Introduction

Port Louis, 10 July 2023

On 07 July 2023, the Cabinet approved the introduction of the Finance (Miscellaneous Provisions) Bill 2023 into the National Assembly. The object of the Bill is to provide for the implementation of the measures announced in the Minister of Finance's Budget Speech 2023-2024. The Bill will be debated and voted at the National Assembly in the coming weeks.

This note highlights the main proposals that the Bill puts forward and that are most relevant for the business community. In particular, it focuses on the proposed changes that concern the financial and operational aspects of businesses. This note does not cover every aspect of the Bill, nor does it amount to legal or other advice.

The partners are also grateful to the firm's associates, pupils and interns for their valuable contribution to this publication over the past weekend.

Areas covered

- Taxation

- Employment

- Corporates

- Financial Services

- Immigration

Abbreviations

Taxation

Personal income tax

- Tax exemption for a person earning up to MUR 30,000 per month.

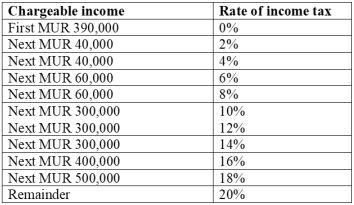

- Flat rate of 15% to be replaced by the following progressive

tax regime:

- Removal of solidarity level on income derived by an individual.

- New thresholds for deductions in respect of dependents, cost of undergraduate or postgraduate course undertaken by dependents, relief for medical or health insurance premium.

- Housing Loan Relief Scheme - MRA to pay MUR 1,000 per month to a Mauritian who has contracted a secured housing loan in Mauritius for an amount of up to MUR 5 million. The allowance would be payable for the months of July 2023 to June 2024, subject to an application being made to the MRA.

Tax-related employment matters (1/2)

PAYE

Notwithstanding the changes to the personal tax regime, where

employees do not submit the Employee Declaration Form, employers to

continue withholding tax from the employees' emoluments at the

rate of 15%, except if an employee opts for deduction at 20%.

Prime à L'Emploi Scheme 2023

The Bill proposes to pay a monthly allowance of up to MUR 15,000 to

an employer who, between July 2023 and June 2024, recruits a female

person or a person with disabilities who was previously unemployed

for at least 1 year. The employee must be a citizen of Mauritius

and resident in Mauritius. They must become employed on a full-time

basis and earn not more than MUR 50,000 in a month. The Bill

proposes to grant the allowance to the employer for a period of 2

years.

Tax-related employment matters (2/2)

Enhanced tax deductions

- The employer of a woman under the Prime à l'Emploi Scheme to be entitled to 200% tax deduction of the emoluments paid to that employee.

- The employer of a disabled person to be entitled to 300% tax deduction of the emoluments paid to that employee.

- A company that incurs capital expenditure on a Child Day Care Centre for the benefit of its employees in an income year to be entitled to 200% tax deduction of that expenditure. (This relief was introduced in 2018 for capital expenditure on crèches only.)

COVID-19 levy

Writing off of any unpaid amount of COVID-19 levy

(including penalty and interest) that an employer has not paid as

at 20 January 2023.

Salary compensation 2023

- The Bill proposes to pay an allowance to certain employers to help them pay the additional remuneration of MUR 1,000 that they are required to pay to their workers from 1 January 2023 for increase in cost of living.

- A monthly allowance of MUR 500 per eligible employee for the year 2023 is to be made available to SMEs where the eligible employee derived a basic wage not exceeding MUR 51,775 and the SME declared (i) an accounting loss for the year 2021-2022 or (ii) its accounting profit for that year would be reduced by more than 50% if it were to pay the additional remuneration to its employees who were in employment as at December 2022. Where the accounting profit would be reduced by more than 10% in the same circumstances, the SME is to be entitled to a monthly allowance of MUR 250 only per eligible employee.

- A monthly allowance of MUR 300 per eligible employee to be made available to non-SME export enterprises in respect of eligible employees deriving up to MUR 51,635 as basic wage.

Other tax relief

Adoption of animal

A person who adopts an animal from an NGO in an income year to be

entitled to a tax relief of MUR 10,000. The relief is available per

animal adopted up to a maximum of MUR 30,000 in an income year.

Donations to charitable institution

A company that donates through electronic means to a charitable

institution to be entitled to 300% tax deduction of that amount,

provided that the charitable institution is involved in supporting

persons with health issues and disabilities, protection or

rehabilitation of street children, or animal welfare and

protection. The deduction is capped at MUR 1 million in an income

year. (Individuals are already entitled since 2021 to tax

deductions of up to MUR 30,000 in respect of donations made to

charitable institutions registered with the MRA.)

