Introduction

On Thursday 19 December 2013, the Minister of Finance on behalf of the President of the Federal Republic of Nigeria presented the 2014 Federal Budget proposal to the National Assembly under the theme "Budget for Job Creation and Inclusive Growth"posed.

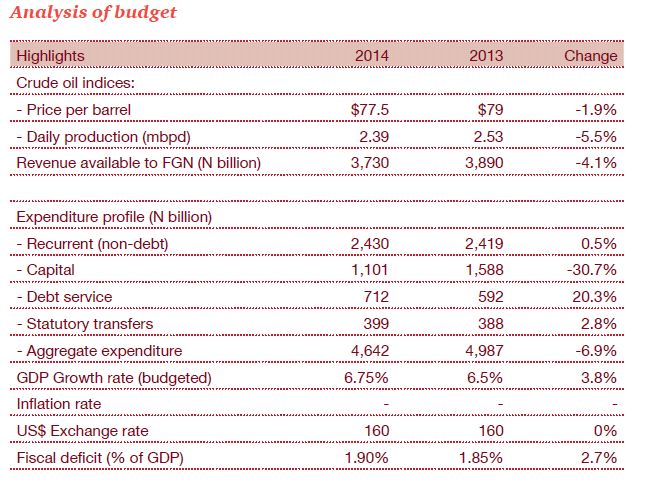

Crude oil indices

The proposed oil price benchmark was the significant dispute between the National Assembly and the Federal Executive that delayed the budget presentation. Due to pressure from the House of Representatives to put the oil benchmark price at US$79, a deliberation between the two chambers of the National Assembly became necessary. After a consensus was reached, the President adopted the recommended benchmark price of US$77.5 per barrel in the budget proposal. The oil price benchmark has been on the increase in the past few years although it is still a conservative amount compared to the market price of around US$104 per barrel projected for 2014 by the International Monetary Fund (IMF) in the October edition of its World Economic Outlook publication. Some justification for the low benchmark may be increasing production of shale oil in the United States. This could ultimately reduce the demand of crude oil from Nigeria and put pressure on price. Other issues include discoveries of crude oil around the world particularly in Africa and potential increase in production quotas by members of OPEC. The US is still Nigeria's biggest customer for crude oil and the internal exploitation of shale oil could eventually reduce demand for Nigeria's crude. Shale oil production has been accelerating in the US, growing from 111,000 barrels per day in 2004 to 553,000 barrels per day in 2011 (equivalent to a growth rate of around 26% per year). As a result, US oil imports are forecast to continue to fall. However, the pace of its impact on global oil prices remains to be seen as pricing could still be influenced by the OPEC cartel and increasing demand for energy in Asia. Overall, we are inclined to favour a conservative benchmark price considering that any negative deviation may lead to significant nonimplementation of the budget. On the other hand, any positive deviation will lead to savings into the excess crude account/Nigeria's sovereign wealth fund.

Revenue generation for government Expenditure

Apart from the price pressures anticipated by the conservative crude oil bench mark price, the budget proposal also assumes a drop in crude oil production in 2014. This may largely be due to anticipated losses from pipeline vandalism, other disruptions and crude oil theft.

The proposed reduction of both the crude oil price and estimated production is indicative of the significant risk the country faces from overdependence on crude oil revenue. Significant shut-ins of oil production and price drops could adversely impact on the performance of government at all levels.

Given this reality, the government has continued to take steps towards improving non-oil tax revenue. Some of the notable measures employed by the Federal Inland Revenue Service (FIRS) are aimed at improving voluntary compliance. Such measures include the ongoing introduction of Integrated Tax Administration System (which is expected to be fully implemented in 2014), increasing awareness of the self-assessment regime, and the recent introduction of transfer pricing. The government has also engaged external consultants to help identify and block tax leakages.

The budget put the projected gross federally collectible revenue at N10.88 trillion, while N7.16 trillion was projected as gross federally collectible oil and gas revenue. The total deductions, including cost of crude oil production, subsidy payments, and domestic gas development is N2.15 trillion which is the same in the 2013 budget.

Subsidy payments were maintained at the 2013 level of N971.1 billion while N3.29 trillion was budgeted as gross federally collectible non-oil revenue.

