with any country, Mexico has a number of corporate structures that all serve slightly different purposes. Arguably the most popular is the Stock Corporation, or S.A. de C.V (Sociedad Anónima de Capital Variable), as it provides the most scope for growth and has a particularly simple formation process to get to grips with. Read on to find out the essential information that you will need to know to form an S.A de C.V.

SEE ALSO: Other company structures and their relevant advantages.

The S.A. de C.V. at a Glance:

Here are some important information to incorporate a company in Mexico.

Is foreign ownership allowed?

– Yes, up to 100% foreign ownership is allowed

Can the company sponsor foreign

employees?

– Yes

Are there capital controls?

– No

Is there a minimum share capital?

– No

What is the minimum amount of

shareholders?

– There must be at least (2) shareholder

Are a fiscal address and legal representation

required?

– Yes

How long does the process take (including the opening of

a corporate bank account)?

– Between 6 and 8 weeks after we have received all the of

the documentation

What are the key steps to incorporate a company in Mexico?

- Define company bylaws

- The formalization of the Incorporation Documents

- Register the company with local authorities

- Open a corporate bank account

- Deposit the required capital to activate the corporate bank account

- Register the company with the Registry of Foreign Investment

- Register the company with the Public Registry of Commerce

- Obtain a Tax ID number

What else must you consider when you incorporate a company in Mexico?

Company Share Capital

The company share capital is the amount of capital (cash or otherwise) subscribed by the shareholders when you incorporate a company in Mexico. The share capital is important and relevant if and when applying for financial loans, working in joint ventures or bidding on local, state or national government contracts. The value of the share capital can impact the ability of a business to be granted loans. A local legal entity with a high share capital will have a greater chance of being granted a loan than a business with a low share capital.

Please note that if debts are owed by the company, the company's share capital may be at risk. The share capital can be increased or decreased at any point during the company's operations, but the share capital should be a number that reflects the company's size and business operations.

In most cases, companies in Mexico begin with a share capital of up to USD$2,500.

Company Formation in Mexico: The country is making significant progress in the World of Technology and is attractive renowed companies to establish operations in the region

Company Legal Representation

The Mexican Company Legal Representative acts as the "legal face" of the business and is the individual who must sign for all company operations; in-turn, they have the legal responsibility to ensure the company operates correctly in the eyes of the local law. This individual must be either a Mexican national or a foreigner who legally resides in Mexico.

Company Fiscal/Legal Address

A fiscal/legal address is a minimum statutory requirement for all legal entities that have commercial operations in Mexico. This address will be registered with the Mexican tax authorities and will be used for all official business communication such as mailing and tax purposes.

Mexican Corporate Bank Account

To incorporate a company in Mexico a corporate bank account will have to be opened.

Corporate Governance Requirements

A board of directors is a group of people who jointly oversee the activities of a company. In Mexico, your company can choose to have a board of directors or a single director, both of which can be foreign individuals.All companies are required to hold an annual general meeting (AGM). The AGM cannot be virtual or held remotely, however, the company can elect a proxy (an agent legally authorized to act on behalf of another).

Originally published 25 November 2018 | Updated on: 27 July 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.