Summary

On 23 March 2020, the Executive Chairman of the Federal Inland Revenue Service ("FIRS" or "the Service"), sent out a notice informing taxpayers that the FIRS has extended the timeline for filing Value Added Tax (VAT) and Withholding Tax (WHT) returns to the last working day of the month, following the month of deduction. The due date for filing Companies Income Tax (CIT) returns has also been extended by one month. This information was communicated via a four-page publication on the FIRS' official twitter handle as part of its business continuity plan in the light of the prevailing COVID-19 (Corona Virus) global pandemic.

Details

The Notice is in line with efforts being made by the Federal Government to minimise and manage the effects of the COVID-19 pandemic, affecting various countries including Nigeria. In this regard, the Notice informs taxpayers of measures undertaken by the FIRS to support them during this period.

The Notice encourages taxpayers to take advantage of the various e-platforms for filing of tax returns and also states that where there is a need for physical meetings this will be limited to no more than ten people at a time while applying globally recommended social distancing and hygiene rules.

It also highlights the following specific palliative measures undertaken by the FIRS to help taxpayers cushion the effect of the pandemic:

- The FIRS has extended the timeline for the filing of WHT and VAT returns to the last working day of the month, following the month of deduction as opposed to the statutory period of 21 days after the month of deduction;

- The due date for filing CIT returns has been extended by one month – i.e. seven months after the financial year end, e.g. July, 2020 for companies with a 31 December, 2019 year end;

- Taxpayers that wish to file their returns with the FIRS without an audited account can file same, provided that the relevant audited accounts are submitted unfailingly within two months after the revised due date of filing;

- The FIRS also intends to publish on its website information requests for desk reviews and tax audits and create a portal where such information can be uploaded to its database for online access review;

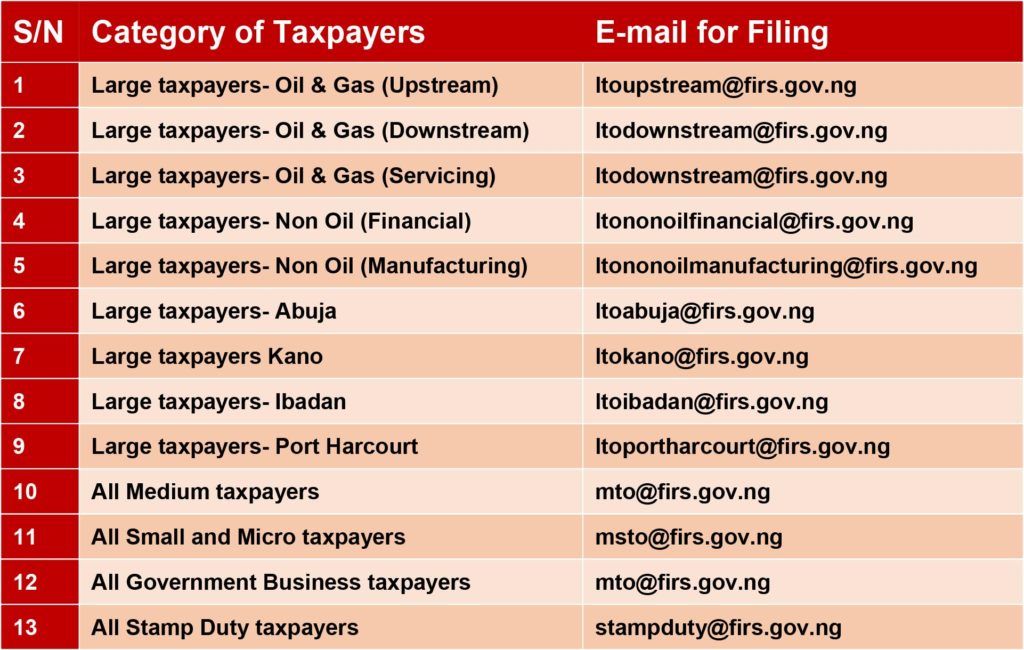

- Taxpayers already registered on the FIRS' e-filing platform can also submit all returns via efiling@firs.gov.ng or alternatively submit their returns as follows:

- Taxpayers are at liberty to engage the FIRS generally via electronic mail or via telephone through the FIRS Contact Centre on 0909 74444444 or 0909 71111111.

Implication

Based on this publication, taxpayers now have up to the last working day of each month to submit their VAT and WHT returns. Although the Notice does not state a commencement date for this, it can be safely assumed that this directive takes effect from March, 2020 and will continue until the FIRS issues a further advisory or Notice in this regard. In order to ensure certainty as to the application of these palliatives and prevent disputes in future, it is advised that the FIRS documents this directive either by way of an Order or Gazette, especially in view of the fact that FIRS Circulars have previously been held not to be binding or have force of law. Since this directive essentially adjusts statutory filing dates, it is necessary to have a basis in law for the palliatives.

Notwithstanding the foregoing, taxpayers are at a liberty to take advantage of the extensions given the likely disruption to their businesses and their ability to comply with filing deadlines within this period. More importantly, taxpayers should take advantage of all available electronic platforms in engaging with the tax authorities and seek professional advice in doing so. Above all, we should all stay safe until when the pandemic abates and we can all return to our normal routines.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.