Excise duty on electric vehicles

The current legislation already provides that for the period

between 01 July 2022 and 30 June 2023, individuals who purchased an

imported electric motor car or electric motor vehicle for the

transport of goods are entitled to claim a refund of excise duty

amounting to 10% of the value at importation or MUR 200,000,

whichever is lesser. The Bill proposes to extend the period of

eligibility to 30 June 2024 and make the refund available to

non-individuals as well.

Tax arrears

The Bill proposes to disregard any penalty and interest on tax arrears outstanding as at 02 June 2023 under the Income Tax Act, the Value Added Tax Act and the Gambling Regulatory Authority Act where such arrears are fully paid on or before 31 March 2024. The taxpayer is to apply to the MRA by 31 December 2023 for that purpose.

Where the tax liability is disputed and the taxpayer wants to benefit from the penalty and interest waiver, they will have to withdraw any relevant legal proceedings before making the application to the MRA.

Tax matters relating to specific industries (1/4)

Banks

- Discontinuation of the regime introduced in 2018 subjecting banks to different income tax rates depending on whether their chargeable income exceeded MUR 1.5 billion in the year of assessment 2017-2018 or if incorporated after 2018, the first year of assessment. Henceforth, the Bill proposes to tax all banks at 5% of their chargeable income on the first MUR 1.5 billion and 15% on the remainder.

- The Bill also proposes to harmonise the special VAT levy on banks at the rate of 5.5% on a bank's leviable income derived in every accounting period. This would replace the current regime whereby banks with a leviable income of more than MUR 1.2 billion are subject to a reduced special VAT levy of 4.5% while those with a leviable income of up to MUR 1.2 billion are subject to a 5.5% special VAT levy.

Telephony service providers

- Reduction in the solidarity levy imposed on operators of telephony services from year of assessment commencing on 1 July 2024 to 5% of accounting profit + 1% of turnover (as opposed to 5% of accounting profit + 1.5% of turnover).

- The solidarity levy is to be payable notwithstanding an operator making a loss in a given year, although the levy is reduced in that case to 1% of turnover only.

Tax matters relating to specific industries (2/4)

Financial services

- The Income Tax already allows PCCs and VCCs to elect to present

separate financial statements in respect of each of their cells and

thus treat each cell as a separate entity for tax purposes. The

Bill proposes to clarify that in such case, the MRA will not

recover income tax due by a cell from the cellular assets of

another cell of that PCC or VCC or from the non-cellular cells

except where such assets are directly attributable to that cell of

the PCC or VCC.

- TDS not to be deducted from payments to management

companies and investment advisors licensed by the

FSC.

- Discontinuation of 5-year tax holiday for investment banks licensed after August 2018.

- Interest derived from a sustainability bond or

a sustainability-linked bond to finance

sustainable projects in Mauritius to be exempted from income

tax.

- Interest derived by a Collective Investment Scheme or a

Closed-End Fund licensed or approved by the FSC to benefit

from 95% tax exemption (while income other than interest to

continue to benefit from 80% tax exemption).

- Virtual asset service providers and issuers of initial token offerings under the Virtual Asset and Initial Token Offering Services Act 2021 to submit to the MRA an annual statement of financial transactions in respect of transactions over a certain threshold, except in respect of non-citizen individuals, companies with a Global Business Licence, and public listed companies, their subsidiaries and associates.

Tax matters relating to specific industries (3/4)

Manufacturing companies

- A manufacturing company that incurs expenditure on market

research and product development to be entitled to 200% deduction

of that expenditure for income tax purposes. The relief is to be

made available to manufacturing companies with an annual gross

income derived from export of goods not exceeding MUR 500 million.

(This relief was introduced in 2021 for market research and product

development for the African market only and available to any

manufacturing company irrespective of their level of gross annual

income. The Bill thus proposes to change these conditions.)

- Extension until 2026 of the tax credit of 15% on the cost of new plant and machinery for manufacturing companies.

Other sectors

- A higher education institution that incurs

costs to conclude a contract with an African University to provide

joint tertiary education for the final year of a course in

Mauritius to be entitled to 200% deduction of those costs for

income tax purposes.

- A company incorporated in Mauritius to be entitled to 200% deduction, for income tax purposes, of expenditure incurred in the financing, sponsorship, marketing or distribution of a film, provided that the film has been approved under the Film Rebate Scheme and is made up of at least 90% of the principal photography of Mauritius.

Tax matters relating to specific industries (3/4)

Other sectors

- Event organisers to no longer be refunded VAT

on accommodation costs in respect of qualifying events (except for

events which have ended on or before 30 September 2023). Instead,

event organisers to be exempted from paying VAT on those

accommodation costs.

- Primary and secondary education providers holding an Investment Certificate issued by the EDB are to be provided with the same VAT exemption as tertiary education providers in respect of (1) construction of purpose-built buildings or facilities and (2) certain costs incurred at the time of setting up or expansion such as plant, machinery and equipment, and IT systems and materials.

Click here to continue reading . . .

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.