The office of the Tax Ombud was established to act as a bridging gap between SARS and the taxpayer. But, taxpayers do not always have a direct line to connect with the Tax Ombud. A taxpayer may lodge a complaint with the Tax Ombud after they have exhausted all the SARS complaints mechanisms unless they are compelling circumstances for not doing so. Otherwise, the process below will have to be followed:

There are three ways through which one can lodge a complaint with SARS:

- Via eFiling. See the step-by-step guide on how to lodge a complaint via eFiling. Please note that you have to be registered on eFiling to be able to do this. You may not download or print the form to send it by any other means.

- By visiting the branch. If you do, you may need to ensure that you have spoken to all relevant higher people before you leave the branch

- By calling the SARS Complaints Management office (CMO) on 0860 12 12 16.

Here are a few tips on winning the battle against SARS poor service/administrative issues and making sure you have a winnable case when you approach them or the Tax Ombud:

Be specific:

If you have a complaint, it is better to call the Complaints Management Office (CMO.) If you call SARS contact centre to get a reference number, specify that it is a complaint with a complaint, specify that it is a complaint and not a followup. If you keep calling the call centre and saying you are following up, it may remain just that, a followup. You need to specify that you have a complaint so that it is treated as one. Some complaints will need case numbers, make sure you call the contact centre to get one.

Try again:

Sometimes, a complaint lodged on eFiling may be rejected for one reason or the other. If you feel you have a compelling case, pick up the phone and call the CMO so that they may record and lodge the complaints on your behalf. You may also call them if you are not sure how the process works on eFiling or if you are too far from a SARS office. For example, I once lodged a complaint about a delayed refund (because refunds should be paid 7 workings days after verification or audit is finalised) but the system kicked me out and rejected my complaint. The complaint was successfully lodged after calling the CMO.

Build a compelling case:

The most important thing to do when dealing with SARS is to build a good case, this is whether you are raising a complaint, an appeal or objection. You will need a system to record your interactions with SARS (at each touchpoint with them). You also need to store documents and supporting documents relevant to the taxpayer's case. The system of recording your interactions with SARS should allow you to build a timeline of how the case is developed and to ensure that you have all the documents you need for this case.

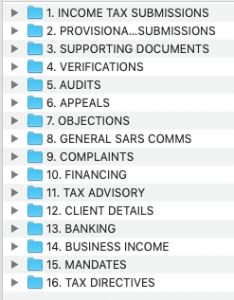

One such system is to make sure each client file/folder contains relevant subfolders that will help you gather the important and necessary information. The other is to build a dashboard that records the timeline and communications with SARS. This can take any form, for example, a Word or Google docs, a task management tool like Asana, Trello or Monday.com.

NB: You do not do this because something has gone wrong, but because things may go wrong and often they do go wrong. Below is an example of client folders that tax practitioners or individuals can use:

The advantage of doing things this way is that you will save yourself a lot of time when doing the actual complaint, even an appeal or objection. The Tax Ombud form will ask you to summary your case in chronological order. So, if you had been building a case over time, this process will be a breeze. You have all the facts and timeline at your fingertips.

For those that are wondering how the Tax Ombud process works, here is a simplified version from their website:

We hope this was helpful

Originally published October 8, 2019

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.