This portends a likely onslaught on taxpayers by the various revenue authorities to meet revenue projections. Unfortunately, for multinationals and big indigenous corporations in Nigeria, the culture of the tax authorities historically has been to focus on collecting more from compliant taxpayers rather than expanding the base to bring evaders into the tax net. Taxpayers should therefore consider strategies to mitigate issues that may arise from tax audits through more transparent reporting, proper documentation and periodic tax healthcheck. Thin capitalisation rules are also anticipated in the near future which would specify a debt to equity ratio for cross-border investments. This would restrict the amount of interest that is deductible for related party loans.

Recurrent expenditure (non-debt)

Despite promises to device ways to significantly reduce recurrent expenditure, the government has proposed an increase in recurrent expenditures which have little or no long term positive impact on the economy. Recurrent expenditure, which accounts for about 52% of the total budgeted expenditure, is planned to increase by 0.8% compared to 2013. This increase in recurrent expenditure (about N20 billion) may become the trend in the future in view of the continued pressure for higher emoluments, allowances, pensions etc. resulting in huge personnel outlay.

Also, the increase is partly attributable to efforts of the federal government to create jobs although it remains to be seen whether this will make any noticeable impact. The increase in recurrent expenditure for the creation of government employment may lead to duplication of functions in government parastatals, ministries, departments, and agencies. Real job creation would not normally occur from increasing number of staff but through stimulation of economic activities especially in the private sector and execution of capital projects. If and when electricity supply improves, the private sector, SMEs in particular, will be able to generate significant employment on a sustainable basis. The new employment and work experience incentives introduced recently are intended to stimulate job creation by granting tax exemptions for employment of graduates and retaining experienced staff. However, employers have not embraced the incentive due to ambiguity, challenges in meeting the criteria and the benefit being taken away by excess dividend tax when such companies distribute dividends from their profit arising from the incentive.

In summary, our view is that the high cost of governance cannot be sustained if the government has plans to improve infrastructure and undertake several capital projects for the benefit of the economy.

Debt service and capital expenditure

Debt service is expected to increase while capital expenditure is projected to decline. The proposed increase in debt service expenditure is 20.3% compared to 5.7 % in the 2013 budget estimate. The rising cost is a reflection of higher debt profile both internal and external. The Minister of Finance has however indicated that the Sovereign debt position remains strong and sustainable. Capital expenditure has been projected to significantly drop by 30.7%% (about N487 billion) from 2013. As a percentage of aggregate expenditure, capital expenditure accounts for only 23.7%. This huge decrease is a major setback in adequately funding ongoing infrastructure projects under the "Transformation Agenda" of the government. Currently, there are several projects that are abandoned due to paucity of funds. Government would then be faced with the alternative of more borrowing or reconsideration of fuel subsidy removal in order carry out infrastructure projects. It remains a fact that enormous investment is required for capital development especially in the areas of infrastructure such as electricity, roads and so on, which are necessary for economic growth and development.

Probably, the way out in many instances is to engage in Public Private Partnerships (PPP) to ease the burden on government and to reduce borrowing..

Statutory transfers

Statutory transfers increased by 2.8% which is less than the increase of 4% for 2013. Based on the medium term expenditure framework, the aggregate amount is expected to increase in subsequent years.

GDP growth rate

The projected growth rate of 6.75% appears conservative given the potential for double digit growth and the necessity to achieve higher growth rate in order to actualize the Vision 20:2020 goal of becoming one of the top 20 economies in the world by the year 2020.

The planned rebasing of the Gross Domestic Product (GDP) is expected to increase the size of the economy to perhaps become the largest in Africa but will lead to a reduction in future GDP growth rate.

Irrespective of the potential increase in the size of the Nigerian economy, the country continues to face challenges in the area of poverty alleviation and problems with insecurity. . The 2014 budget shows that government will continue to spend money on measures to curb the unrest in the North and continue to consolidate on the relative peace in the Niger-Delta post-amnesty.

Key Sectoral Allocation

The expenditure breakdown for 2014 shows that social sectors like education and health got 10.6% and 5.7% against the international benchmarks for developing countries of 26% and 15% respectively. The increase in the allocation for education (about N493.5billion) is commendable when compared to 2013 but still insufficient considering the level of deterioration in public education at all levels. The constant industrial actions, inadequate quality manpower, little investment in research, technological deficiency, and obsolete academic materials need to be addressed. The six month strike action recently called off by the Academic Staff Union of Universities reflects the crisis in the education sector. In addition, the ongoing strike by the Academic Staff Union of Polytechnics (ASUP) is an indication that the government needs to have a proactive rather than reactive strategy to address the fundamental issues in all keys sectors of the economy.

Also, agriculture and rural development despite its huge contributions to GDP and employment generation got a paltry allocation of 1.4% of the budget.

Other key sectoral allocations include Works, N128.6 billion (or 2.8%); Power, N62.45 billion(or 1.3%); Defence, N340.3 billion (or 7.3%) and Police, N299.6 billion (or 6.5%).

Inflation rate

The budget makes no mention of the projected inflation rate. However, the objective of the government has been to achieve a single digit inflation rate. As at November 2013, inflation rate stood at 7.90%. Inflation has remained within the target of the Central Bank of Nigeria (CBN) of less than 10% in 2013. This is attributed in part to the relative stability in exchange rates due to CBN's regular intervention to support the naira. Considering the steps taken to reform the power sector, electricity supply is expected to improve in the medium to long term while cost of doing business is expected to reduce thereby keeping inflation rate at a single digit.

The 2015 election is fast approaching and the country is likely to experience a higher level of spending as indicated by the increased allocation to INEC. We therefore expect more pressure on inflation in 2014.

Exchange rate

The government has proposed to maintain the exchange rate around N160 to US$1 despite decline in the nation's foreign reserves. The CBN has to remain consistent in supporting the naira with tight monetary policy actions and exchange control. Evidently, policy measures by CBN such as restricting companies to sourcing of foreign currency in the autonomous market for payment of dividends, repatriation of capital and proceeds of investment, sale of international tickets and consultancy services have assisted in keeping the exchange rate stable. However this has contributed to the increasing gap between the official and parallel rates which in turn portends a risk of round tripping.

Tax changes

There are no changes proposed to the income tax and VAT rates.

Some of the expected policy actions of government include the following:

1. To encourage local production and assembly of vehicles in Nigeria, import of new and used vehicles will attract import tariff of 70 percent of the cost of the vehicle, and another 35 percent duty of the cost of the vehicle.

2. To improve the value chain on key automobile products like metals, iron ore, plastic and tyres, there will be a tax holiday for five to ten years for local manufacturers of tyres. Unless this is applied to unincorporated entities, in our view, there is already a framework for the tax relief under the Industrial Development Act.

3. In order to encourage the local production of rice, a 10% duty and 100% levy was applied to both brown and polished rice. However, as local producers were not able to increase production to meet consumer demands, there was a surge in smuggled rice from neighbouring countries. Consequently, the Nigerian government is likely to review the import regime on rice.

4. On the reforms in the petroleum sector, the Petroleum Industry Bill (PIB), which is Nigeria's comprehensive oil and gas legislation, is expected to become Law before 2015.

Other important aspects of the Budget

Power roadmap

Following the privatisation of the generation and distribution companies, the government has proposed 62.4 billion to be allocated to the power sector. Most of this fund would be for the Transmission Company of Nigeria (TCN) which is essentially a measure by government to guarantee the success of the whole exercise. The new tariff for electricity, the MYTO-2, has a component of subsidy for the Distribution Companies to cater for losses from complying with the prescribed electricity tariffs.

Job Creation

The focus of the proposed 2014 budget remains job creation and reduced unemployment. The agriculture, manufacturing, construction, and housing sectors are expected to be the main drivers of job creation.

Priority sectors

Besides the agricultural sector, the Minister of finance has indicated that all infrastructural sectors are top priority for the government and the budget will go towards supporting those sectors. One of the sectors of prime importance to the government is housing. Based on the medium term expenditure and fiscal strategy framework, there is expected to be an increase in access to mortgage finance through the establishment of a mortgage refinance company.

Conclusion

The 2014 budget is a relatively tight budget compared to 2013. The delay in the presentation of the budget was avoidable and we hope that the legislative arm will promptly pass the budget. As always, the major task remains the implementation of the budget given that the 2013 budget was only 64% implemented as at when the 2014 budget was presented. We hope that a better implementation of the 2014 budget will be achieved.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.